This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

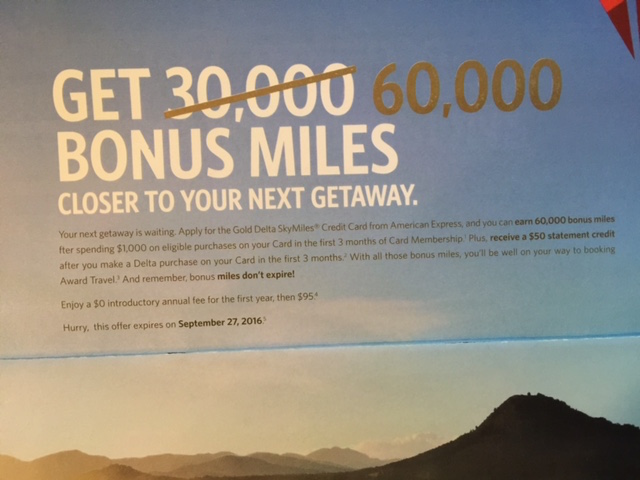

Targeted: Amex Delta Gold 60k offer

It wasn’t too long ago that American Express had a publicly available 50k Gold offer and 60k Platinum offer for their personal and business cards. Well, a reader of Miles’ has sent us an email with the details to an even more lucrative offer circulating. It’s an Amex Delta Gold 60k offer, and it’s pretty appealing.

The Deets:

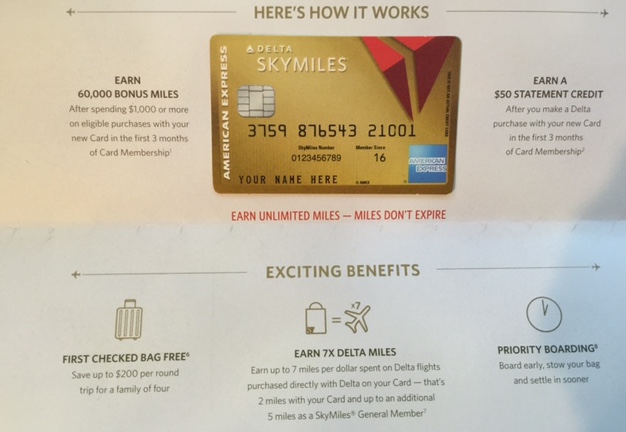

- 60k Delta SkyMiles after $1000 spend in 3 months

- $50 statement credit

- $95 annual fee waived the first year.

Assessment:

I’ve seen Delta Gold 60k offers before, but this one is even sweeter with the $50 statement credit. After min spend you’d have 61,000 Delta SkyMiles – almost enough for a one way business class ticket to Europe. I think that SkyMiles are great for partner business class, like Virgin Atlantic Upper Class. I had the opportunity to fly the Big Bird 747 from SFO to LHR last year and loved it.

YMMV, but some people have had success calling and asking to be matched to targeted offers. I’ve never really had success with this strategy of matching, and have only been matched when better offers are extended publicly within 90 days of my application, but hey…never hurts to ask.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.