This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

OMAAT broke the story earlier today….United poured gasoline all over their program, struck a match, and lit it on fire. It’s an absolute afront to their loyalty members to raise redemption rates by over 30% across the board and not even send a single email. This really goes to show you how important it is to maintain your points in flexible currency accounts like Amex, BIlt, Chase, Citi, or Capital One since all of those programs can transfer into partner programs and you’d have access to Star Alliance award availability at lower prices than United now charges. This devaluation makes the likes of Aeroplan, Avianca LifeMiles, Singapore, ANA, etc far more attractive.

The greatest use of points and miles is to make travel that you’d otherwise not take…possible. The biggest aspirational trips for a lot of Americans is to the see the world, and high on that list is Europe. Well…that was the first destination to get hit, and I’d guess it’s just a matter of time before we see the rest of the world get gutted as well. Let’s take a look at the damage.

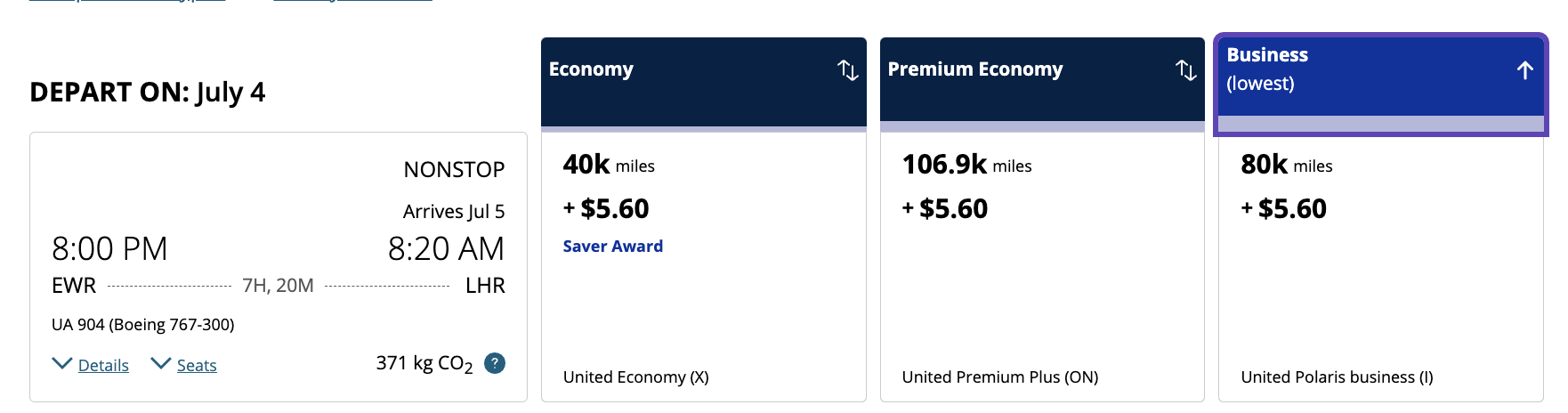

Going to Europe on United planes

It used to be that you could redeem United miles to fly to Europe at the following rates

- Economy was 30k

- Business Class was 60k

You’d pay a few thousand extra if you were redeeming within 30 days, but that was the base rate. You may find some cheaper econ rates here and there, but now these are the base rates

- Economy is 40k

- Business Class is 80k

What a joke.

