This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I had just flown from Vegas to Miami aboard AA’s 757 with lie-flat seats and visited the Flagship Lounge, but I was HUNGRY when I arrived. When I think about it, I only had a tiny bit of yogurt on my flight and a glass of champagne in the lounge because they were in the midst of replenishing food, and the menu here looked pretty good. As a result, Dave and I headed over to the Corona Beach House before taking our business class flight to Buenos Aires aboard AA’s 777-200 with Super Diamond seats. In a sentence…it hit the spot.

Corona Beach House Miami Details:

- 6:30am to 10pm

- Concourse D, near gates D23, 24

- no Take out

- Can only use once per 24 hours

Here’s a list of cards that offer Priority Pass access:

Details of Using your Priority Pass – $30 a person and gratuity is included

The full details are below, but we were afforded $30 per person, and unlike many Priority Pass lounges, the tip was included. Amazing.

Cardholders can use their lounge visit entitlement to receive US$30 off the bill. Each US$30 deduction represents a single lounge visit within the Cardholder’s existing lounge visit allocation for which the Cardholder will, where applicable, be charged. E.g. if a Cardholder registers 1 Guest they will receive US$60 off their bill which will be charged as 1 Cardholder visit + 1 Guest visit on their account. Only 1 card per visit per Cardholder will be accepted and at point of registration. 2. The US$30 is valid for the purchase of any meal and/or drinks excluding ‘To-Go Orders’ and ‘Grab and Go’. To be eligible, all Cardholders and guests are required to show a valid Card and and a MIA Outbound Departure Boarding Pass with confirmed same-day travel before placing an order. 3. US$30 is non-transferable & cannot be exchanged for cash substitute or refund if the final bill is lower than US$30 per person. 4. Cardholder is responsible for the balance if total final bill exceeds US$30 per person. 18% gratuity is automatically added to the final bill. 5. Free Wi-Fi is limited to 45 minutes and subsequent usage is subject to payment. 6. Priority Pass and its Affiliates Companies shall not be liable should the offer value be less than Customers lounge visit entitlement. Customers who pay for lounge and guest visits are advised to review program Conditions of Use prior to accessing the offer.

