We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A lot of noise has been given to Neel Kashari, CEO of the Minneapolis Fed, calling for a new 6-8 week hard lockdown. The crux of his reasoning rests upon the idea that rolling opening and closings hypothetically cause more economic hardship, and that the economy would fare much better if we did another complete lockdown to stymie the spread of Covid. Of course, in order to ascribe to this strategy, one has to concede to the belief that extraordinary fed intervention is effective, and those guiding that intervention are wise enough to steer the ship better than the collective market.

Personally, I think the Fed has played a large part in inflating a massive equity bubble, has consistently missed inflation targets, and is contributing to an erosion of the faith in the dollar as a reserve currency. Then again, I’m not here to debate those points, but rather, I’d like to highlight a part of his reasoning for another shutdown: The US Savings rate. While I’m a huge advocate of saving, it doesn’t equate to rich credit card bonuses in the short term.

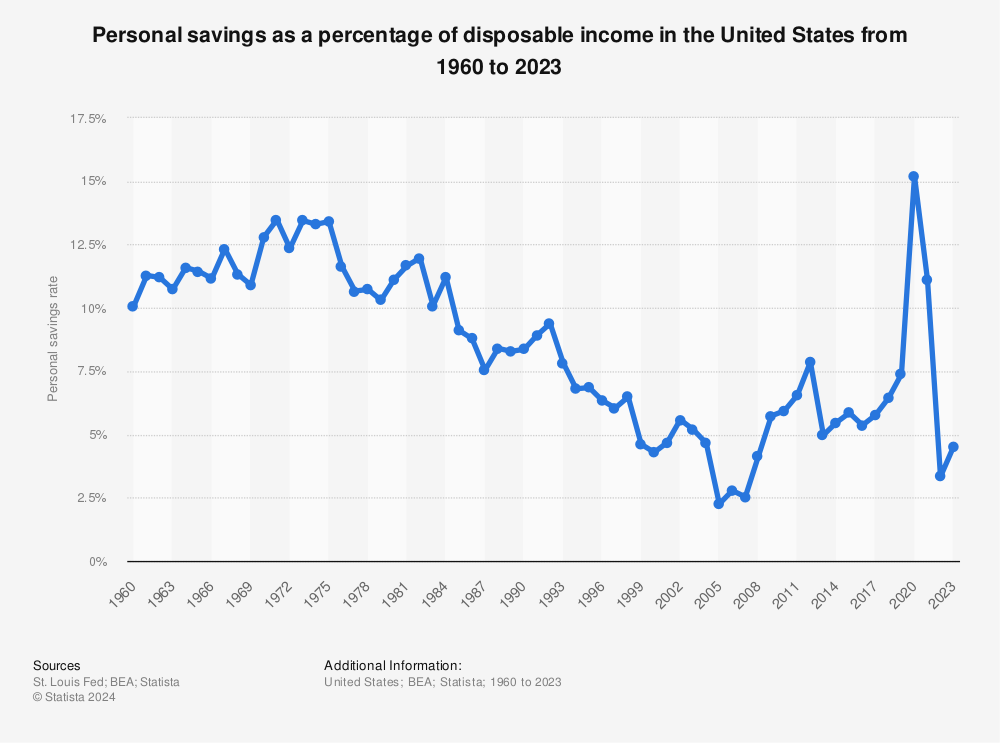

Kashari argues that high US Savings rates would be the needed fuel to financing further rounds of easing. You can see in the chart below from Statista that Savings have been exceptionally high, and according to Kashkari means we don’t have to worry about building up a deficit.

Find more statistics at Statista

To put these numbers in perspective…here’s a chart dating back to the 60s

Find more statistics at Statista

Higher Savings won’t equate to immediate economic recovery

Traditionally, an increased savings rate means that banks have more deposits and can lend more money as a multiple of these deposits. Increased investment leads to job and economic growth. However…these are not normal times.

In fact, banks have continued to make any line of credit more difficult to acquire – that means not just business/construction/ home loans, but also revolving lines of credit like Credit Cards that you and I love to rack up points with.

Why? Banks are bracing for record loan loss. We talked about this a few months ago, and with forebearance coming due in the next couple of months, the banks have built up billions in reserves to account these losses. Multiple sources are saying a massive wave of evictions is in the future of US housing, and much of the PPP loans will run out alongside the $600 weekly unemployment checks. It feels as though we are in the eye of the financial hurricane. While banks have reported profits on their trading desks it has been fueled by cheap money and a level of Fed intervention never imagined. Perhaps the piper will never be paid, but this market feels extremely disconnected to what’s happening on main street.

If banks aren’t leveraging their savings deposits to stimulate growth via investment in expansion, economic recovery is delayed and recession ensues. Macro Economic forecasts aside, banks aren’t making money off lending, and to exacerbate decreased streams of income, more people are switching to debit as credit card balances are paid down.

This all leads to a further suspension of rich credit card offers.

But how about the increased offers we’ve already seen

We’ve seen increased offers from United and Marriott lately, but here’s the thing: Marriott raised $900M from selling points cheaply to Chase and Amex, and United leveraged MileagePlus for a $5B loan. These offers are on the back of these sales and banks are quite restrictive on who can get approved anyways with tighter lending standards. Because banks are able to purchase these points at below market pricing, they can offer higher bonuses because they require lower margins to be profitable.

Clearly this runs contrary to my point that we aren’t going to be seeing rich credit card offers going forward, but caveats are caveats. A big part of this is that lending is so strict, but not impossible. Banks are going to be willing to lend to their best borrowers, even in the midst of disaster, but that doesn’t mean it’s a bellwether for what you and I may experience.

What should we be looking out for then?

Alterations to restrictive bank rules and increased native bank currency offers could signal the worst is behind us

Native Currency offers.

When Chase starts incentivizing their rich Ultimate Rewards cards like the Chase Sapphire Preferred/Reserve, etc it’ll be a good sign. Same goes for Amex . We recently saw an amazing deal on the Freedom Unlimited, but remember that is geared to be cash back, and doesn’t include the rich perks of their premium cards.

Bank rules.

What haven’t seen change? 5/24, once in a lifetime, 8/65 rules are all still in tact – when those policies become more lenient we will know that the worst is behind us, and perhaps they never will, but I’d guess if the trend to debit and savings continue – they’ll do something to lure people back.

Keep an eye on Savings rates

As banks understand their true exposure to loan loss and the choppiest water is behind them, they’ll begin to leverage deposits into loans. This will compound and as the economy rebounds, people will feel a greater sense of security in spending their discretionary income, savings rates will begin to normalize.

If Savings rates continue to stay above 10-15%, I wouldn’t hold my breath for record breaking credit card offers on flexible point currencies that cost the banks that issue them the most. With that said, I’d assume we will continue to see some pretty good offers from cobranded cards from brands that are hurting the most from the recession: I.e. Hilton, United, Marriott, Hyatt, Delta, etc.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.