This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

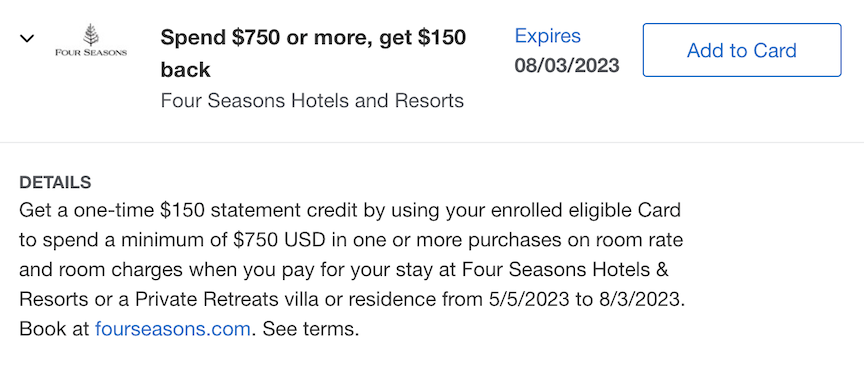

American Express is back with a great targeted spend offer with luxury hotel group Four Seasons. The biggest catch here is that it’s limited to the US, Mexico, Canada, Costa Rica, Anguilla, and St Kitts + Nevis. We’ve seen this deal on an annual basis for quite some time now. Notably, the bonus will trigger if you buy a Four Seasons Gift Card at a physical hotel property, but not online ( it explicitly states eGift Cards are excluded ).

I currently have 10 American Express card and pay over $2k a year in annual fees. Amex offers like these help me earn back my annual fee multiple times over in statement credits and bonus points. I value Amex points at roughly 2 cents, which means if you received this deal as 15k points vs $150, you’d earn $300 worth of points.

- American Express Platinum

- American Express Gold

- 3x American Express Business Platinum

- 3x American Express Business Gold

- 2x American Express Blue Business Plus

Not a bad deal if you’re staying anyways, or looking for a cool gift idea just make the purchase In the hotel.

Here’s a look at the deal

- US Cardholders only

- Expires 08/03/2023

- Must spend $750+

- Excludes

- Four Seasons Private Jet

- Four Seasons Beds

- Four Seasons Magazine

- Only valid on room rate and room charges

- Only valid at listed locations – reservations must be made in person or at fourseasons.com ( I believe charges billed to room will still trigger even if booked elsewhere )

OFFER TERMS

Enrollment limited. Must first add offer to Card and then use same Card to redeem. Only U.S.-issued American Express® Cards are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Offer valid for eligible U.S. Card Members for purchases at one of the participating properties in the Four Seasons Private Retreats Collection of luxury home rentals in the U.S., Mexico, Canada, Costa Rica, Anguilla and Saint Kitts and Nevis. Offer also available at Four Seasons Hotels and Resorts properties in the same locations, plus the Bahamas. Reservations must be made online at U.S. website fourseasons.com or in-person. Excludes Four Seasons Gift Cards purchased online. Not valid for Four Seasons eGift Card purchases. Excludes any service or amenity not charged to a room, third party bookings, Four Seasons Private Jet, The Four Seasons Beds, Four Seasons Magazine subscriptions and other amenities. Qualifying purchase means a purchase at Four Seasons Hotels and Resorts or Private Retreats luxury Rentals made during the offer period with your enrolled American Express Card and which is in an amount totaling at least $750 USD as posted to your account, following conversion from a foreign currency, if applicable, in accordance with your Card Member Agreement. Offer only valid on room rate and room charges. Offer not valid for lodging stays that are paid for before the promotion start date or after the promotion end date. Offer is non-transferable. Limit of 1 statement credit per Card Member. You may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer. For example, you may not receive the statement credit if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet. Purchases may fall outside of the offer period in some cases due to a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction (for example, the purchase date for online orders may be the shipping date). Statement credit will appear on your billing statement within 90 days after 8/3/2023, provided that American Express receives information from the merchant about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase from merchant until all items/services from your qualifying purchase have been provided by merchant. Statement credit may be reversed if qualifying purchase is cancelled. If American Express does not receive information that identifies your purchase as qualifying for the offer, you will not receive the statement credit. Limit 1 enrolled Card per American Express Card online account. The enrolled Card account must be active, not past due, canceled, or have a returned payment outstanding to receive the statement credit. Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied. Amex Offers are available for varying and limited periods of time and are dynamic and personalized. If you navigate away from the Amex Offers page, you may see different offers when you return. For questions regarding your Card Account, please call the number on the back of your Card. By adding an offer to a Card, you agree that American Express may send you communications about the offer. POID: K5M1:0001

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.