We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This is kind of crazy and illustrates just how generous American Express is being with their customers. At the end of September, I was targeted for an Amex Business Platinum offering 150k after $15k spend in 3 months. A couple weeks after receiving the card Amex introduced 4x referral earn + the referral bonus. Whatever your card currently earns in points, add 4x to it, and that’s what it’ll earn for 3 months, up to $25k spend. It created a magical storm for me and set me up to earn over 300k points in 3 months, and even more going into next year.

As an aside – you should check out the post Frequent Miler has up about earning over 600k! He walks through a multi card strategy that is incredible and unlike my situation, doesn’t start with a targeted offer.

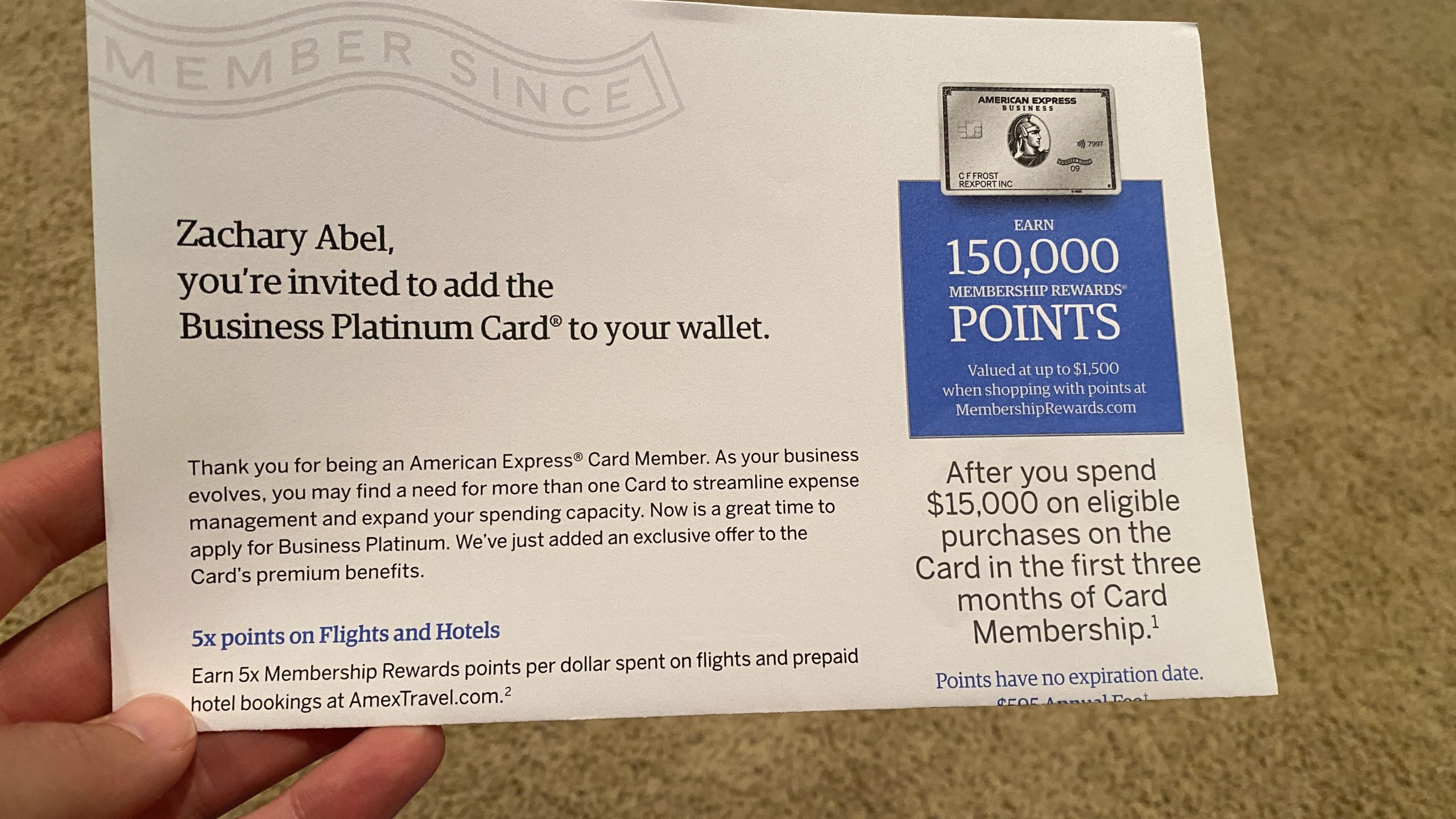

I received this targeted offer for 150k Amex Points via a Business Platinum Card –

You can see the dedicated website for the offer here:

