We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

POP: Singapore Airlines Business Class A350-900 MAN-IAH

Let’s be honest. Sometimes you don’t want to read a whole review. So we’ve created a new series called POP: Pictures Only Post. Posts in this series will feature the product, minimal description, and focus on 5-10 Pics. A more detailed review will come in the following week or two, but here’s a quick look at the Singapore Airlines Business Class A350-900 MAN-IAH.

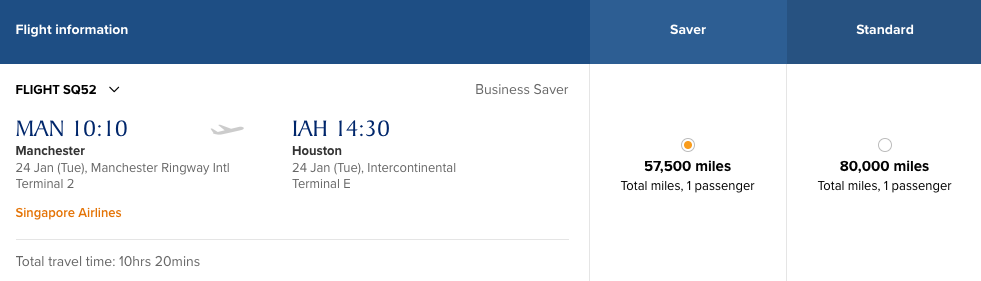

This is the return leg back from a quick trip to Europe planned for a MM contributor and frequent premium cabin traveler whose outbound was on Ethiopian Airlines Business Class. Ultimate Rewards were transferred to Singapore Airlines and only took 8 hours. In total…less than 50k points and about $330.

This kinda SIA doesn’t offer any kind of “Cheap Thrills”

Who doesn’t love a sexy accent, especially when it’s rose gold. Prrrrrrrr

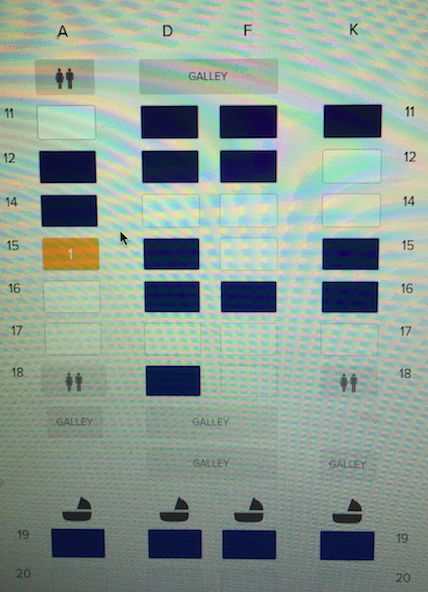

The difference between sitting in the Bulk Head and elsewhere…Much more leg room in bulkhead.

If your friends say you like to push buttons…you’re gonna love these seats.

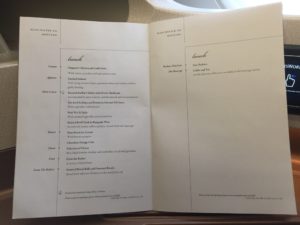

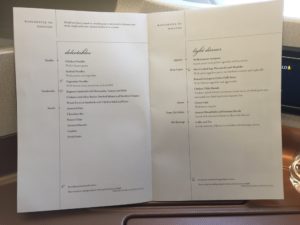

IFE and Menu

Gotta get that signature satay with peanut sauce. Chicken Stuffed with forest mushrooms for the main.

Getting turned down never felt so good 😉

Stay tuned for the whole review! Hope you enjoyed this POP!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.