We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Bilt Rewards has launched a new home buying tool that will reward you with 1 Bilt Point for every $2 of your purchase price. Buy a $100k home, get 50k Bilt Points. Buy a $10m home, get 5 million Bilt Points. There is no cap, and the tool, embedded in the free Bilt app, will also give you an affordability calculator. Let’s dig into it more and also look at the new NAR rules that you should be aware of….Note: I am a Bilt advisor and investor.

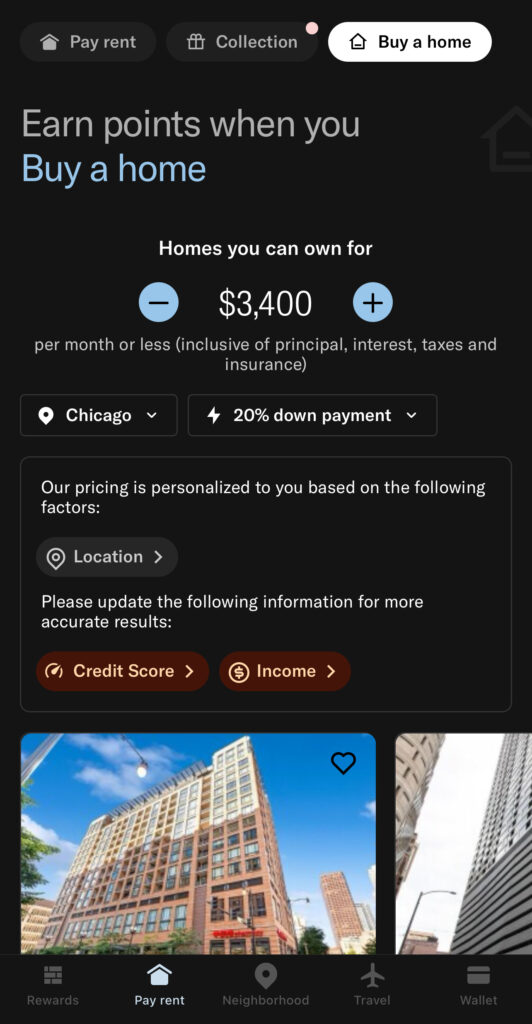

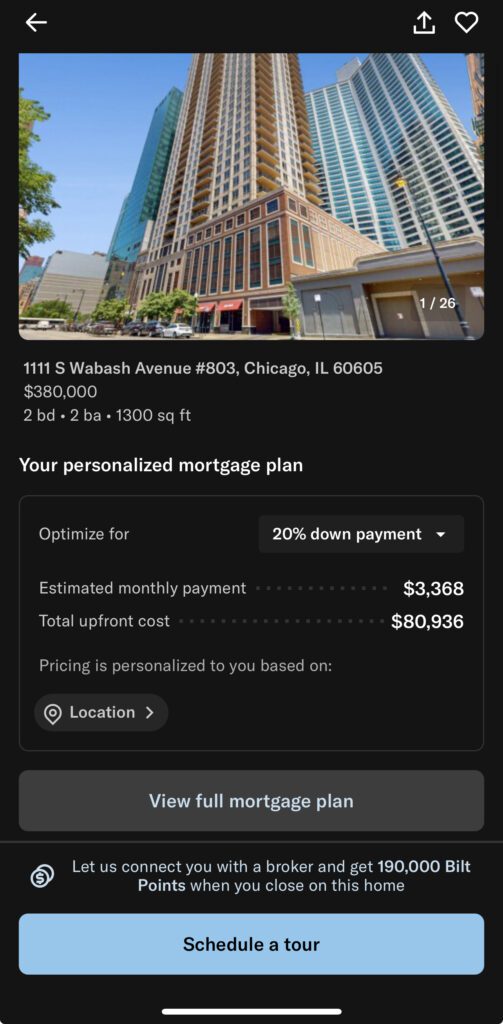

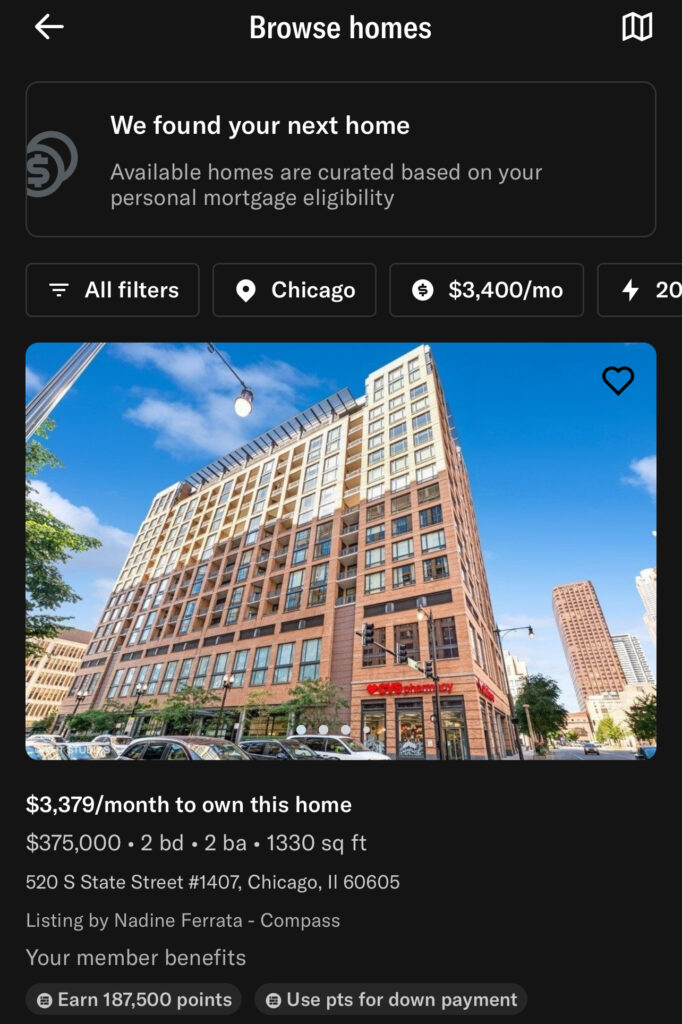

If you pay rent via Bilt, they have all of your information regarding your current rent, credit score and history, income etc. If you don’t, you’d simply enter it in and the app will show you potential homes that you can afford taking into consideration the downpayment you’d like to make, whether you’re willing to pay more or less than your current rent,a and potential mortgage qualification.

The tool includes:

- Converting home listing prices into transparent best estimates of all-in monthly payment amounts that include costs like property taxes and insurance;

- Factoring in Bilt Members’ actual financial profile to determine indicative rates and mortgage types across FHA, Fannie Mae, Freddie Mac, and NQM lenders;

- Allowing Bilt Members to explore various downpayment scenarios and to incur added savings by applying Bilt Points towards a down payment; and

- Showing available homes across different cities based on monthly payment to see how Bilt Members’ buying power differs by geography.

If you see a home you’d like to tour, Bilt will put you in contact with an agent from eXp, their partner, and when you buy a home, you’ll earn points. One thing I’d point out is that you don’t need to use this broker, or even brokerage, in order to buy the home you find. You’d need to use an eXp broker to earn Bilt points, but if for some reason you don’t like whom you’ve been paired with, you could request to change.

