This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’ve been sent this targeted offer a couple of times in the past month and thought many of you may be eligible. I currently have a Citi Thank You preferred card, as a result of downgrading a Citi Thank You Premier 3 years ago, and lo and behold…it paid off. Not only did it keep my Citi clock running, and points alive, but it may earn me even more points. I received a similar offer roughly 4 years ago for a Citi Gold account to earn 50k AA miles, took advantage of it, but this time around…Thank You points are the bonus.

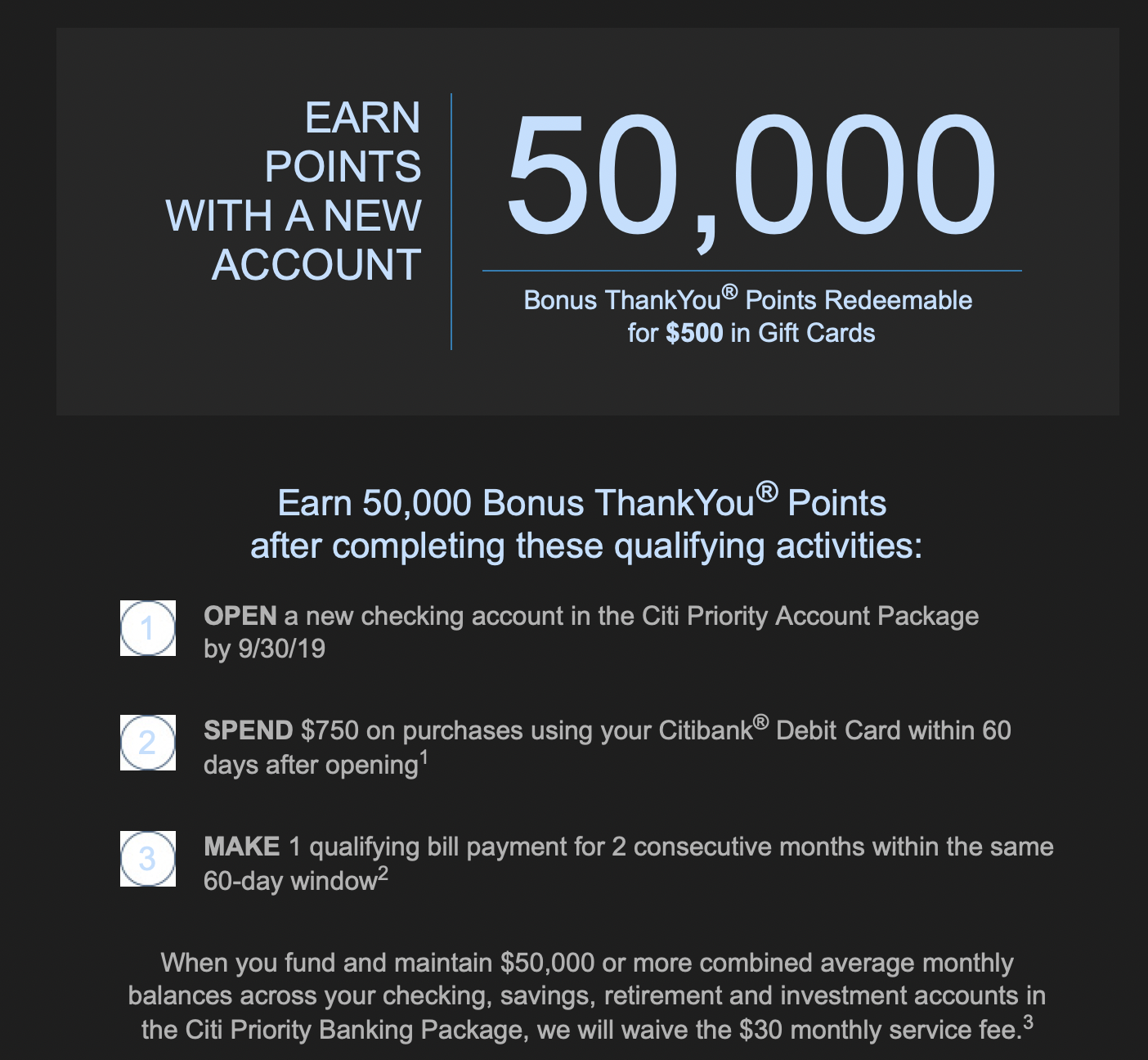

Here’s the deal

- Earn 50k Citi Thank You points when

- Open a new Citi Priority Checking account by 9/30/19

- Spend $750 using the Citibank Debit Card associated with the account within 60 days of account opening

- Make 1 qualifying bill payment in 2 consecutive months within a 60 day window.

One major thing to note is that the account comes with a $30 per month service fee if you don’t maintain a $50k account balance. You can read about the features of Citi Priority Banking here

How I would go about achieving this.

I’d more than likely be looking to take advantage of the points because I like the bank I currently work with, but free points are fantastic.

- Deposit $1k into the account on September 15th

- This gives 2 weeks to get the ball rolling, receive my debit card, etc

- Two bill payments in consecutive months

- On September 30th I would pay half a utility bill due in Mid October

- On October 1st I would pay the other half of the same utility bill

- Early October I’d spend $750 on the debit card

- I have a couple larger expenses I’m planning to make so I’d just spend $750 on this card

The last time I did this it took 90 days to receive the bonus points. Worst case scenario, this means I’d end up paying 4 months at $30, or $120, to receive 50k Thank You points.

This goes along with the terms and conditions:

- ThankYou Points will be credited by Citibank to your existing ThankYou Member account within ninety (90) calendar days from the date you complete Required Activities. At the time the ThankYou® Points are to be credited to your existing ThankYou® Member account, your Citi/ThankYou® credit card account and the new Eligible Checking Account must both be open and in good standing. Fiduciary, estate, business and/or trust accounts are not eligible for this offer; however, trust accounts that are a Living Trust and Custodial accounts are eligible.Citibank may change or discontinue this offer at any time before this date without notice. Enrollment and participation in this promotion does not guarantee eligibility. All accounts subject to approval. APYs are variable and subject to change without notice after the account is opened.

Try this link

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.