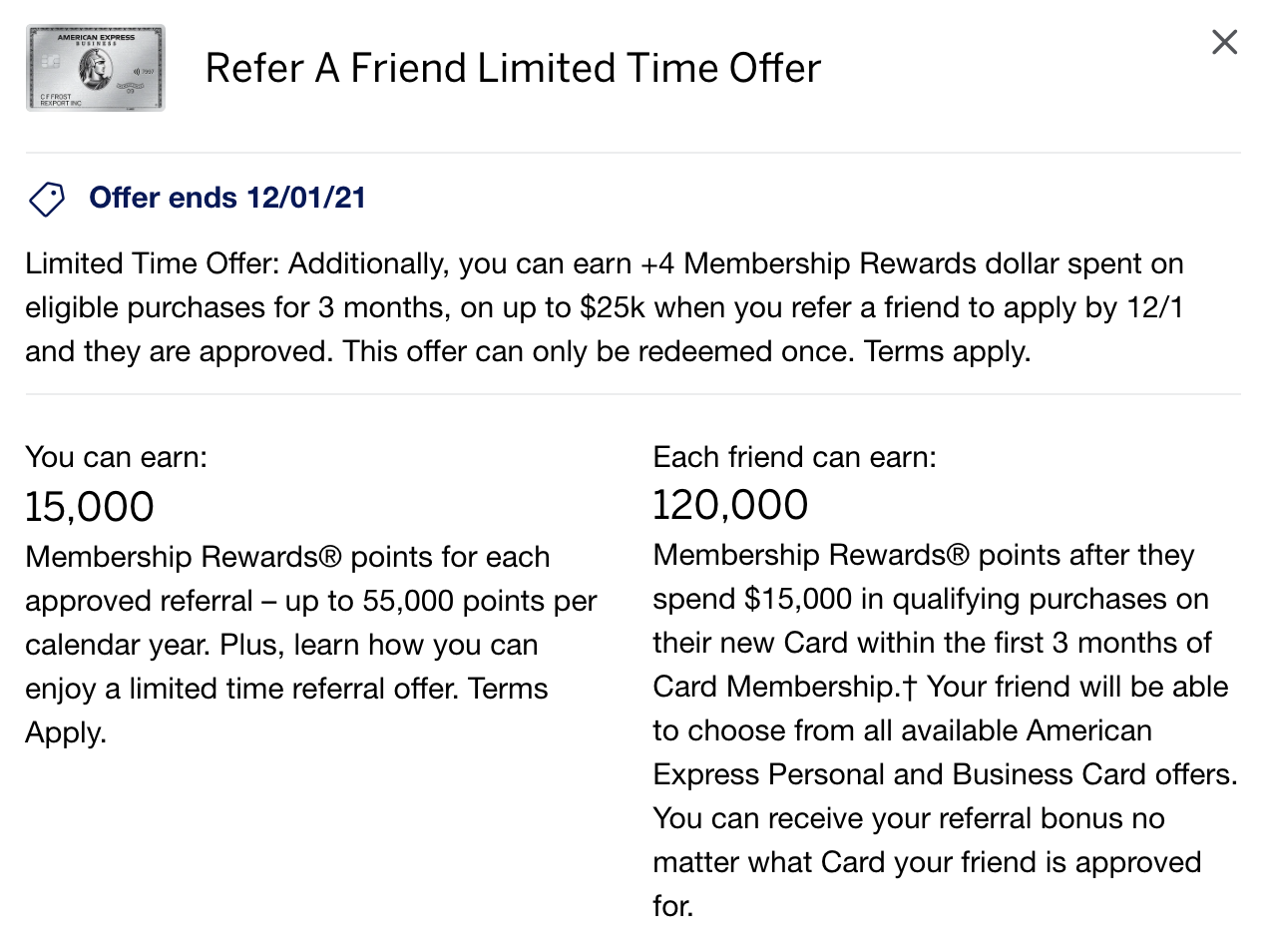

That card also has this referral offer – 55k + 4x

Don’t forget our dedicated reader referral pages where you can earn loads of points too

Don’t forget our dedicated reader referral pages where you can earn loads of points too

Since I’m constantly trying to use points on my travel for the site, I cycle through my referrals first, and usually very quickly I max out. I then work my friends and family through the site, and finally, I start adding your links that you leave below. I leave them up for a few weeks and then cycle in another one.

- Amex Gold

- Amex Green

- Amex Aspire

- Amex Platinum

- Amex Biz Platinum

- Amex Everyday Preferred

- Amex Blue Business Plus

- Amex Biz Gold

How I’ll earn 335k points in 3 months

I signed up for this card on September 30th. So technically, the min spend ends 12/30/21, but my first 4x referral wasn’t until October 24th. That 4x will continue until 1/24/22.

For the remainder of 2021

- 150k Welcome Offer

- 55k Referrals 2021

- 75k because +4x on min spend $15k

- Potentially another 40k if I spend $25k