New rules on commission and NAR changes:

- NAR Buyer Rules

- Buyers are now required to sign an agreement with a broker prior to viewing a property – excluding open houses. You can make this a single property agreement, add contingencies, but you’re signing an agreement so keep this in mind especially when it comes to the point down below.

- Buyer Commission

- Earlier this year changes occurred whereby the Seller no longer automatically pays the commission of the buyer’s agent/broker on a sale. This means that you can negotiate this if you’re the buyer.

This means you can say Hey, I want my Bilt Points and I’m only going to pay you x, y, z. The broker can decide whether or not they want to work with you, and depending on how hot the real estate market is, will determine how much they’re willing to concede.

The point here is that you need to negotiate these terms ahead of the viewing, and ahead of signing any contract. I love the idea of earning points on Rent, and 1 point per every $2 without a cap is pretty amazing ( other companies have offered points on home purchases, but usually they are in accordance with opening a mortgage with that company, or it’s capped, or it’s a much lower ratio ).

Overall

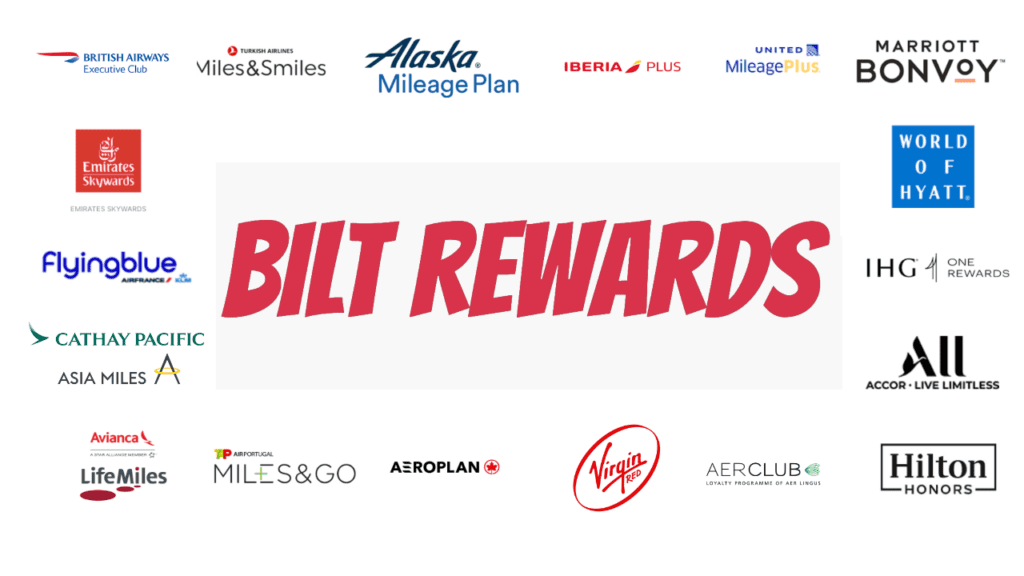

Bilt Points are arguably one of the top 3 most valuable points ( alongside Amex and Chase ), and the ability to negotiate terms that would include earning a ton of Bilt points is a fantastic opportunity. Bilt has great transfer partners as seen below.

If you’re buying a million dollar house, and earn 500k Bilt Points, you could redeem them at 1.25c in the Bilt Travel Portal or transfer them to the partners down below. I peg Bilt Points when used strategically to transfer at about 2 cents a piece. Meaning, you’re earning about $10k in Bilt Points on a $1M home purchase, or roughly 1% back at this valuation.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.