This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Offers for Hilton Stays

As I’m sure you’re aware, American Express and Hilton have a strong credit card partnership. Starting this time last year, I started to notice an increase in the number of targeted Amex Offers incentivizing Hilton hotel stays.

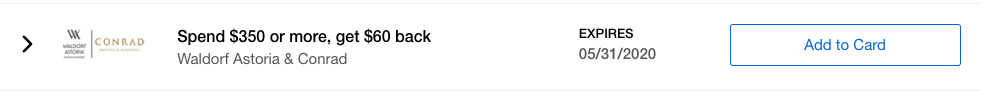

Many of these offers we’ve seen in the past and are back, and some are specifically targeting specific locations. If you’re a Hilton loyalist…these offers could be very rewarding for you.

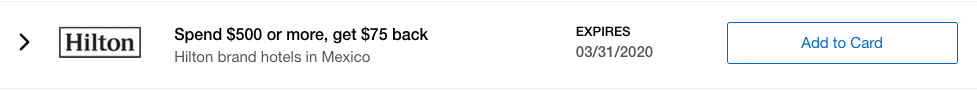

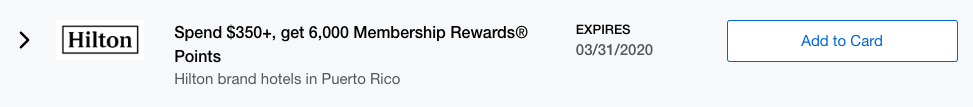

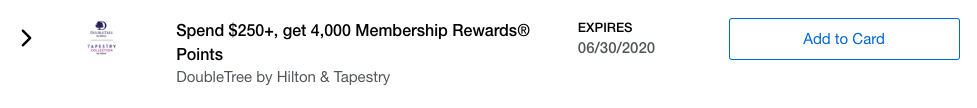

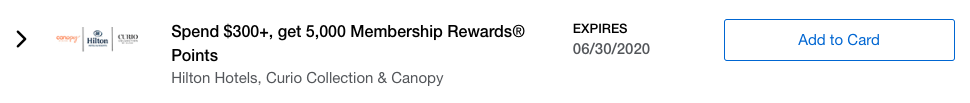

Also, make sure you check each card that you have. Amex Offers tend to target in two ways: one in cash, the other with points. I’ve provided a mix of each below. Remember, you need to add these to the targeted card and pay with that card.

I’ve written A LOT of articles in the past about Amex Offers, and how this benefit alone can save you your annual fee and then some. These were all targeted on my American Express Platinum card which carries an annual fee is $550 ( Check this article out with our 10 reasons it’s easily worth the annual fee )

Make sure you check all of the specific details with each deal, but here’s a look at what I was targeted to receive.

I’ve reviewed many Hilton properties in the past, but some of my favorites are:

- Waldorf Astoria Bangkok

- Waldorf Astoria Edinburgh, Calendonian

- Conrad Bali

- Conrad London

- Waldorf London

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.