This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

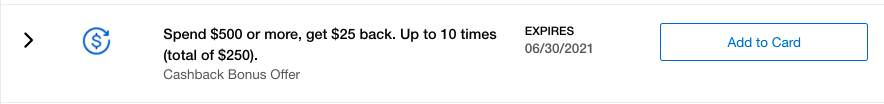

Amex Offers: Cashback bonus

This offer is pretty much self-explanatory, but I want to highlight two caveats. 1) You must have been a cardholder prior to 11/1/2020 and 2) You have to spend the $500 in one fell swoop. The second stipulation is a bit different than other Amex Offers since it requires the $500 to be made in a single purchase, most Amex Offers permit the spend requirement to be combined across multiple purchases. This particular offer was targeted for my Amex Blue Business which is no longer available for sign up, but I’d assume other cards are available as well.

If you have any large purchases coming I would look into splitting them up. The vendor may be willing to allow you to make 4 payments of over $500 rather than a single $2000 purchase. Since this isn’t pegged to any one vendor, it could also be stacked with other Amex Offers like Spend $500 at Ferragamo get 10k points.

Unfamiliar with Amex Offers in general? You should read our complete guide to Amex Offers

Here are the 7 American Express Cards that I keep, why we have them in our wallet, and recommend your consideration. Amex Offers are incredibly valuable for all members. We earn tons of cashback and Amex points every year from Amex Offers which helps us justify keeping so many cards.

Also remember that you can earn referral bonuses on each and every card you carry ( go here ). It’s how we earn over 500k points a year without spending a dime.

- American Express Platinum

- American Express Gold

- American Express Green

- American Express Business Platinum

- American Express Business Gold

- American Express Blue Business

- American Express Blue Business Plus

Cashback Bonus offer: Spend $500 get $25 back up to 10x

- Must spend $500+ in a single purchase by 6/30/2021 to get $25 back

- Only valid for cardmembers who had their card prior to 11/1/2020

- May only do this 10 times

- Cash advances, other fees and charges such as interest, annual fees and foreign currency conversion fees are not eligible transactions and do not qualify for this offer

Terms and Conditions:

Must first add offer to Card and then use the same Card to redeem. Offer to enroll is only available to eligible U.S.- issued American Express® Cards who are Basic Card Members or Additional Card Members prior to November 1, 2020. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Basic Card Members and Additional Card Members must separately enroll an eligible Card. Offer valid for eligible purchases made at any merchant that accepts American Express in the U.S. An “eligible purchase” means a purchase of at least $500 made with your enrolled Business Card by 6/30/2021. Each time you make a single eligible transaction totaling at least $500, you will receive $25 back via statement credit. Limit of 10 statement credits (total of $250) back per Card Member. Cash advances, other fees and charges such as interest, annual fees and foreign currency conversion fees are not eligible transactions and do not qualify for this offer. Offer is non-transferable. The enrolled Card account must not be cancelled or past due to receive statement credit. Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied. Statement credit will appear on your billing statement within 90 days after 6/30/2021, provided that American Express receives information from the merchant about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase from merchant until all items from your qualifying purchase have been provided/shipped by merchant. Statement credit may be reversed if qualifying purchase is returned/cancelled. If American Express does not receive information that identifies your transaction as qualifying for the offer, you will not receive the statement credit. For example, your transaction will not qualify if it is not made directly with the merchant. In addition, in most cases, you may not receive the statement credit if your transaction is made with an electronic wallet or through a third party or if the merchant uses a mobile or wireless card reader to process it. Amex Offers are dynamic and personalized, so the offers you see may change. For questions regarding your Card Account, please call the number on the back of your Card. By adding an offer to a Card, you agree that American Express may send you communications about the offer. POID: K1J5:0006

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.