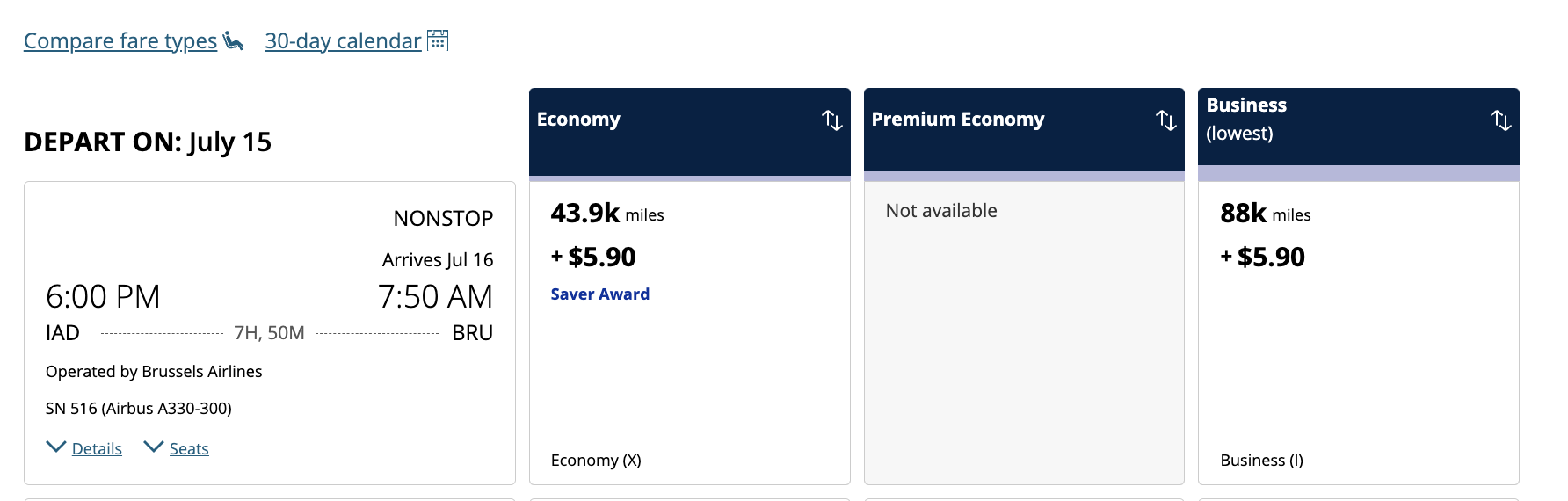

Going to Europe using United miles for Partner flights is even worse

Partner used to be

- Econ was 30k

- Business was in the 70k to 77k range

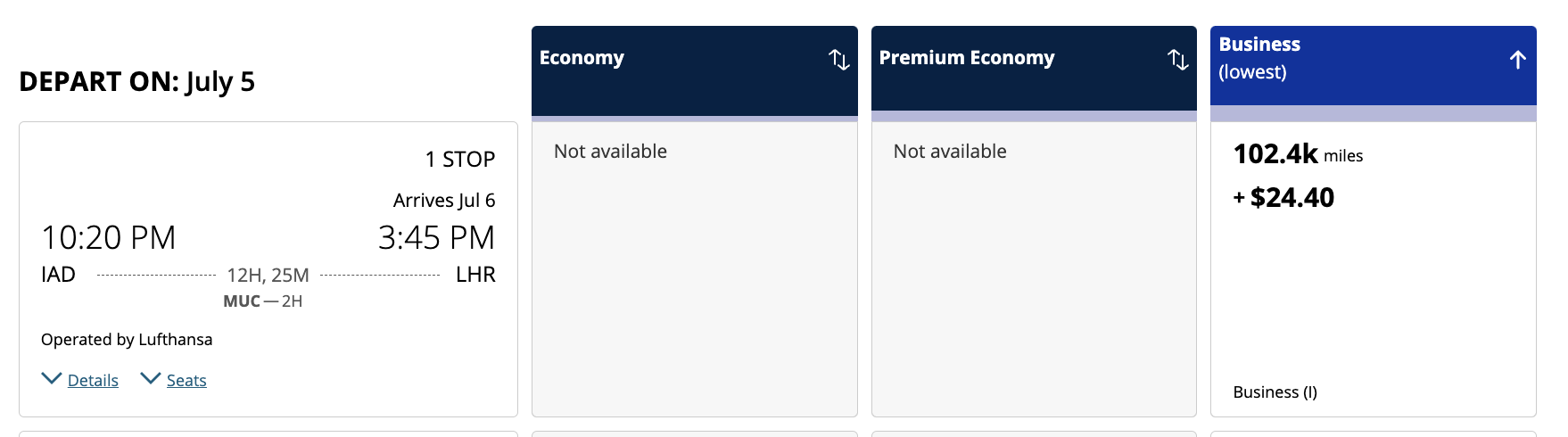

Now look at this disaster

- Econ is 43.9k

- Business starts at 88k, sometimes 99.8k and even 102.4k

To put this in perspective here are some partner redemption rates to Europe

