We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

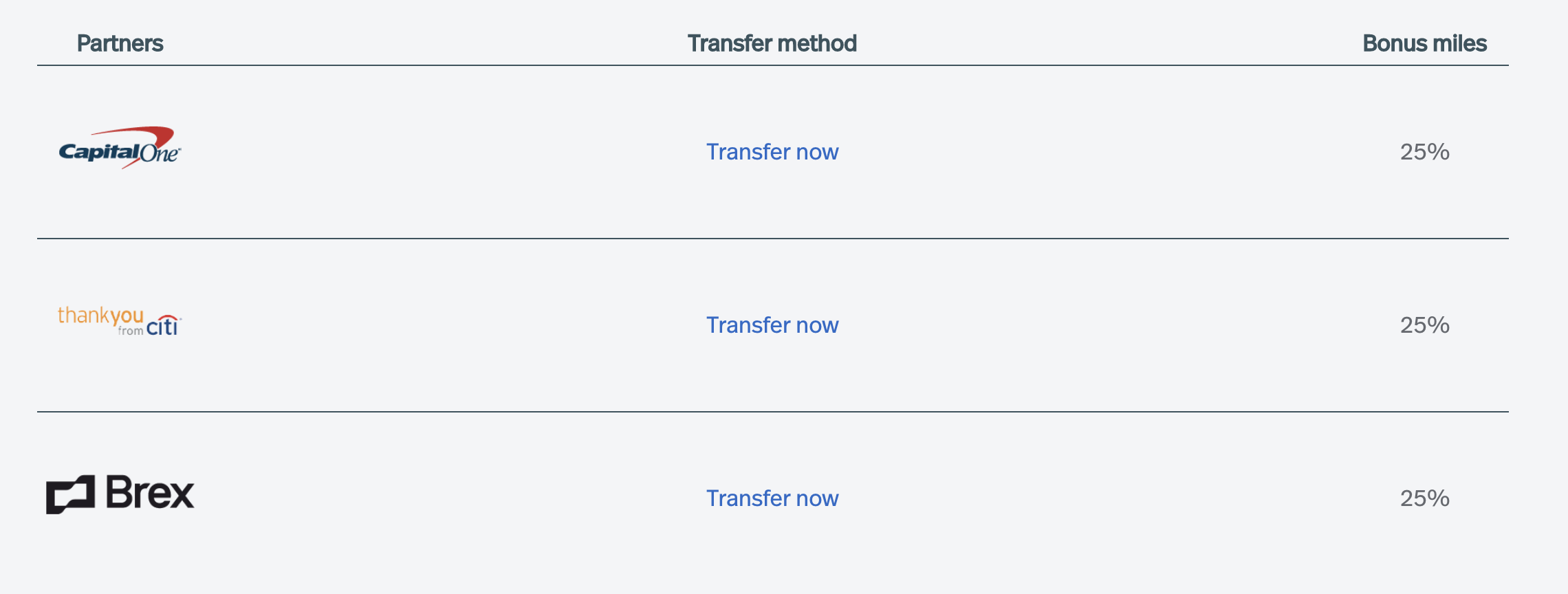

Avianca LifeMiles are one of my favorite programs even if their tech can be frustrating. The rates are just so good, and you can always email them to issue tickets ( support@lifemiles.com ) if they aren’t showing up on the website. Currently, until 12/17/21 you can transfer points from 3 banks and enjoy a 25% transfer bonus. This could be particularly valuable if you’re looking to book travel next year.

The Cap1 Venture X just dropped…it’s our pick for best Premium card for most people

Transfer between now and 12/17/21

- Capital One

- Citi Thank You

- Brex

What are some great uses of Avianca LifeMiles?

In order to use Avianca LifeMiles, you need to know where to use them best. Here’s a half dozen redemptions that we think are pretty amazing.

