We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Buy American Airlines miles for 1.8¢

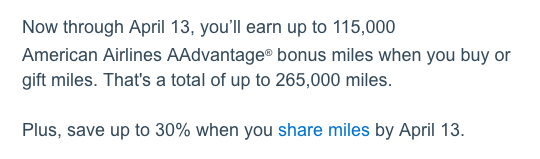

I was emailed this morning regarding a great offer to buy American Airlines miles for 1.8¢. I’m racking my brain trying to think of a deal whereby miles could be purchased for much less and it doesn’t really get much better. What does this mean? If you’re looking at using American Airlines miles in the near future for a redemption and are short – this could be an opportune time. I never recommend buying miles speculatively, but if you’re actively planning a trip, then this could be a great time to pick up some miles on sale.

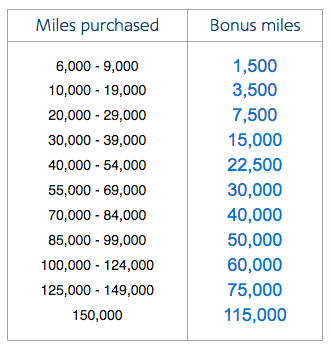

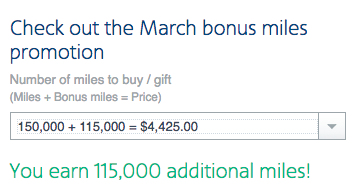

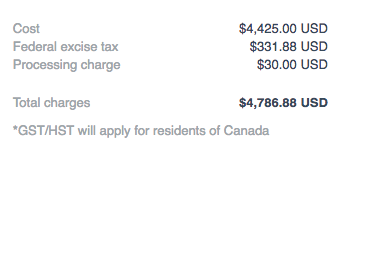

The maximum purchase is 150k + 115k bonus = 265k

That will set you back roughly $4800 or 1.8¢

I wrote a Monkey Miles Memo regarding the value of buying points

If you haven’t read it, and are questioning this premise it’s worth a look. I’d say that buying American Miles at $0.018 is a good opportunity for a point purchase to truly make sense. Either shore up your account, or see the outright space and purchase the entire load of points you need for that redemption. Let’s take a look at few of those instances below.

You can use miles to fly on American’s fantastic reverse herringbone products.

Like I did on the 777-200 from LHR to ORD – only 57,500 miles or $1035

Or on Japan Airlines First Class. 85k from the States to Japan or $1530.

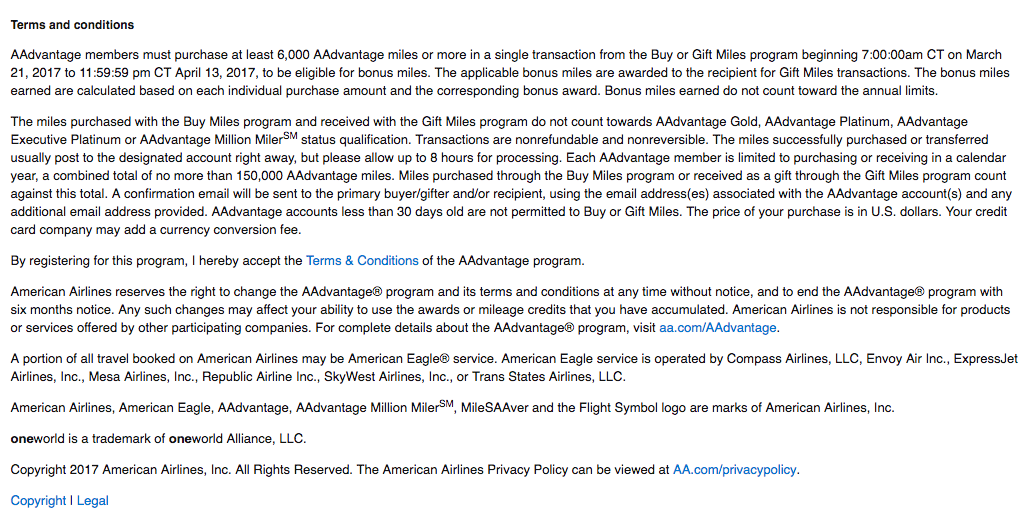

You have until April 13, 2017

- Must purchase at least 6,000 miles

- End 11:59:59 pm CT on April 13, 2017

- Only redeemable miles, no EQM

- Max is 150k

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.