We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Rumor Update2: Is Amex’s announcement the TIER ONE?

Tier One…this is rumor people. Unlike Doctor of Credit who has some inside sources at Amex, I’m just doing some good ole’ digging and trying to connect some speculative dots. I originally saw the rumors posted on Reddit and thought it would be fun just to speculate its veracity. Some of those same contributors who posted have said it’s silly to speculate from a random post. Guys…This is fun! I certainly am not guaranteeing anything nor substantiating any rumors, but I first posted because I’m a geek for this stuff and it’s fun. For goodness sakes I write with Miles.

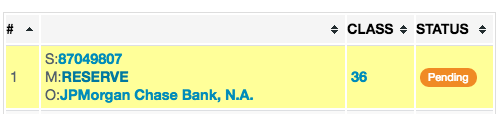

After seeing the post pop up on DoC it occurred to me that this thing could actually be real. So I started thinking about the series of steps Chase took to release their Reserve. They, too, surreptitiously leaked their card online through Reddit and Flyertalk. Coincidence? Maybe. But, one of the big things that validated the leaks was the revelation that Chase had registered a trademark: Sapphire Reserve. Well, American Express has just registered a trademark under the same classifications as the Reserve named Tier One. So will Amex release a new card named the American Express Tier One?

American Express Tier One has a nice ring to it.

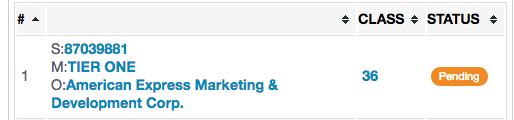

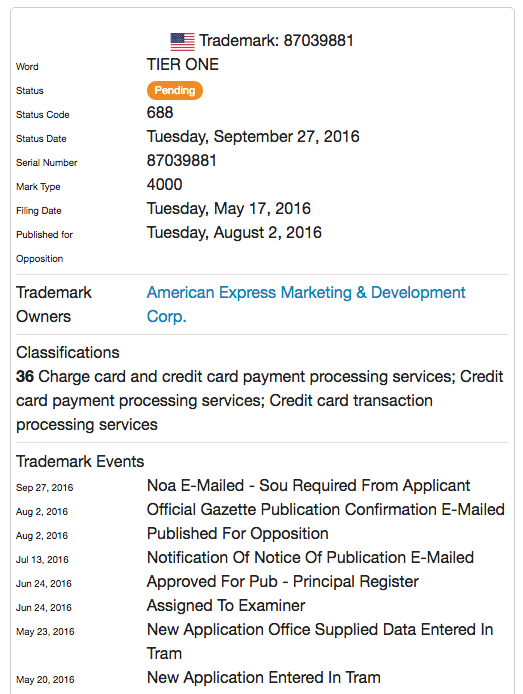

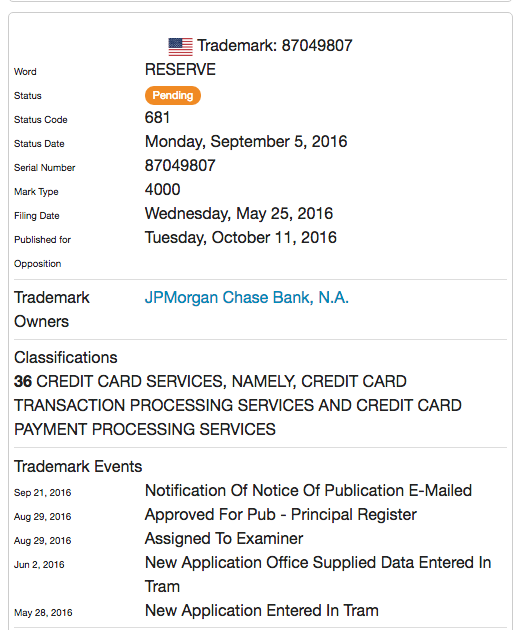

Here are the trademark registration details. The status has also been updated as of yesterday – ironic since that’s when the gossip started. Whereas when you look at the Reserve status it was updated September 5th.

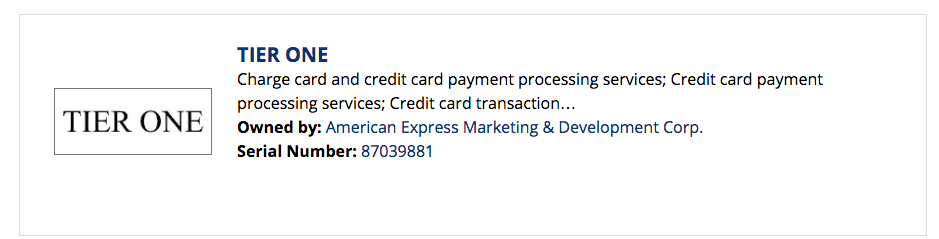

And here

These registrations look strikingly similar to Chase’s registration of Reserve:

I have no idea if this is true or not, but the speculation is SUPER fun

I mean, the credit card landscape has tremendously changed in just the last year or so. With the introduction of Prestige and Reserve, Amex NEEDS to do something to bolster their position in the market. Not to mention the fact that they lost Costco…Now there is BIG TIME buzz about an announcement in October. I MEAN CAHMON – this is amazing for us point geeks.

Certainly American Express registering the TIER ONE trademark doesn’t mean this is a new card or that they are even releasing a new card. But, you have to admit…it makes it a wee bit more fun =)

Maybe this October announcement is the TIER ONE, maybe it’s just added benefits. Who knows…it could be nothing or there could be no announcement. But then again…Maybe someone reading this already knows about the TIER ONE and can rule it out or in. If so…lemme know.

Let the speculation begin

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.