This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Ugh…Uber Tips

I’ve had many a job. I’ve worked in the service business and believe me I understood and still understand, as a waiter, tips are depended upon. In restaurants, as a standard tip, I leave 20% – even if it’s spotty service. More if it’s great. I even tip in foreign countries at U.S. percentages ( which are the highest in the world). I leave tips for the housekeeping staff at hotels. When I take a cab…I leave a tip. Why did I love the concept of Uber and Lyft? YOU DON’T HAVE TO TIP! Call me whatever you want, but for goodness sakes – I want to see a fare and know what I’m paying. It was great – no hassle, no haggle, no talking, no one trying to sweet talk you into tipping them more. I liked getting in the car, playing on my phone from point A to point B, getting out of the car, rating 5 stars for a pleasant experience and that was that. If the driver was exceptional…slip them some cash. But it was NEVER expected.

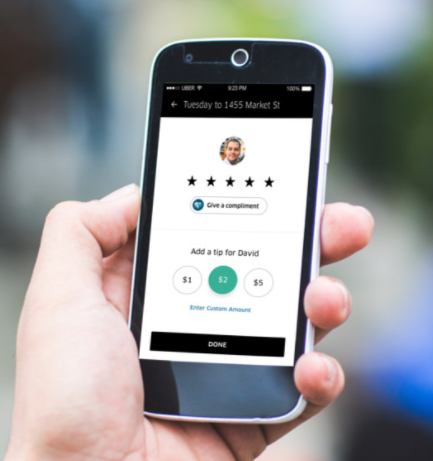

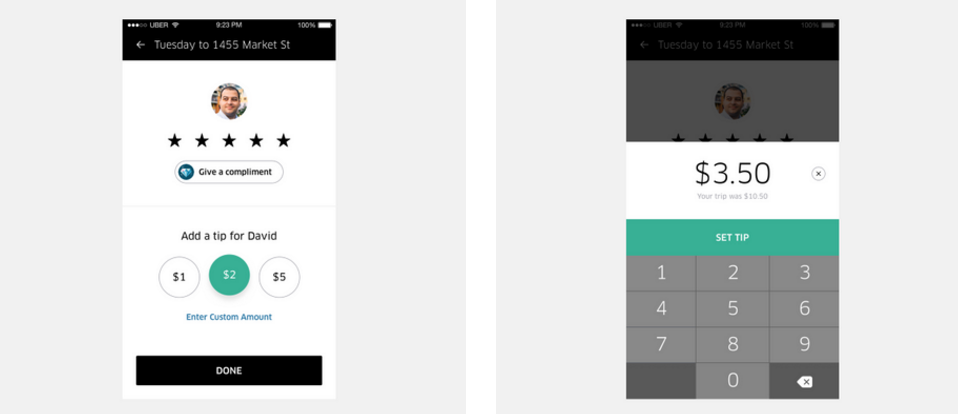

Now, tipping is an option on Uber.

At some point Lyft added the tipping feature and there have been multiple times where the driver has told me a story about “someone” who took the service and then never tipped and what a jerk they were. Oh…really? Did that person have to listen to you complain about someone else not tipping because that may be why they didn’t tip you…because I’m not going to tip you either.

The tip became expected. How does that help passenger experience?

I can see what’s going to happen – whether you have a clean car, use foul language, drive erratically, play loud music, etc, etc – drivers will be disappointed if you don’t receive a tip. Drivers will subtly encourage you to tip, blah, blah, blah. Let’s be honest, the reason tipping has been added is to appease DRIVERS not passengers because they’re losing those drivers to Lyft, etc. They’ve cut how much the drivers were making on every ride so now they’ve added tipping to subsidize it. Ugh…

Exceptions…

If you put my bags in the trunk, had water for me, charged my phone, gave me mints/gum, put on my playlists – I can see why this warrants a tip as it’s above and beyond.

If you want to read more on how the tipping will be done…go here.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.