This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

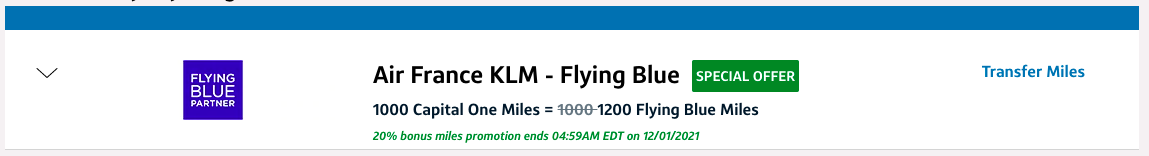

AirFrance/KLM announced their first international promo awards in well over a year and the timing couldn’t be more perfect for Amex and Capital One cardholders. As I mentioned in a prior post…Amex is getting a 25% transfer bonus and Cap1 also has its own 20% bonus. This comes on the heels of the new Cap1 Premium Card!

Let’s take a look at how these two offers can be stacked for

Transfer Cap1 to FlyingBlue with a 20% transfer bonus

Stack with Flying Blue Promo Awards

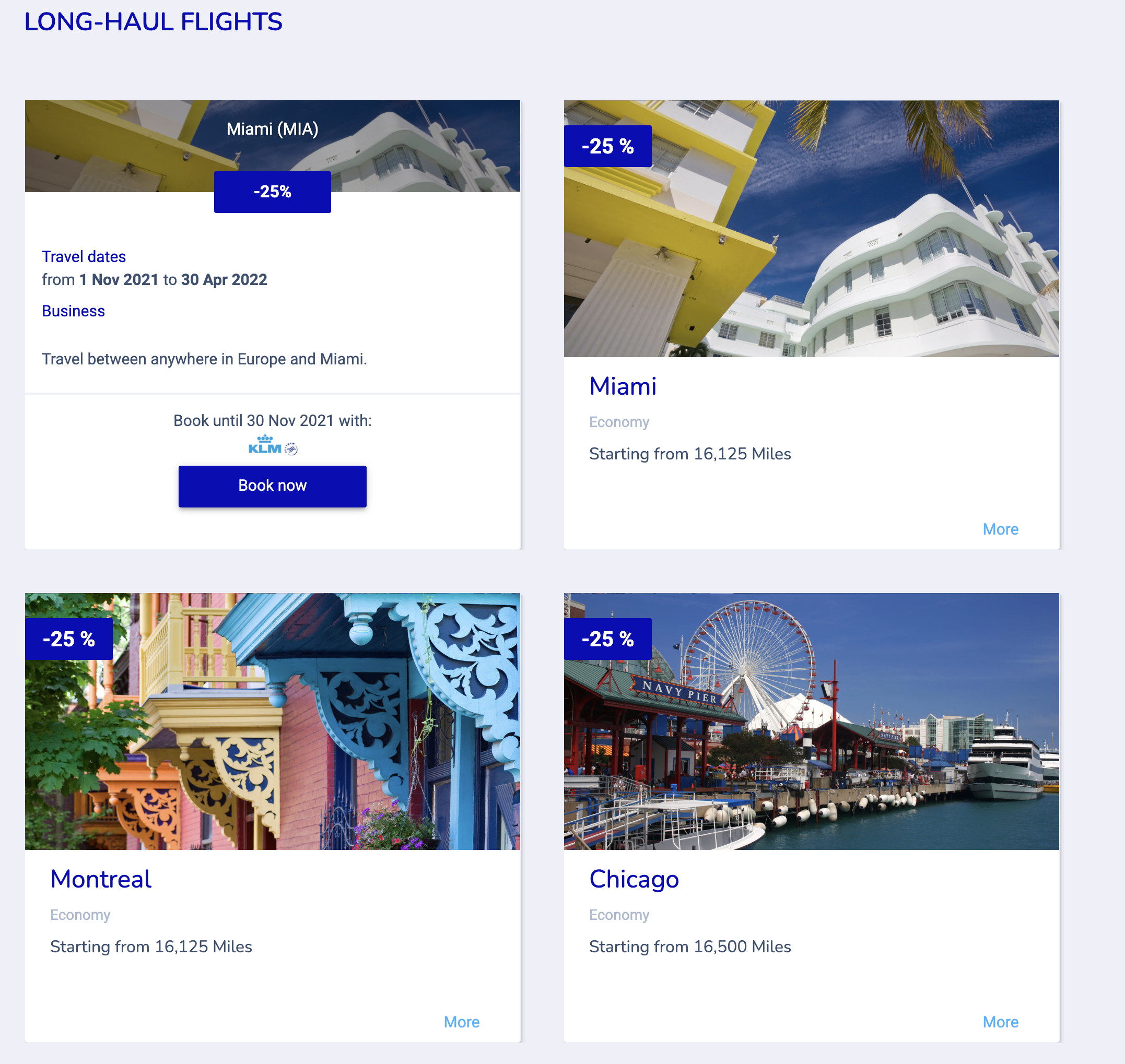

Currently you can find the list of Air France FlyingBlue Promo Awards by going here. One option that is intriguing is the long haul 25% discount on flights to/from Miami – I found several dates with flights as low as 55k, which equates to 44k Amex points one way. Pretty screaming good deal.

- Promo awards are changeable but not cancellable

- You can book between 11/1/21 and 4/30/22

- Make sure you check all the terms and conditions prior to booking

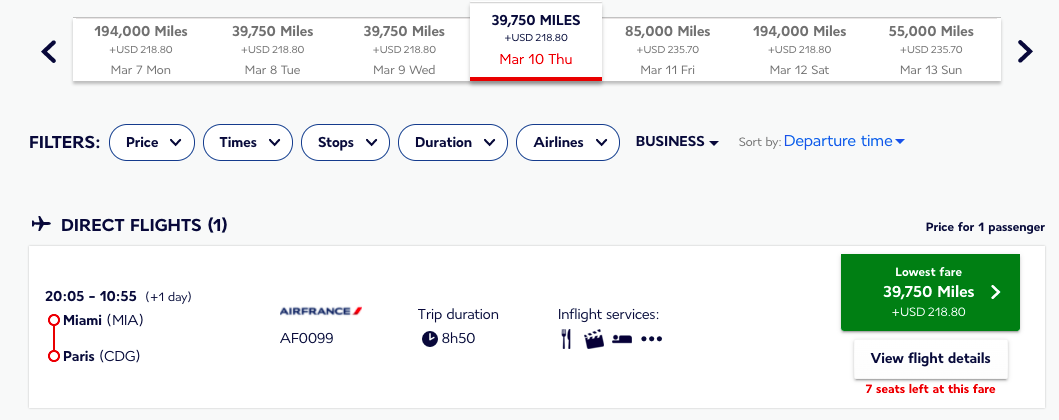

Look at these redemptions!

With the current promo… you’d only need to transfer 34k Capital One Miles to fly business class each way. Note that the taxes and fees are something to consider and roughly $200 to $400 each way. 68k Cap1 Miles and

Some cool options for Air France/KLM Flying Blue?

