This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

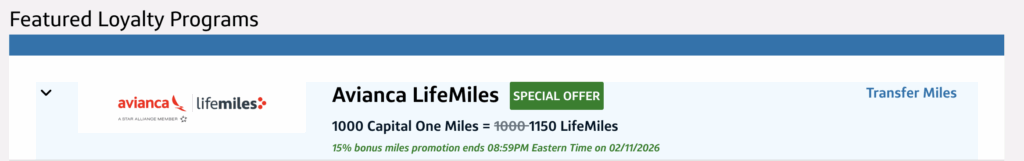

Capital One just dropped a new transfer bonus to Avianca LifeMiles program that may be attractive to you. You can get a 15% transfer bonus when you transfer Capital One Miles to Avianca LifeMiles.

Capital One to Avianca LifeMiles

- 1000 Capital One Miles = 1150 Avianca LifeMiles

- Ends 2/11/26

Unfamiliar with Avianca’s Lifemiles program…you’re probably not alone

Avianca became an Amex transfer parter in 2018 and provides excellent access points to Star Alliance award inventory. You can also use them on AeroMexico and Iberia.

Should you transfer?

Personally, I would take advantage of this if you know that there is a trip that you want to take. If not…I wouldn’t transfer your very valuable Amex points to Avianca simply to get a 15% bonus.

Analysis

If you’re looking to make an award redemption in the near future…this could be a great time to make use of the program and achieve your travel aspirations at lower prices! If not..I wouldn’t pull the trigger.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.