This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Singapore Airlines Krisflyer is a transfer partner of all the major flexible point currencies: Chase, Amex, Citi, and SPG ( soon to be Marriott ) which makes it one of the easiest points to earn and best to use. I’ve personally used Singapore Airlines Krisflyer to fly Lufthansa First Class, Singapore Suites, Singapore First Class, EVA Business Class, I booked Untied’s new Polaris with it, multiple domestic US flights, the list goes on and on. It’s one of my favorite go to transfer partners. They not only rep some of the most competitive rates, but their change/cancellation fees are some of the best as well. So what’s the problem?

The only problem I face when using SQ to book my own flights, as well as recommending it as a currency for award clients, is transfer time. It’s not instant. There’s nothing quite like seeing avail on the flight you want, but then watching the seconds pass as you wait for the points to transfer over to your account. So which transfer partner will get points into your Singapore Account the fastest?

Consistently, I’ve found the fastest way of populating my Singapore Airlines Krisflyer account is with Chase Ultimate Rewards.

I’ve done multiple transfers this year and 4 hours seems to be the average time Chase to SQ. *I will note…if it’s your first time transferring, it’s taken longer, so take this into account. Also remember that SQ miles expire after 3 years, regardless of use.

| Program | Time | |||

|---|---|---|---|---|

| Chase Ultimate Rewards | 4 hours | |||

| Citi Thank You | 12-48 hours | |||

| American Express Membership Rewards | 10 - 18 hours | |||

| SPG StarPoints | 7+days (according to Frugal Travel Guy - transfer done on Monday Mornings) |

*link to Frugal Travel Guy

Widget not in any sidebars

Don’t forget that Singapore Airlines allows waitlisting on their flights.

This is how I got my entire family into Suites last year. That link gives a very in depth account of how we went about it, but the long/short – if you have sufficient miles in your account to book, you can waitlist your ideal flight, and then book your back up flight. When the waitlist clears, you can then switch into your preferred cabin/flight.

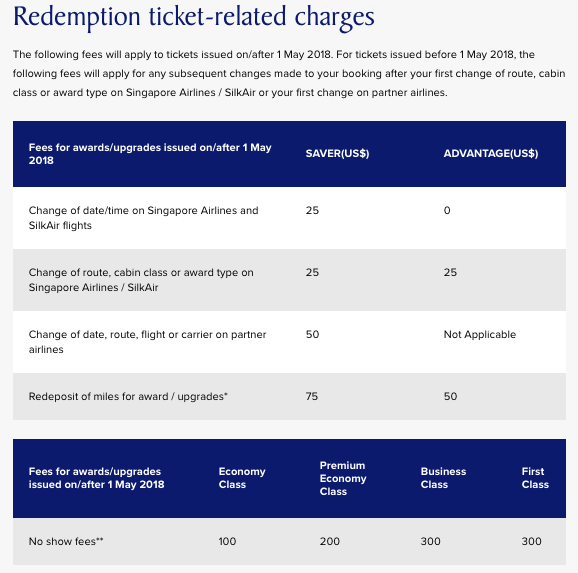

They also have very competitive change/cancellations fees

Widget not in any sidebars

Singapore removed fuel surcharges from flights on their metal. This makes flights TO the UK on their A350 from Houston a great way of accessing Europe. Just 65k miles.

Watch coming back…you’ll get hit with high surcharges tho.

As I’d mentioned before…we’ve used SQ to fly Lufthansa First Class and EVA Royal Laurel. Two of the best ways to sip champagne and forget about your life down below.

If you’re trying to book those flights quick, and your SQ account is low, Chase will be the fastest way to shore up your account.

Usually I like to shore up my accounts with various programs. Each program has a unique set of partners that may have increased applicability depending on the redemption. I’d hate to only use Chase or Amex because I may deplete my account below a threshold I’d need for a future redemption inaccessible. I’d rather spend more points if I can use 3 flexible currencies than less points using one ( if it’s within reason.) If you don’t understand this, ask me questions in the comments and I’ll do my best to explain.

Here’s how I generally approach transfer. As an example, on a redemption requiring 60k points, I would evenly divide it between Chase, Amex, and Citi. However, if I’m in a pinch, and need to snag a seat quickly, I’ll transfer the entire amount from Chase to get it done quickly.

Widget not in any sidebars

*feature image of the new Singapore Business Class courtesy of Singaporeairlines.com

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.