Using Air France to fly on Air France Business Class

Air France offers one of the very best business class products to fly across the Atlantic to Europe. Quick tip…avoid the A380.

Aside from that aircraft, you’ll get a swanky business class to fly flat on your back, toast champagne high over your head, and experience some tasty wine and food in flight.

One thing to note – not every date is going to show reduced promo prices, and only Miami will price in at the sub 40k level. You will find many other dates pricing around 55k or 46k Cap1 Miles. I booked the 77W in business class and you can read the full review here.

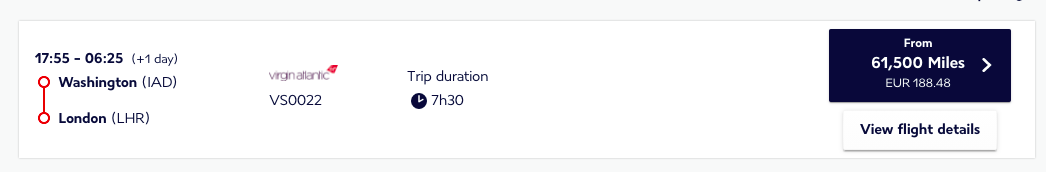

Using Air France to fly Virgin Atlantic Upper Class

These will be redeemable with the transfer bonus, but not the promo awards

This is a great use of Cap1 miles since it capitalizes on the Air France and Virgin Atlantic partnership. Air France doesn’t throw as many taxes and fees on bookings vs what Virgin puts on their own award flight so you ought to be able to book Virgin Atlantic Upper Class starting at 61k + $200 give or take.

Don’t forget there is are two versions. The classic herringbone styled Virgin Atlantic Upper Class seen below on the A330.

But also the new Upper Class featured on the A350

Overall

This could certainly be valuable to you when combining it with a FlyingBlue Promo award

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.