This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Don’t panic! They’re still some of the best out there.

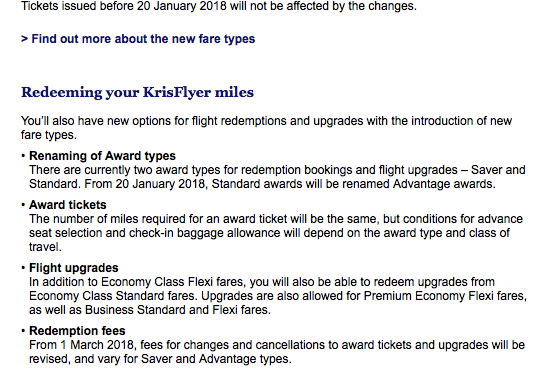

Changes within Krisflyer started earlier this year when they devalued their own award chart. Next came partner awards ( which was a great loophole, but alas, it’s closed). The last hang on was their incredible change fees – from nothing to just $20/$30. I’ve utilized this sweet spot many times, and while it’s they’re going to be more expensive, they could have been MUCH worse. Starting March 1, 2018 Singapore will implement new ticket fees.

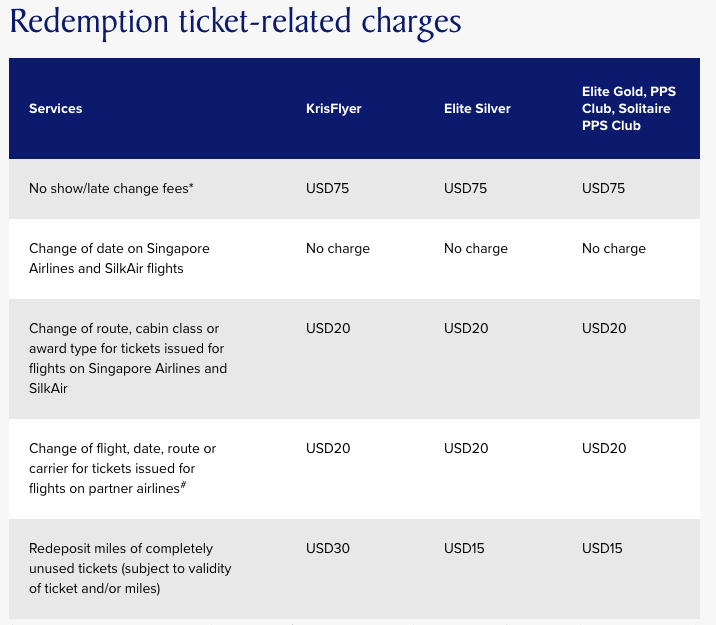

Here’s a look at their current fee structure.

I received this email and immediately panicked

Devaluations are never pretty, and while Singapore’s haven’t been egregious, they have happened. The line item that stuck out the most was the redemption fees.

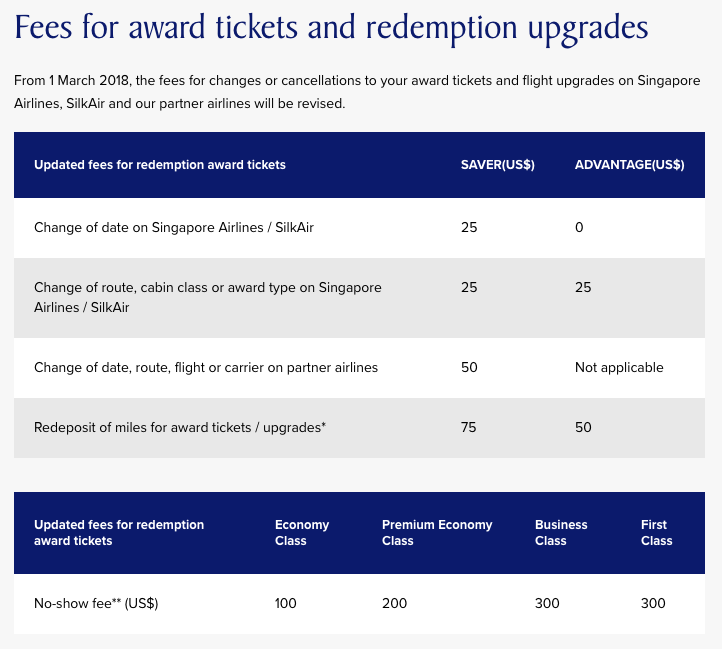

Here’s the damage – it’s not that bad really.

If you’re flying on Singapore Air

- Change of Date, cabin class, or award type will be $25 if you’re on a Saver ticket

- Changes of date alone on the new “advantage” ticket ( the old standard) will cost you nothing.

If you’re flying a partner

- Any change will cost you $50.

- Not a terrible change from $25

Redeposit of your miles

- $75 for Saver awards

- $50 for Standard

*$75 will apply to any partner flight as they can only be booked at the Saver level.

The main thing I don’t see is what happens to Elite members of Singapore Airlines. I’d expect some sort of reduced fee structure to be introduced for them, as they currently have set up on the existing fee chart.

Overall:

The fee structure that they maintained prior to their award devaluations wasn’t going to last. If you compare these to American, United, Delta who can levy $200 to change/redeposit tickets, these rates are still a comparative steal. Singapore’s award chart is still very competitive.

For instance, you can fly business from the States to Europe for just 65k miles. While that’s 10k more than you’d spend on Aeroplan, it’s 5k less than you would spend using United for a partner. I’d rather spend 65k Singapore than 55k Aeroplan, as Singapore’s currency is far easier to accumulate. ( SPG, Chase, Amex, Citi).

For most of the bookings I make on Singapore, I’ll incur the $50 partner fee most frequently. I often make placeholder reservations with Singapore. For instance, I’ll book a business class seat as a backup to a Lufthansa First class seat that I’d prefer. When/If the Lufthansa space opens I’ll change the ticket and confirm the more desired routing and cabin. This used to cost me $20. I’ll still pay the extra $50.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.