Within USA

- Economy 8750

- Business transcon 25k

USA to Europe

- Business Class 63k

- First Class 87k

USA to South America

- Economy

- Northern South America 20k

- Southern South America 30k

- Business Class

- Northern South America 40 to 60k ( Avianca Metal is cheaper

- Southern South America 60k

USA to Africa

- Business Class 78k

USA to Asia

- Business Class 78k

- First Class 90k

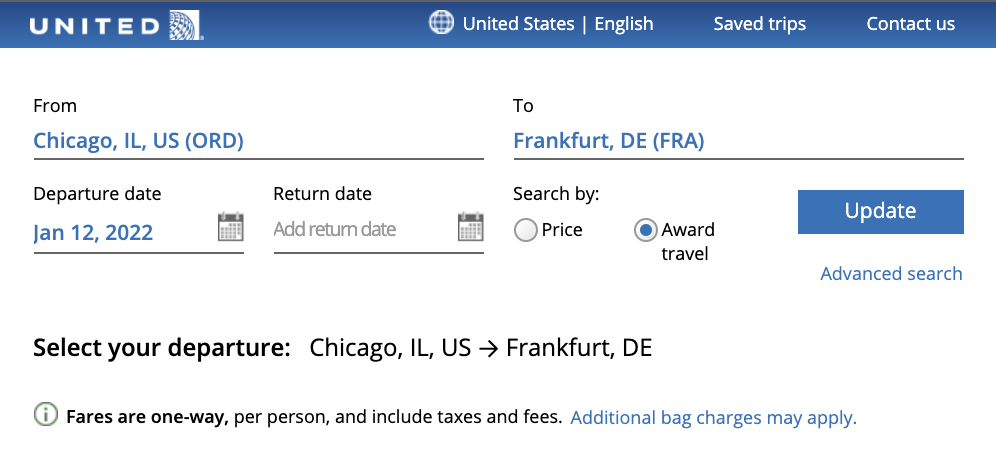

Searching for award space – first go to United.com

Remember the easiest tool to use to find Star Alliance award space is on United.

Which will populate the search like this – I turned on calendar view:

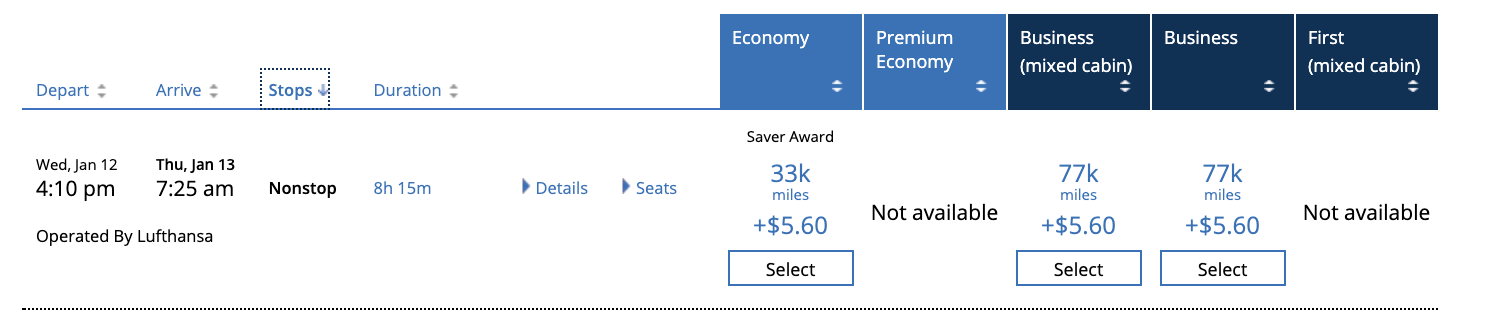

And then you can see the direct flight option on Lufthansa

And then you can see the direct flight option on Lufthansa

Which then looks like this when you search on Avianca LifeMiles

Which would cost just 51k miles during this transfer bonus promo

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.