This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

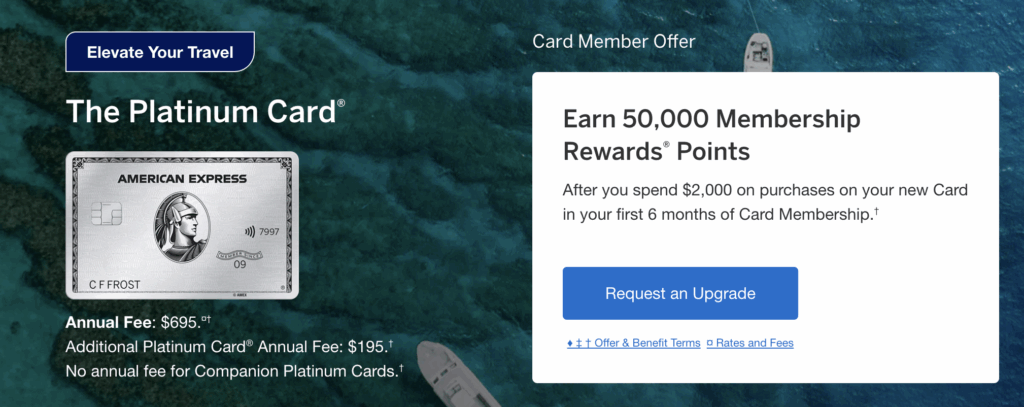

American Express Platinum Upgrade Offers

The Platinum Card® from American Express is one of the most sought after premium cards on the market. One of the limiting aspects of American Express and welcome offers are the application rules – specifically the “once in a lifetime” language that their cards have in regards to welcome offers. Upgrades are one of the ways to get a welcome offer again – case in point. The current upgrade offer regarding Amex Platinum is something to consider ( especially if you’ve had the card and this is an incentive to get it again as an upgrade ).

Two are currently hitting my account and my dad’s

If you’re targeted you’ll see it after logging in, or by calling the number on the back of your card and inquiring if any upgrade offers are available to you

Older offers:

100k American Express Platinum upgrade offer

I was just sent a screenshot highlighting an attractive upgrade offer. It’s not the best I’ve ever seen, but given the fact that Amex has changed application rules, it’s not too shabby, especially if you once had a platinum, and now have a gold and you could get it again.

- 100k after $6k in 6 months

What if you have had an Amex Platinum – do I qualify?

It appears so, two of the readers had an Amex Platinum in the past, the other never had one. I not only had one in the past, but still carry one that was grandfathered in as an Amex Platinum Mercedes a few years ago. I still received an upgrade offer…I’ll likely take it, and then cancel my Amex Platinum since I don’t need two Plats and the other has a fee due in April.

Is this the best upgrade offer we’ve ever seen?

In the past we’ve seen

- 100k after $6k spend in 6 months

- 75k after $6k in 6 months

- 75k with $5k spend in 6 months + 10x US Supermarkets and US Gas Stations is a fantastic upgrade offer.

- 100k + 5x dining and 5x gas

Will I get a hard pull?

I don’t believe so. Usually with upgrade offers nothing changes with your account…the account number stays the same, etc. In fact, you could keep using your old card and it would work. This also works with downgrades. With that said… anything is possible, but you shouldn’t get a hard pull.

Will a new account appear on my credit score?

Similar to the hard pull question, you will not have a new account appear of your credit score. The account is just changing internally.

What if I’ve never had Amex Platinum before?

If you’ve never had Amex Platinum in the past…I would try and get the best possible offer you can get. You can find that on our top offers page

Some great uses of Amex points

While you can certainly use Amex points within Amex Travel, our favorite travel redemptions are utilizing over 20 Amex partners. Moving points into these programs unlocks an incredible amount of value and potential to travel like you’ve always dreamed. Check out our dedicated page to great uses of Amex points – we’re always adding additional uses.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.