We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Targeted: Chase 100k Marriott Rewards Premier Credit Card Offer

I received a targeted email this morning from Chase regarding a 100k Marriott Rewards Premier Credit Card offer. While I believe this matches the highest offer ever, and this is a good offer, there’s another angle to think about. The other 100k+ Marriott Rewards offer – the one masked as an Amex SPG 35k. As you’re probably already aware, SPG can be converted to Marriott Rewards 3:1. So those 35k SPG starpoints equal 105k Marriott Rewards. If you’ve already had the Amex then this is a great way to shore your account. Personally, I love Marriott, so does my family, and I’m a big fan of the new partnership between Marriott and Starwood.

I’ve never been targeted for this offer before. It’s always a nice start to the day 🙂

Let’s take a look at the details

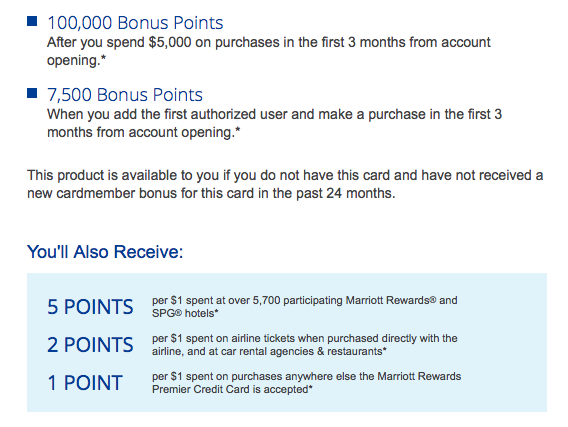

- 100k after $5k spend in 3 months

- 7500 bonus points after adding an authorized user and making a purchase

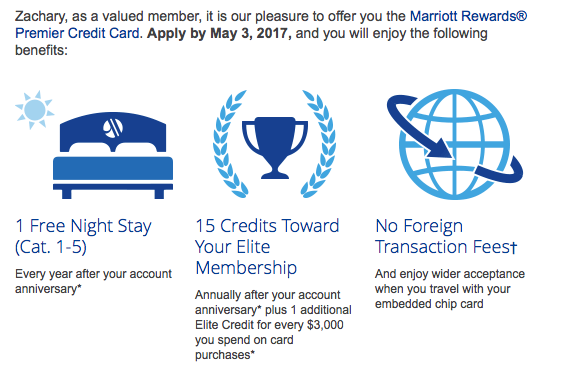

- 15 nights towards elite status.

- Every year you’ll receive at free Category 1-5 night

- No foreign transcation fees

- Must be under 5/24

- Apply by May 3rd

Just to reiterate – you must be under 5/24

Oddly I was targeted for this offer even though I currently sit at 6/24. I was reminded of that recently when I was REJECTED on my second attempt for a Reserve. There is some evidence to suggest that I could be approved if I applied as I was specifically targeted…

Will I apply?

If I was sitting far under 5/24 I think I probably would, and I’d even consider tag-teaming it with the Business version which has an 80k offer. 180k Marriott Rewards will get you 5 nights at a Category 9 hotel anywhere in the world. Like the Marriott Park Lane in London. A newly refurbished, beautiful, and rich hotel off Hyde Park.

I reviewed it last year as part of my trip to see the Colts play in London.

Typically this would cost 225k, but Marriott has a great deal where you can book 4 nights and get the 5th free. A great way to stretch out the value of your points and get a higher return on redemption.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.