This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Cathay Pacific Asia Miles transfer bonus

Ordinarily we see bank specific transfer bonuses, but every now and then, we see a program specific transfer bonus where you’ll get that bonus when you transfer points from a wide range of banks into said program. Well, this time around, that program is Cathay Pacific Asia Miles. Until 3/31/24 you will get between a 10% bonus when you transfer credit card points into Cathay Pacific Asia Miles. I’ve updated the master list of transfer bonuses to reflect this new transfer bonus, so be sure to check that out!

You do need to register which you can do here– and as always I never recommend transferring without a specific redemption in mind.

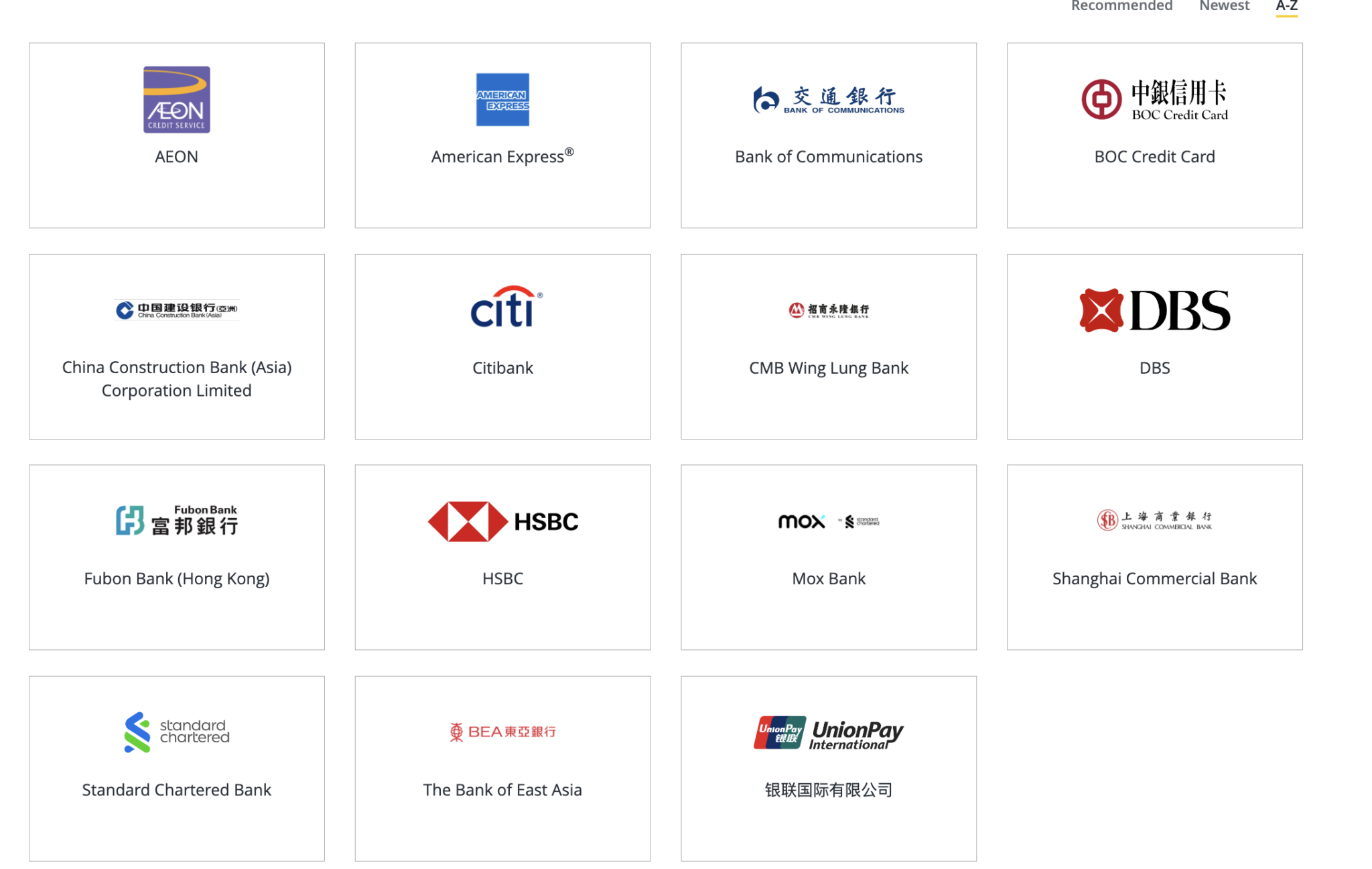

In the USA Cathay Pacific would give a bonus to these programs:

- American Express

- Citi

Here’s all the banks for Cathay Pacific Asia Miles transfer bonus:

Have we seen this before?

