This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

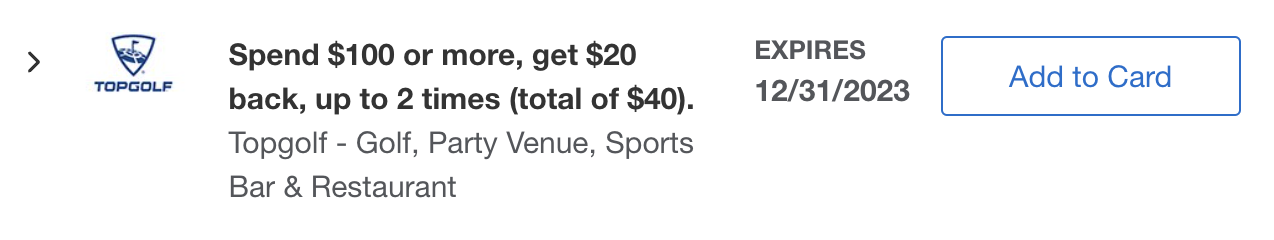

Who doesn’t love Top Golf? Check your Amex account and see if you’ve been targeted, but this is an easy way to save $20 on $100 spent. It specifically says that Online Gift Cards are excluded, but does not mention gift cards purchased in person. If you frequent Top Golf much, or you may give a gift card as a future present, it may be worth testing this out to see if they work in person.

I find throughout the year the savings that can be had by adding Amex Offers to your targeted cards can outweigh your annual fee without taking any other benefits into consideration. Maybe not the entirety of the $2000+ that I pay in Amex Annual fees from my 10 cards, but every bit helps. If you are unfamiliar with Amex Offers, go here to read our guide.

Here are the 10 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- American Express Green ( I no longer hold this card, but referrals are open if you want to leave yours )

- American Express Business Platinum x3

- American Express Business Gold x3

- American Express Blue Business Plus x2

Details: Amex Offers: Top Golf Spend $100 get $20 back

- US Only

- Excludes gift cards purchased online,

- Excludes purchases made at Topgolf Swing Suites or Toptracer Range locations.

- Offer is non-transferable.

- Valid only on purchases made in US dollars.

- Limit of 2 statement credits (total of $40 back) per Card Member.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.