We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

500 mile upgrades on the same Itinerary and record locator

I recently booked a trip with 2 people on the itinerary and received one record locator. I’d imagine that most people traveling together experience the same situation; however, it’s not a regular thing for me. Typically I book things separately even if I’m traveling along with someone: I have just found it easier to manage itineraries whether redeeming points or paying outright. In this situation, both of us are Aadvantage members and we are both seeking Executive Platinum status for next year…we’re currently Platinum. Now, as many of you know, you’ll be prompted with 500 mile upgrade requests on each leg of your itinerary. Here is where the situation got interesting because I don’t have enough 5-hundos in my account to cover both of us. So I called into AA to ask them what’s the dealio with 500 mile upgrades on the same itinerary and record locator?

Requesting the 500s

If you are unfamiliar with 5 hundos, they are upgrade certificates that you can use to upgrade your flight 500 miles at a time.

- Let’s say your flight is 2499 miles that means you’d need you’d need 5 certificates. 5×500 = 2500 total allowable flight miles

- BUT… if it is 2501 – you’d need 6. 6×500= 3000 total flight miles.

- 2501 is over the total allowable flight distance even though it’s just 1 mile.

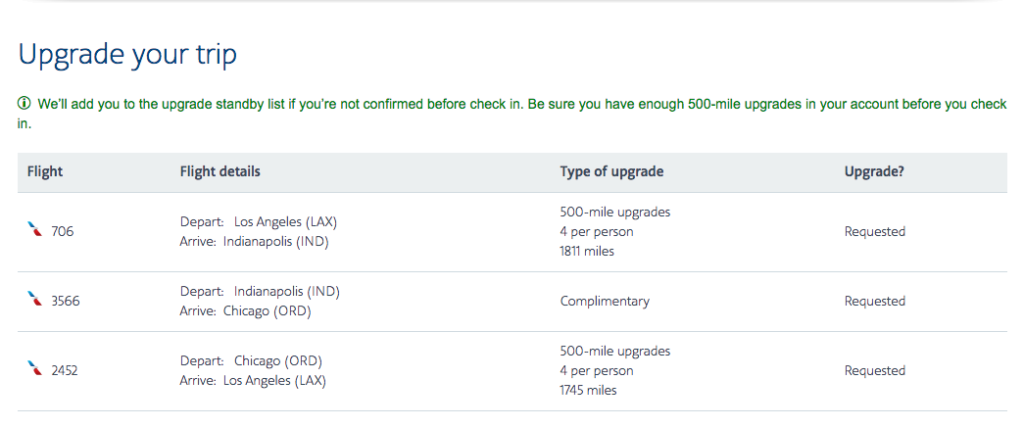

- If the flight is under 500 miles, you don’t need to use any 5 hundos and you will be auto-requested. Here is what it looks like when you’re prompted to use your 5 hundos:

If you’re Platinum like we are, your requested upgrades will be processed 72 hours out. Just because they are processed doesn’t mean that they will clear and you will get your upgrade. Upgrades are based on available space and the upgrade is prioritized based on status and timeliness of your request and check-in. As a Platinum, I have found that I never clear until I’m at the gate. So far this year, I’ve cleared on 3 different flights with 500 mile upgrades…2 of which were under 500 miles in total distance and didn’t use any certificates.

So what happens when there is more than one person on an itinerary, record locator?

There are two options…

- you can request upgrades and pay for them out of your account OOORRRRRRR

- you can request upgrades and pay for them out of two accounts.

*Make sure that both passengers have listed their Aadvantage numbers on the itinerary.

How can I use 5 hundos out of separate accounts?

Whomever has the higher status with AA should book the itinerary and make the request. That will give you the best shot at clearing your upgrade. THEN, at the gate you can specify to the gate agent whose account the upgrades will be deducted from.

In my situation, both of us are Platinum so it doesn’t really matter whose account the itinerary was booked under or who made the 500 mile upgrade requests. Had our situation been different and let’s say I was Gold and my partner was Platinum, it would make more sense for her to book the itinerary and make the requests, and then at the gate we can individually apply our 5 hundos.

Regardless, the 500 mile upgrades are deducted until the gate agent clears you. This then allows you to specify to that gate agent who will ultimately pay for the upgrade.

So to recap, you can specify the account of which the 5 hundos are being deducted at the gate after your upgrades clear.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.