This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I prefer the 40k Chase Hyatt Visa than 2 free nights version

In case you’ve missed the news…Chase looks to be changing their Chase Hyatt Visa card from 2 free nights at ANY Hyatt in the world to 40k points starting June 29th. If you are looking to hit up Category 6 or 7 hotels in the next 12 months…go for the current deal. If you’re like Miles and I…the 40k offer ( which is 45k after you add an authorized user ) is much better. Why? You don’t have to use those points in the next 12 months, and you can use them for Cash + Points bookings.

The Chase Hyatt Visa is a great card. I first got it in 2012. I may sign up for it again.

Yes, Hyatt has made an unforced, uncompetitive error with the introduction of World of Hyatt. That doesn’t mean that there isn’t significant value in the program. Now that the card will offer 40k points…it’s far more enticing to me than was the 2 free nights.

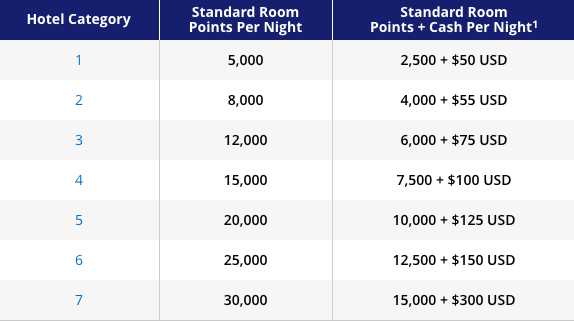

Cash + Points increases the value of your points.

Let’s take a look at the Park Hyatt Saigon, which is incredible. and we visited earlier this year for New Year’s Eve. It’s a category 4 hotel. Rates are nearly $400 a night. So the current offer could get you 2 free nights there. Not a bad deal…worth $800, right? However…cash + points is just 7500 points + $100. Those 40k points could be used for 5 nights. Those 37,500 points would save you $1500. Yes, you’d shell out $500, but you’d get a much better value for your points – even spread that out over other hotels.

If you’re thinking of hitting up a Category 6 or 7 hotel…then this may be the time to do it. Otherwise, if you’re like us, this is a good deal for you.

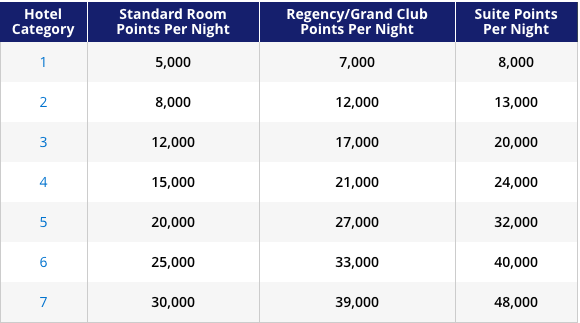

You can use the charts below to calculate things, but having the ability to now employ Cash + Points is, in my opinion, a great option.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.