We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Update! – Read the fine print closely. This was actually for a new card not an upgrade. My current Biz Gold was mentioned in the offer but the links populate a new application not an upgraded offer. My Apologies…original article below:

Keep your ears pricked! I just received an absolutely monster, the biggest I’ve ever seen, upgrade offer to Amex Business Platinum. I’m not alone, I’ve seen 140k offers from MaxMilesPoints and it seems this may be a new round circulating. The best part…it seems, accordingly to the offer terms, that I have until the end of April to take the upgrade offer. This continues the heaps of points Amex continues to throw at existing cardmembers via upgrades and targeted offers. Let’s take a peek at my 150k Amex Business Platinum upgrade offer.

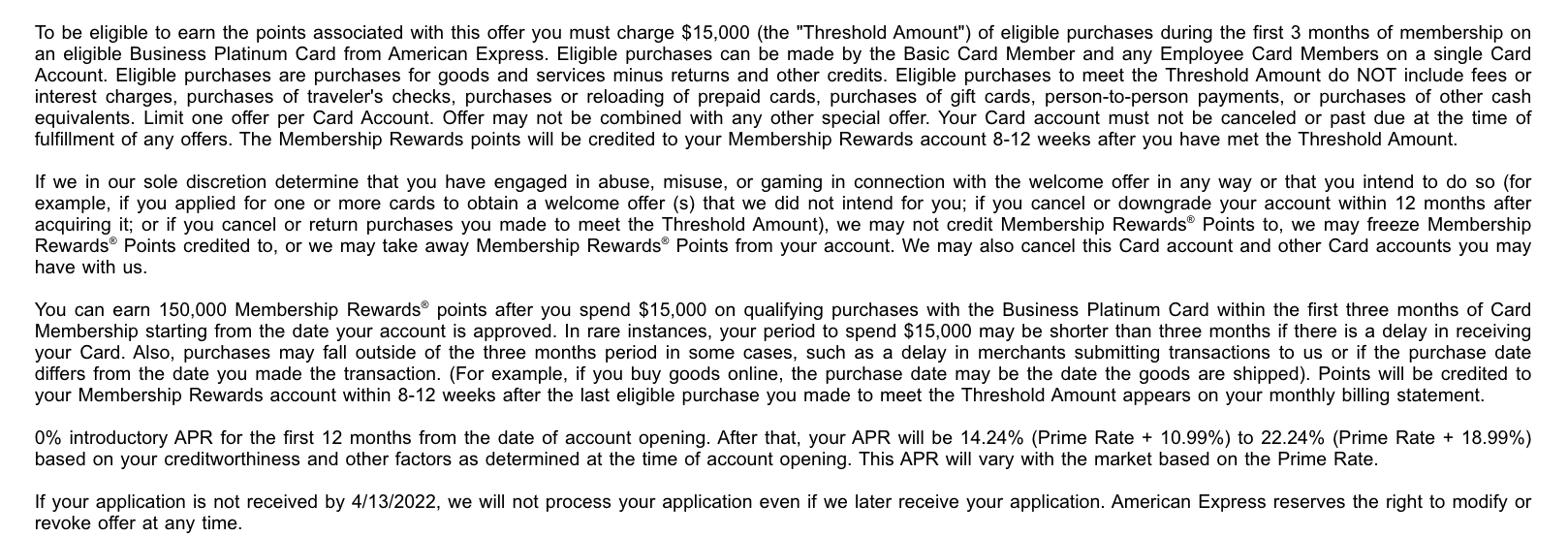

- 150k after $15k spend in 3 months

- 0% interest for 12 months as well on qualifying Pay Over Time purchases.

You can see here on the very last line…if your application isn’t received by 4/13/22 we will not process your application. They could modify or revoke as well…

You can see here on the very last line…if your application isn’t received by 4/13/22 we will not process your application. They could modify or revoke as well…

Here’s a rundown of the Amex Business Platinum

- Annual fee $595 (Rates and fees)

- Annual fee goes to $695 (Rates and fees) if application is received on or after 1/13/22.

- $179 Clear credit (enrollment required )

- $200 annual airline incidental fee reimbursement (enrollment required )

- $120 Wireless Credit ( enrollment required )

- $10 per month wireless credit,

- Must make payments directly to any US Wireless provider

- 1.5x points on qualifying purchases over $5000

- 1.5x on up to $2 Million at select categories

- Electronics goods, retailers, software, and cloud service providers

- Construction materials and hardware supplies

- Shipping providers

- Global Entry fee reimbursement – worth $100 (enrollment required )

- Priority Pass Select membership – worth ~ $400 (enrollment required )

- Cell Phone Insurance

- $800 per claim, 2x per 12 month period

- $50 deductible per approved claim

- Delta Sky Club lounge access – when flying on Delta

- Centurion Lounge access – network expanding and very worthwhile

- Access to Fine Hotels and Resorts

- Amazing benefits such as free breakfast, resort credits, room upgrades, early check in, late check out, etc

- Using Amex FHR has earned me $100s per stay each time I use it.

- Amazing benefits such as free breakfast, resort credits, room upgrades, early check in, late check out, etc

- Over 20 transfer partners: like Singapore Air, Air Canada, Air France, British Airways

- Marriott Gold status (enrollment required )

- Hilton Honors Gold status (enrollment required )

- The Hotel selection

- slightly different than Fine Hotels and Resorts, but provides great benefits, credits, and upgrades

- 5x points on flights booked through Amex Travel

- Access to International Airlines Program rates for select premium cabin flights originating in the USA

- $400 Annual Dell credit ( enrollment required )

- This is split into 2, $200 credits, applied every 6 months: Jan to June and July to Dec

- $360 Indeed credit ( enrollment required )

- get $90 per quarter, Up to $360 annual statement credit

- on all Indeed hiring and recruiting products and services

- $150 Adobe credit ( enrollment required )

- : $150 annual statement credit on select purchases,

- Adobe Creative Cloud, creative apps and services, and Acrobat Pro DC with e-sign.

Honestly…these offers just seem too good to be true but they keep targeting

My biggest concern here is that I currently have 2 Amex Biz Golds. With an offer like this, I’d do it in a heartbeat, but I have 3 Amex Business Platinums already and don’t want to tempt fate. Every single card has been a targeted offer to me specifically, via USPS or email, but after the whole Amex shutdown fiasco earlier this year via a rogue rep, I don’t want to somehow end up collateral damage. I have a while to think about it, but keep an eye out as you may get targeted as well.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.