In 2022

- Another 55k Referral

Ok this is slightly longer than 3 months to hit the 2022 55k referral, but It’ll like populate within the first couple weeks of 2022 so i’m rounding.

335k off a single minimum spend and another 40k if I max out the $25k in 3 months for a grand total of 375k points.

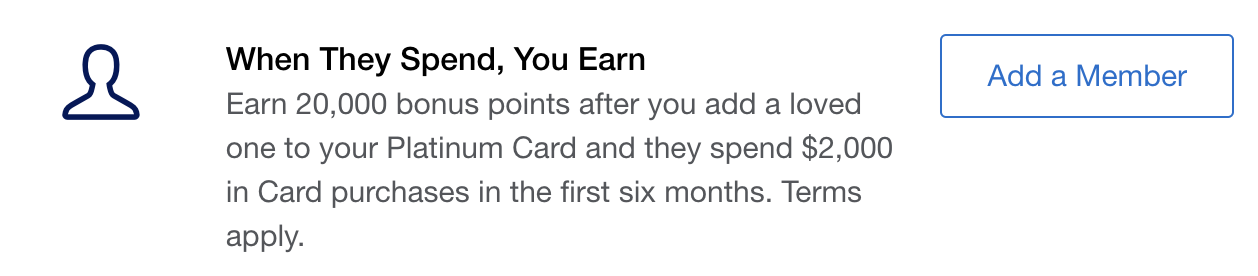

This doesn’t take into account the Authorized user bonus I could take advantage of as well.

- 20k points after $2k spend in 6 months

- Up to 5 authorized users

That could push my total haul up over 400k points

Overall

I really hemmed and hawed adding this card to my wallet. I’ve received multiple targeted offers this year from Amex to add additional cards to my wallet that I already held. 2 biz Golds and now 2 Biz Plats. Ordinarily Amex I’ve taken advantage of most of them, and I’m really happy I pulled the trigger on this one and have the opportunity to earn nearly 400k points. . While my offer was targeted, most of the techniques I’m using are available to anyone that has an Amex card.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.