Yes, we’ve seen this in the past with up to a 15% bonus.

What are some good uses of Asia Miles?

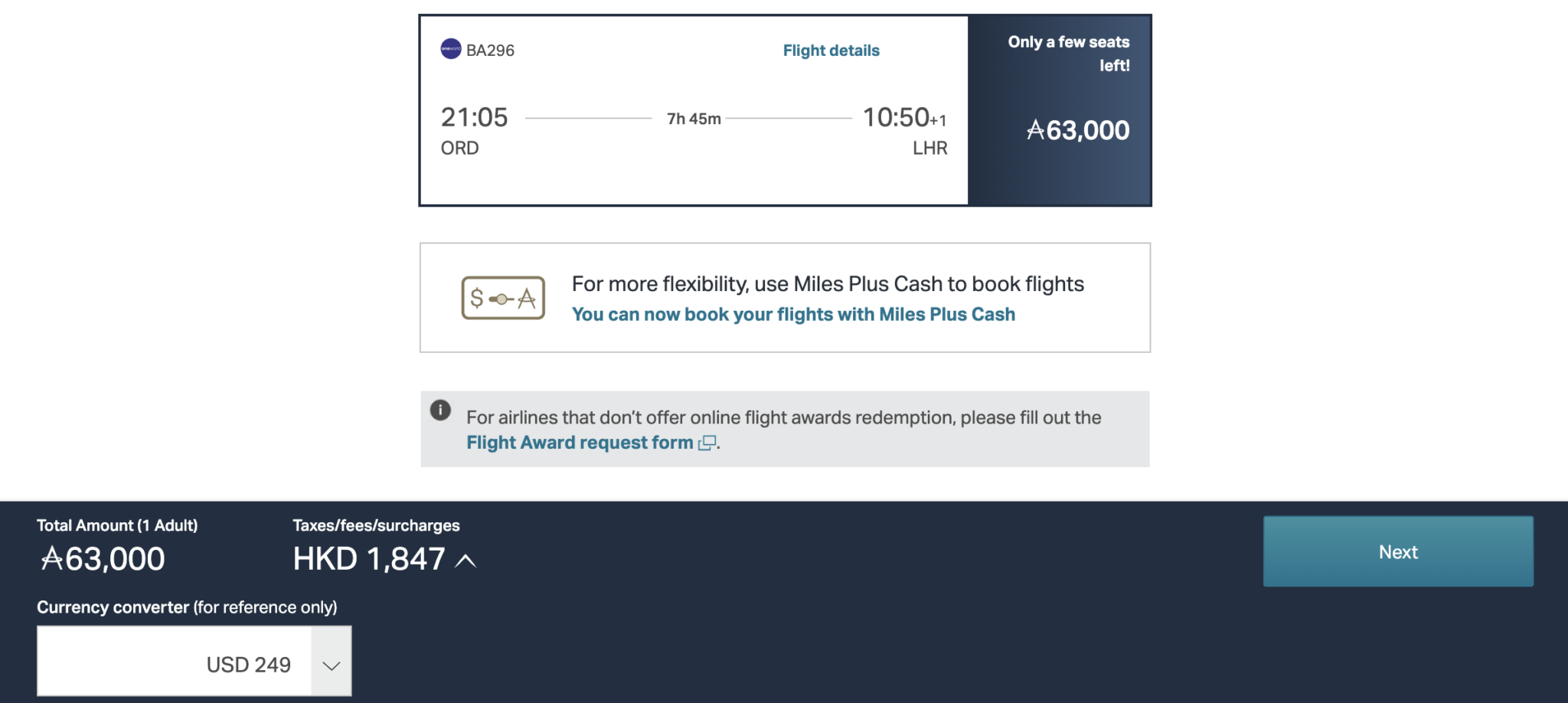

1) British Airways with lower surcharges

Yes, you can significantly reduce the uber high surcharges that BA passes on to you if you opt to book your flights with Asia miles vs another award currency. Here are the prices from the West Coast and then East Coast using Asia Miles to fly on BA or AA