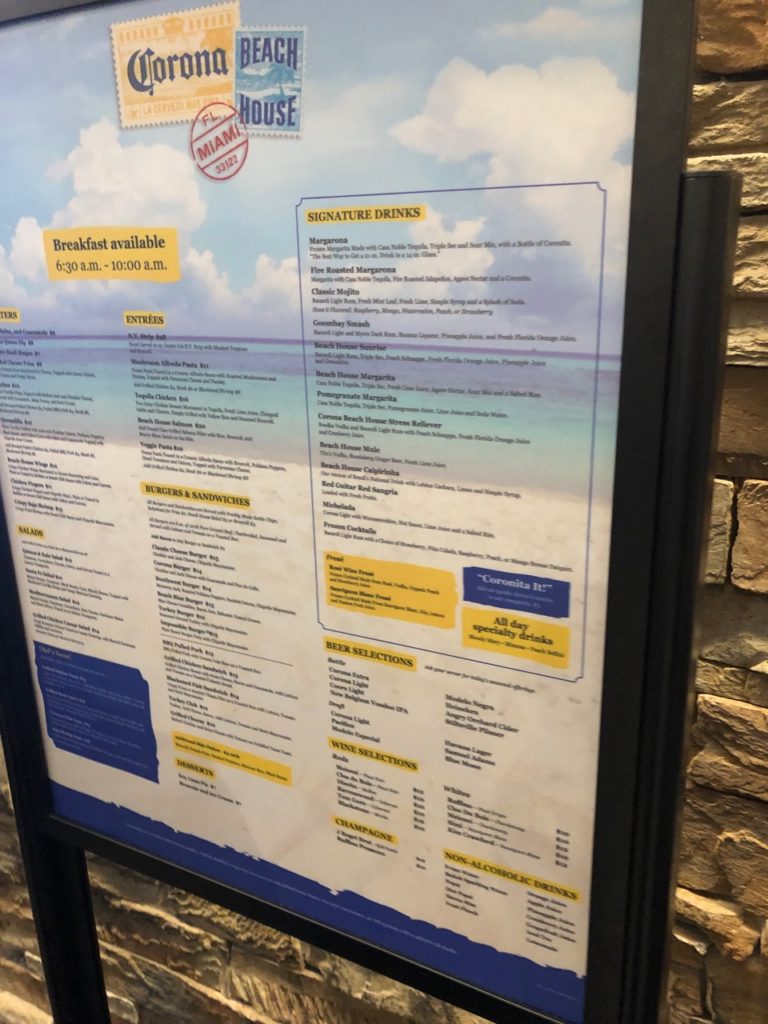

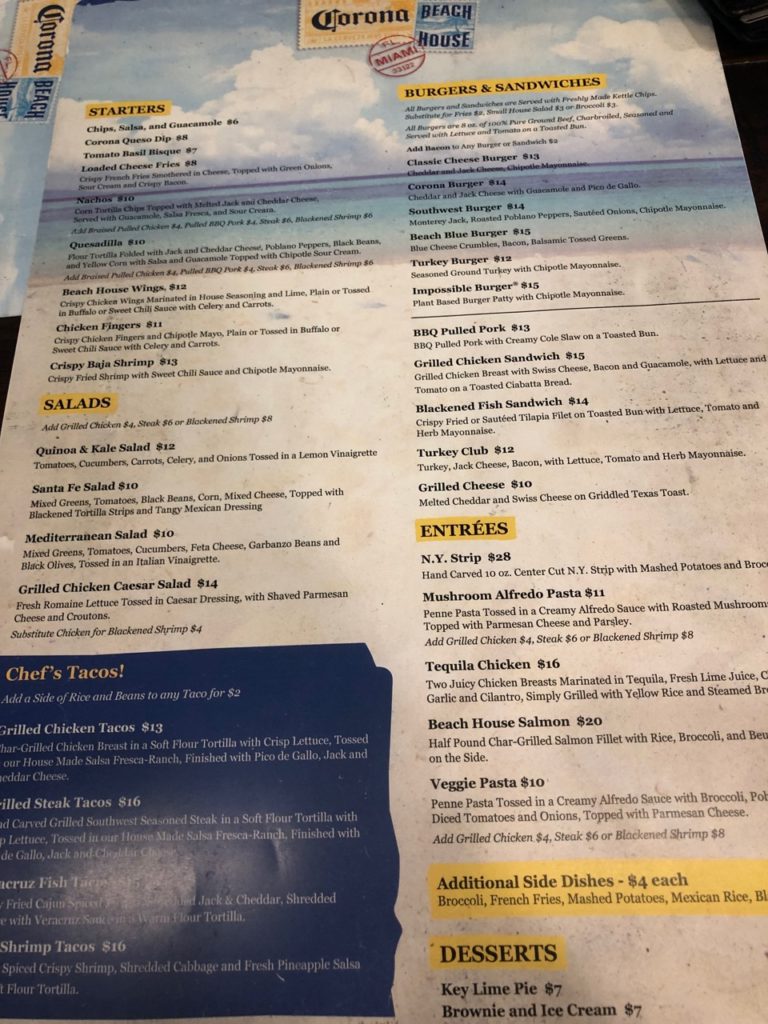

Here’s a look at the menu

I ended up having an impossible burger with fries and a beer. Dave had the same and our bill came in under the $60 total. It was totally what we wanted: bar food, quick, easy, and best of all…completely free with a Priority Pass.

Overall:

Ordinarily I’d have pictures of the food, but I hadn’t seen Dave in a long time and we just got talking, toasting, and stuffing our faces so much that by the time I realized…everything was half eaten. But, trust me…if you’re in the airport, it’s a fun little pop in/pop out restaurant that was quick with tasty food and I will definitely hit up it the next time I pass through the airport.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.