- Avianca LifeMiles are 63k

- Aeroplan is 70k

- Singapore 81k

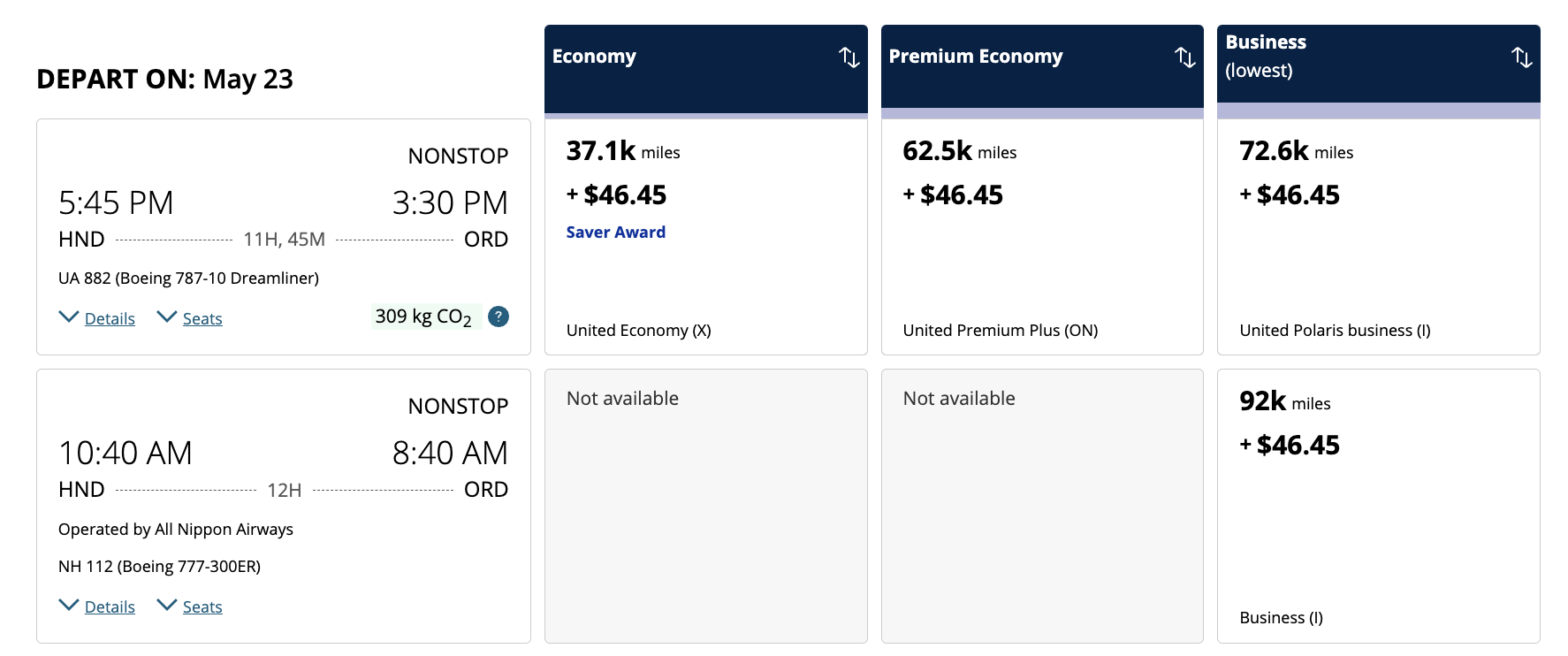

A tad bit of a devaluation to Asia…

Partner used to be 88k and there is a close in booking surcharge being added which bumps both sides up.

Disappointing to say the least

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.