We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Free Appetizers or a bottle of wine just for being a cardmember? Yes, it’s true.

Taste is a little known perk of American Express that I recently discovered while reading another blog, Travelsort. What’s better yet? You don’t need some fancy schmancy Amex Platinum, you qualify by having ANY American Express. That is a fantastic perk if you end up eating at one of the restaurants that participate as you could get free food or a discount on your meal.

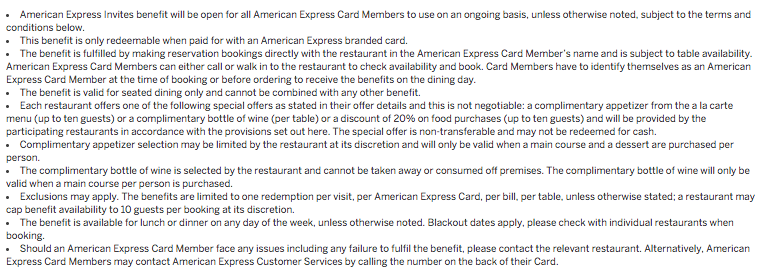

Participating Restaurants choose of the following perks

- Comped Appetizer

- must get main course and dessert are purchased per person

- Comped Bottle of wine

- Selected by restaurant

- must get a main course per person

- 20% off entire bill…up to 10 guests

See the following for complete rules and restrictions: You must let them know you’re paying with an Amex ahead of time.

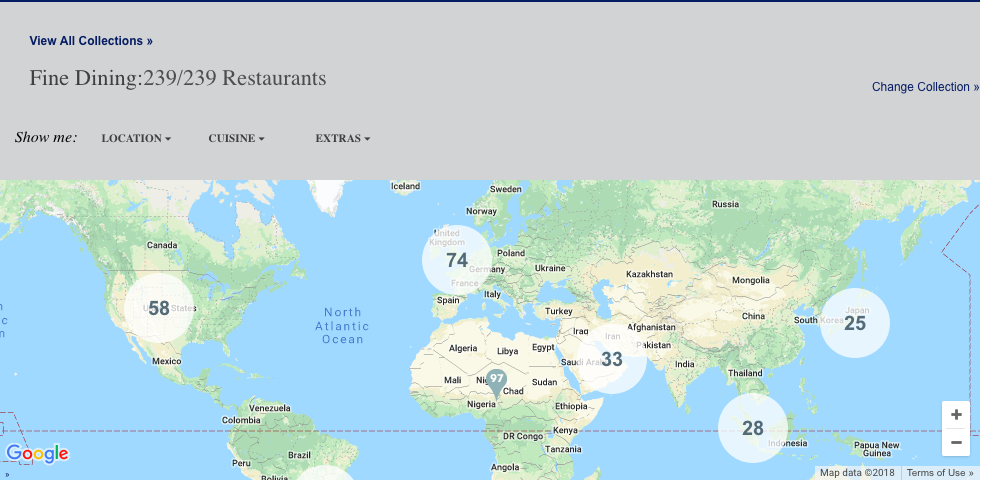

A global map of the participating restaurants in Taste:

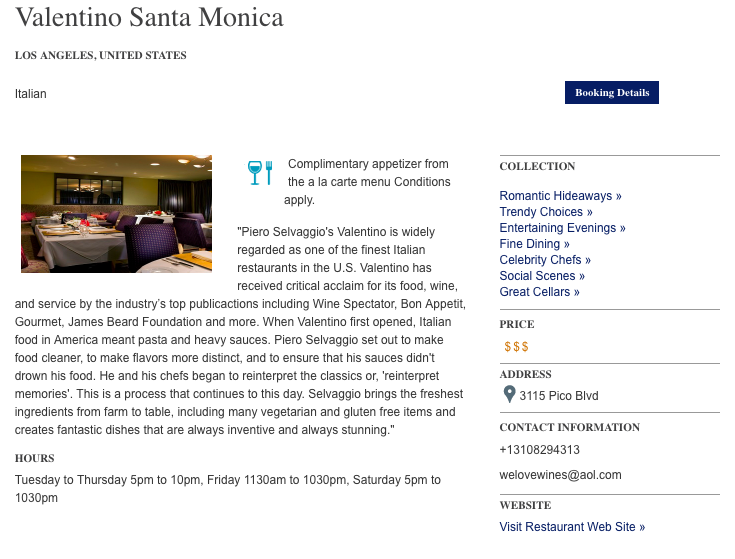

An example in Los Angeles:

Did you know about this perk?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.