- Business Class from the Midwest or East Coast at just 63k miles

2) Better award avail for Cathay Pacific First and business class

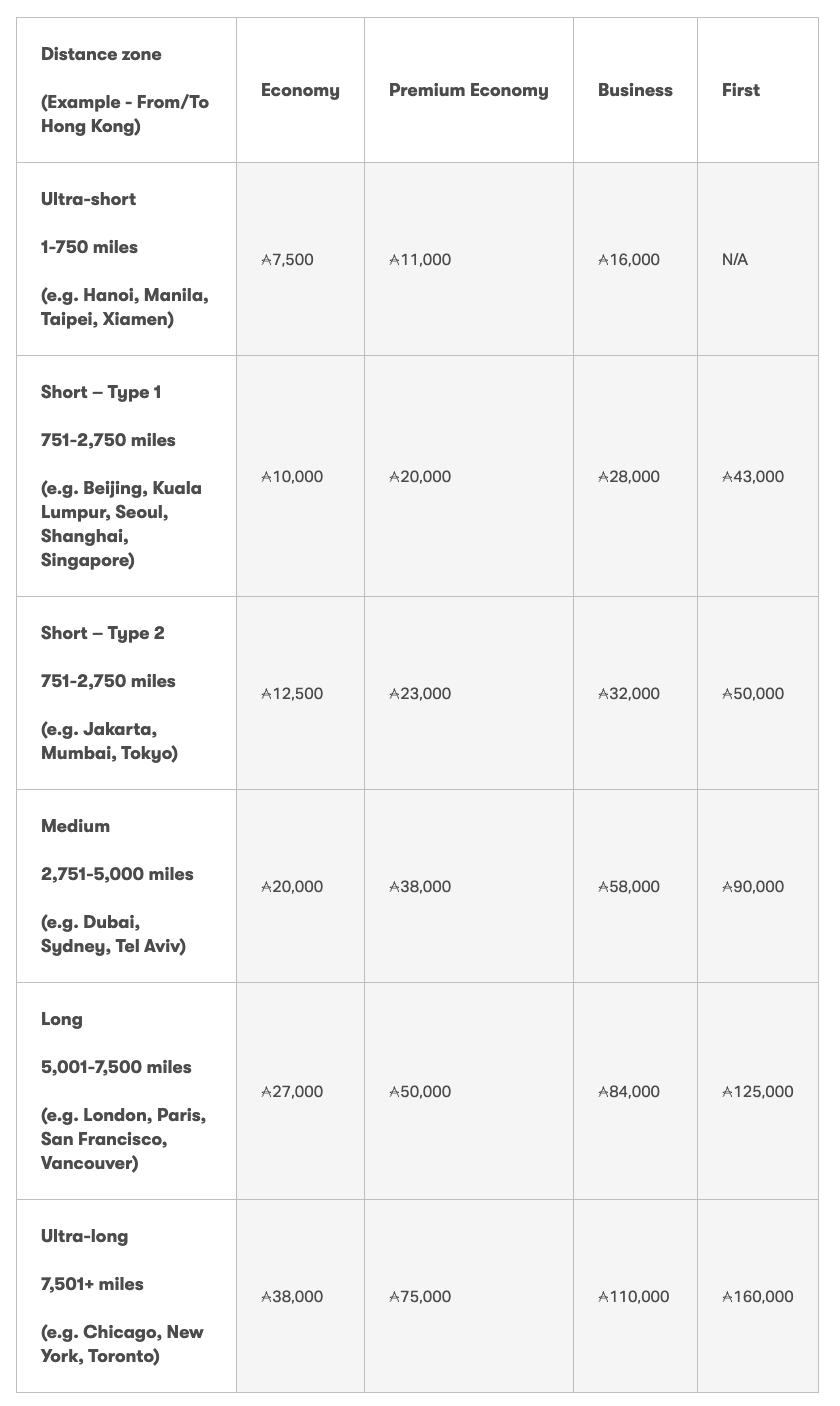

Cathay Pacific has a few different award charts, but you’ll want to focus on “standard” since it provides the cheapest redemption rates.

You can have access to more award space and lock in business class to Asia from Anywhere in America for 110k miles – or 101k Amex Points with this bonus.

One of my favorite first class experiences is Cathay Pacific First Class. It’s very rare to find award space outside of 14 days from departure if booking with a partner airline, you’ll need to look 10 months way from today. However, Asia Miles gives greater access, but you’ll end up spending more miles than you would on Alaska Airlines, for example. Prices range from 125k to 160k depending on if you’re flying from the west coast or east coast of the USA.

Recap

This could be an advantageous way of populating your Asia Miles account for a redemption you have in mind!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.