This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

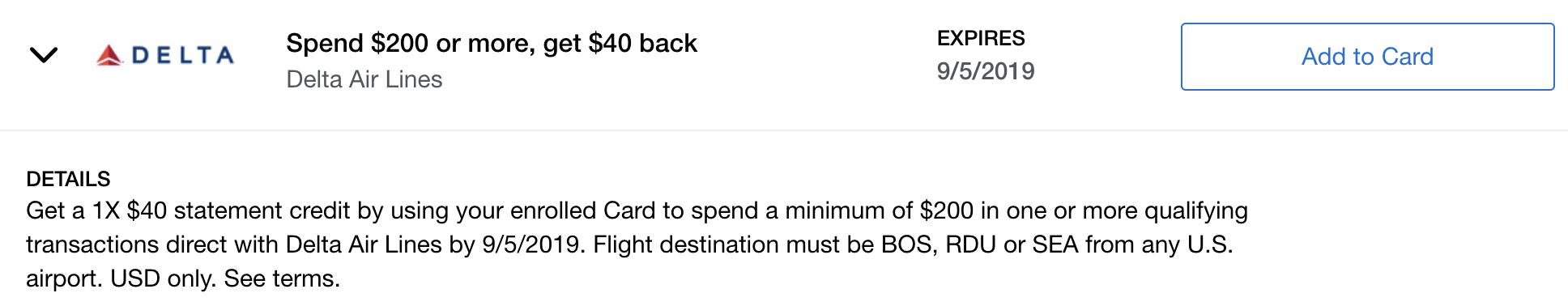

I’m a huge proponent of Amex Offers, but I was perusing my offers today and was super excited when I saw a Spend $200 get $40 back offer with Delta. Then…I saw the specific terms. The only valid options are flying into Boston ( BOS ), Raleigh-Durham ( RDU ) or Seattle ( SEA ). They also need to be non-stop and only the base fare qualifies. If you are looking to visit any of those three cities and you’re targeted…you’ll get a nice little flight discount. I do have to say that this is probably the most specific Amex Offer I’ve seen.

Must:

- Depart a US City

- Fly Non-Stop, Roundtrip to:

- BOS, RDU, SEA

- Multi-City/One Way do not Qualify

- Only Base Fare counts

Full Terms and Conditions:

Enrollment limited. Must first add offer to Card and then use same Card to redeem. Only U.S.-issued American Express® Cards are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Offer valid only for round trip flight purchases made directly with Delta Air Lines through U.S. delta.com, via U.S. Fly Delta App, and U.S. reservation telephone line at 800-221-1212. Excludes Delta Private Jets & On Demand Charter services. Purchases made through third parties or affiliated agents will not qualify for this offer. Purchase must be in U.S. Dollars (USD) and flights must originate from any U.S. airport, with destination only to Boston Logan International Airport (BOS), Raleigh-Durham International Airport (RDU) or Seattle-Tacoma International Airport (SEA). Flights must be purchased as non-stop round trip (no connections). Multi-City and one way flights with the same origin/destination requirements will not qualify for meeting the purchase requirement of $200. Only the base fare of your flight will qualify for the purchase requirement. Cabin class or fare upgrades must be booked at the time of the initial purchase in order to qualify. All other purchases and add-ons (such as Wifi, insurance, etc) will not qualify for meeting the purchase requirement. Offer is non-transferable. Limit of 1 statement credit per Card Member. The enrolled account must be active, in good standing and not in default to receive the statement credit. Statement credit will appear on your billing statement within 90 days after 9/5/2019, provided that American Express receives information from the merchant about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase from merchant until all items from your qualifying purchase have been provided/shipped by merchant. Statement credit may be reversed if qualifying purchase is returned/cancelled. If American Express does not receive information that identifies your transaction as qualifying for the offer, you will not receive the statement credit. For example, your transaction will not qualify if it is not made directly with the merchant. In addition, in most cases, you may not receive the statement credit if your transaction is made with an electronic wallet or through a third party or if the merchant uses a mobile or wireless card reader to process it. By adding an offer to a Card, you agree that American Express may send you communications about the offer. POID: GDL9:0001

Here are the 5 American Express Cards that I keep and links to their current offers, why we have them in our wallet, and recommend your consideration.

- American Express Platinum

- American Express Gold

- American Express Business Platinum

- American Express Blue Business

- American Express Blue Business Plus

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.