This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Airlines updates on 2020 and 2021 Elite Status

American Airlines has finally gotten around to releasing the broad strokes of what it plans to do with Elite Status qualification for 2020, and hint at what may be in the works for 2021. I just heard today on CNBC that airline revenue for the 2nd quarter may drop 90% year over year, and 3rd quarter may drop 40-60%. This was referring to the big 3 as a whole, but it speaks to the desperate times we’re facing, and what I would guess is just the start at the promotions and incentives the industry will throw at customers to get them in the air. Let’s take at look at what American Airlines is doing to extend elite status, lower qualification thresholds, and incentives credit card spend.

American Airlines Aadvantage Elite Status Extension by a year until 2022

American’s elite status calendar runs from February 1st until January 31st – something Alaska desperately needs to match since they will fold into One World, and there is a window of time where the prior year’s activity hasn’t credited and you could be flying without your due status benefits. AA has has agreed to extend status effective May 15, 2020

If your current elite status expires on January 31, 2021, we’ll automatically extend the expiration date until January 31, 2022.

Lower Elite Qualification for American Airlines Aadvantage

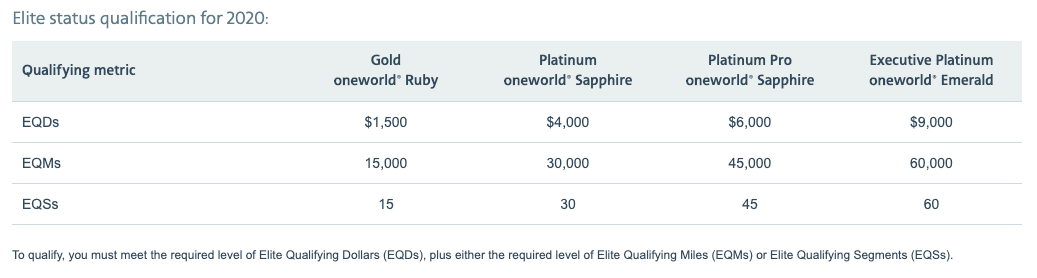

Across the board, EQD/EQM/EQS requirements for Elite Status are all dropping by 40% which should help travelers either don’t have status or would like to bump up a status level. There is no waiver in EQD. Again – goes into effect May 15, 2020

One thing to note is if you are currently Executive Platinum you won’t get additional SWUs, but they are extended – see below.

As a comparison:

- Alaska has extended status through 2021

- United has extended through 2021, but also reduced requirements by 50%

- This also includes United’s straight up buy status via spend threshold of $24k PQD requirement now cut to just $12k for the year…you must fly 4 United flights tho.

- Delta has extended through 2021, but rolled over all MQM into 2021 for 2022 – no reduction in this year’s qualification

Elite status qualification for 2020:

Extending expiration of systemwide upgrades by 6 months

Additionally, if you requalify for status with the new lower requirements you’ll be rewarded with 4 SWUs that will expire 1/31/22.

Earning additional Executive Platinum rewards

Here’s the big thing to remember, and I still push for programs to rollback to 2015 requirements, but Executive Platinums used to get 8 System Wide Upgrades at 100k EQM with no EQD requirement just 5 years ago. With this reduction, you can now earn 2 more SWUs at 90k EQM and another 2 SWUs at 120k.

Previously, members who qualified for Executive Platinum status received a choice of 1 reward upon reaching 150,000, 200,000 and 250,000 EQMs, respectively. For 2020, we’re lowering the levels required to earn these rewards:

Reach 90,000 EQMs and choose from:

- 2 systemwide upgrades

- 40,000 bonus miles

- Gift of AAdvantage® Gold status

Reach 120,000 EQMs and choose from:

- 2 systemwide upgrades

- 40,000 bonus miles

- Gift of AAdvantage® Platinum status

Reach 150,000 EQMs and choose from:

- 2 systemwide upgrades

- 40,000 bonus miles

- Gift of AAdvantage® Platinum status

The new lower EQM thresholds will take effect by May 15, 2020.

You can now earn Million Miler status miles via Credit Card spend.

All credit card spend used to count towards Million Miler status, but that changed end of 2011, and this is an attempt to incentivize cardholders to push spend through their cards. It is the profit center of the Big 3 US airlines after-all. In fact, airlines are discussing using their programs as collateral for loans and selling miles at a large discount to banks to weather the storm.

Here’s the thing…unless you’re within striking distance of status…why bother. I don’t think that the airline programs are in danger of collapsing since they could be sold off ( a la Air Canada ) to finance continuing operations.

There is quite a bit of opportunity cost in pushing spend through one of their co-branded cards as well since you may earn far more points on category spend with cards like Amex Gold, Chase Freedom, etc.

What they should have done, and could have been effective for people aiming to hit the next level of status was allow credit card spend to count towards higher EQD and EQM thresholds. Suddenly you’d have a lot of people shoving spend through cards, and with such reduced air traffic less erosion of benefit dispersion even with more elites in the pool.

$1 spent on eligible AAdvantage® credit cards equals 1 mile toward Million MilerSM status

We’re introducing a limited-time promotion to help you reach Million Miler℠ status and receive benefits like elite status. For all eligible Citi / AAdvantage® and AAdvantage® Aviator products, as well as select AAdvantage® credit cards outside the U.S., every dollar spent on net purchases that post between May 1, 2020, – December 31, 2020, will count as 1 mile toward Million Miler℠ status.

Aadvantage change fees have been waived with caveats

Any travel that is booked by May 31, 2020 for travel through September 30th, 2020 – they don’t mention when you need to cancel by, prior to take-off I’d assume ;), has been wavied.

Beyond that…refer to the table below – provided by AA.

Recap

The elite status extension is great, but will more incentives be needed to get people to fly AA vs other carriers? As it is…whether you have Delta, United, American, or Alaskan elite status…you have it for another year. So, if I have to fly, where would I put my money?

Delta has the best domestic routes and United has, in my opinion, the best partners. United, arguably has the best top tier status when you factor in the Global and Regional guaranteed upgrades. I’ve long thought AA’s angle, certainly pre-US Airways merger, was its award program. They’ve done everything possible to join the status quo in devaluations instead of priding itself on a customer friendly program with outsized value that could mine fliers from competitors.

With this program, I don’t think they’ve made it comparatively advantageous to pivot business to them vs their competitors. In fact, I’d say, thus far, United has made edging up in status the easiest to come by.

Air Traffic started to precipitously drop in February and came grinding to a near halt in March/April. We still don’t know when the country will start to open up, but the idea is that it will be rolling open, not all at once, etc. Personally, I’m at home in LA, and we are under lockdown until May 15ht, and that will more than likely get extended into June. That means over 3 months where, even if I wanted to travel, I couldn’t really. That’s 25% of the year right there so a 25% reduction should have been factored in regardless.

AA dropped requirements by 40% whereas United dropped by 50%, and even made 1K buyable for $12k and 4 flights. If you’re flying the banker route between NYC and LHR which I’m sure will fire up soon…that’s only a few last minute flights and you’re 1k with a bevy of bennies. Why would you fly AA over United if your company is paying full fare J rates for biz.

With all that said…I’m Gold and if I end up flying again this year on revenue fares…I’ll go for Platinum at least.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.