This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One Lounge Washington D.C. Dulles

As luck would have it, Capital One debuted their new Capital One Lounge at Washington D.C. Dulles on a day, Sept 7th, when I happened to be flying out of IAD. Even cooler, I was the 3rd person through the door!

How fun is that?

I got to see the lounge the morning it was “soft opened” and it truly is a stunner. The only thing that is disappointing is the fact it’s in DC and not Atlanta. I’d be here every time I took a flight.

Highlights I really like:

- Grab and Go Food

- Power outlets at every seat

- Cold brew coffee on tap

- Secure Lockers

Where is the Capital One Lounge Washington Dulles?

You can find it just beyond the TSA PreCheck, between the East and West Security Checkpoints. This is the view you have when you exit TSA Pre and you can see the lounge peeking out on the left and right.

Capital One Opening Times

- Soft Opening

- 8:30am to 7pm 9/7 to 9/15

- Normal Hours

- 5:30am to 9pm for normal operating hours

Who can enter?

- Capital One Venture X Rewards Credit Card (Rates & Fees)

- Primary cardholder gets Unlimited access + 2 guests

- If you add Authorized Users they get unlimited access + 2 guests as well

- Additional guests are $45

- Primary cardholder gets Unlimited access + 2 guests

- Capital One Venture Rewards Credit Card (Rates & Fees)

- 2 complimentary visits per year

- You get one guest per visit

- Additional guests are $45

- Capital One Venture X Business

- Primary cardholder gets Unlimited access + 2 guests

- Additional guests are $45

- Capital One Spark Miles for Business (Rates & Fees)

- 2 complimentary visits per year

- You get one guest per visit

- Additional guests are $45

- Kids under two can enter Capital One Lounges for free

- Other Capital One Cardholders and Non-Cardholders

- $65 per visit

Secure Lockers

Immediately to your right, there is a set of 10 lockers that you can drop your stuff in while you hang out.

Grab and Go food

In the same entry area, one of the best aspects of the Capital One Lounge is the grab n go food. They had sandwiches, granola bowls, salads, loads of different beverages. Simply check-in, grab, and head to your gate.

Coffee bar

Capital One has invested in high end, made to order, coffee experiences. There is cold brew on tap, and if you’d like a flat white, latte, or macchiato, simply as the barista. Want it to go? Done. Gonna stay and sip? Voila, you’re all set.

It also features some great pastries, fresh fruit, etc. It all looks and tastes like a legitimate coffee shop – not an airport lounge trying to fool guests with subpar products.

Colombe will supply cold brew on tap and drip coffee from Blanchard’s Coffee Roasting Company, a Virginia Based roaster.

Seating Options

The lounge as wide open since I was one of the first people in it. Every single seat has access to power and there are lots of different options. We ate at the small tables shown below.

The lounge is roughly 8500 square feet, and this is the area immediately to the right when you enter.

In the back of the lounge are quiet work stations where you could get work done or have a small meeting.

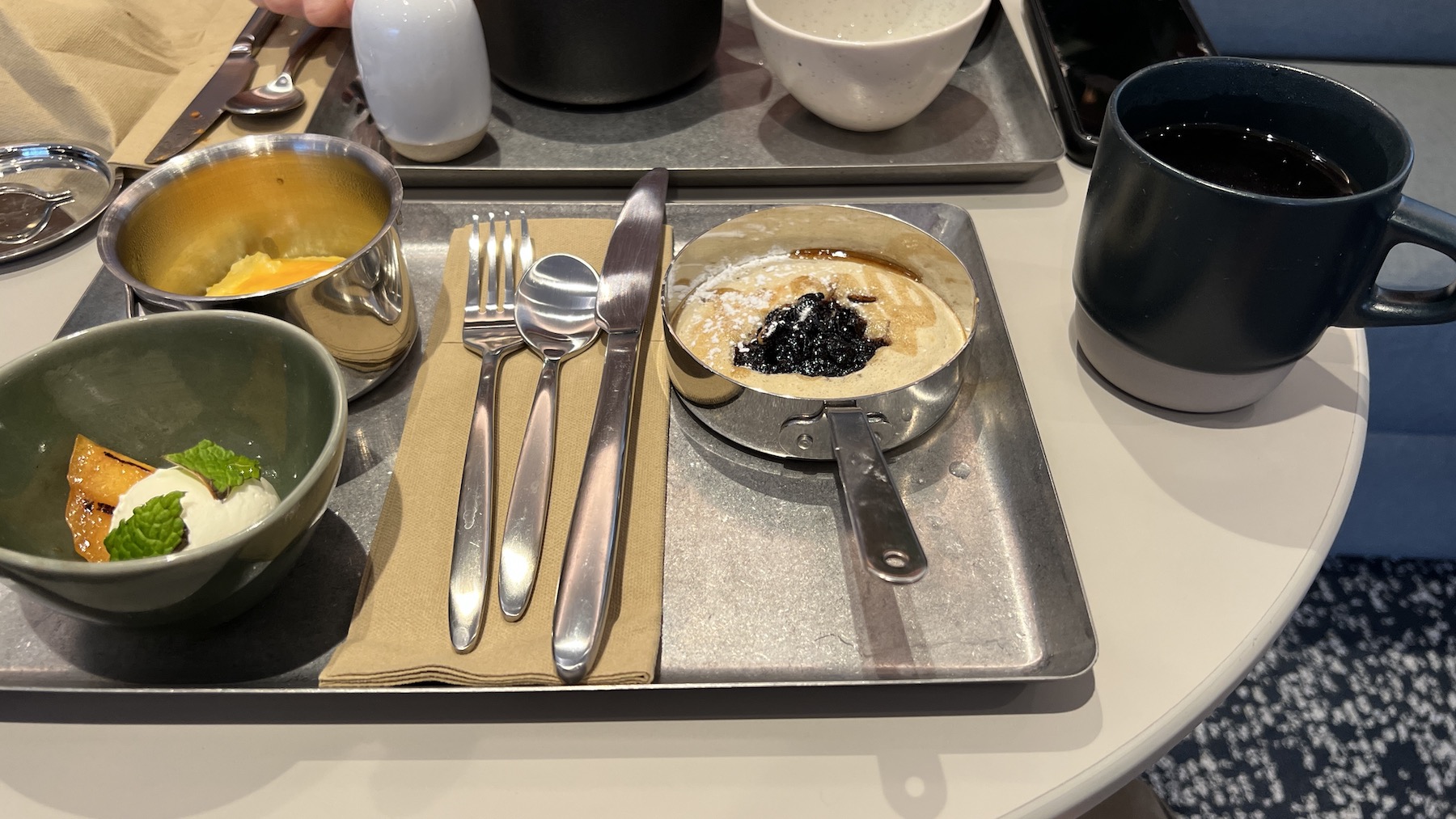

The Food and Bar

There are multiple drinks on tap

And a ton of small bites to nibble on. Everything I tried was very, very good.

I would particularly recommend the shakshuka

The Bar

It was 8am so I didn’t have any of the craft cocktails or beer on tap, and I also realized I didn’t get a up close picture of the bar. But, you can take my word for it, it’s quite attractive.

Overall

I was very excited to see the Capital One Lounge the morning it opened and it did not disappoint!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.