We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Referral bonuses are an incredible way to earn points ( be aware of 1099s being sent though ), and I try and do my best to max out each card’s annual referral limit. Today, while I was perusing my Chase account, I noticed my balance had spiked and figured a referral bonus had posted. Typically Chase, will send out an email notifying you that a referral bonus has posted, but despite my balance going up, I didn’t receive an email. I decided to play around and see which account had earned the bonus. While doing so, I stumbled across a nice little feature that shows you a break down of all your point earning, but specifically, your annual total of points earned from referrals. This is a great tool to use and can be accessed with just two steps.

Step 1: Log into your account.

You’ll see the toolbar at the top. Click the 3 lines for the drop down menu

You’ll see the following menu – click Rewards Activity

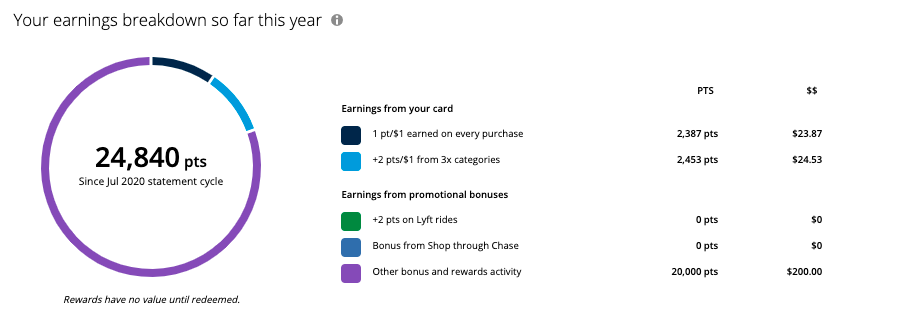

Step 2: After you click “Rewards Activity” you’ll see the following chart.

As you can see below, I received a refer-a-friend bonus on my Chase Ink Business Preferred.

Here’s a list of the current referral bonuses available

As always, please see our main Chase Refer A Friend page where you can leave your links.

- Chase Sapphire Preferred – 15k per referral – 75k max per year

- Chase Freedom – $50/5kUR per referral – $500/50k max per year

- Chase Freedom Unlimited – $100/10kUR per referral – $500/50k Max per year

- Chase Ink Business Preferred – 20kUR per referral – 100k max per year

- Chase Ink Business Unlimited – $150 or 15k points per referral – $750 or 75k max per year.

- Chase Ink Business Cash – No Referral – Refers to Ink Business Unlimited – $150 or 15k points per referral – $750 or 75k max per year.

- Chase Ink Business Plus – No Referral – Refers to Ink Business Preferred – 20k per referral – 100k max per year

- Chase Southwest Cards – 10k points per referral – 50k max per year

- Chase United Explorer Plus – 10k United Miles per referral – 50k max per year

- Chase Marriott Bonvoy Business – 20k Marriott per referral – 100k max per year

- Chase World of Hyatt – 5k Hyatt points per referral – 50k max per year

- Chase IHG Premier – 10k IHG points per referral – 50k max per year

- Chase Disney – 100 Disney Dollars per referral – 500 Disney Dollars max per year

You can help out the site by using our Referrals links – feel free to leave yours below

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.