This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One Venture X Rewards $300 Annual Credit

I think the Capital One Venture X Rewards Credit Card is the best ultra premium card for most people. It earns a base 2x on all purchases, travel portal bonus points, has a great Priority Pass lounge membership, a $300 annual credit in the Capital One Travel Portal, a 10k mile anniversary bonus, and Capital One continues to improve its loyalty program by increasing more 1:1 partners.

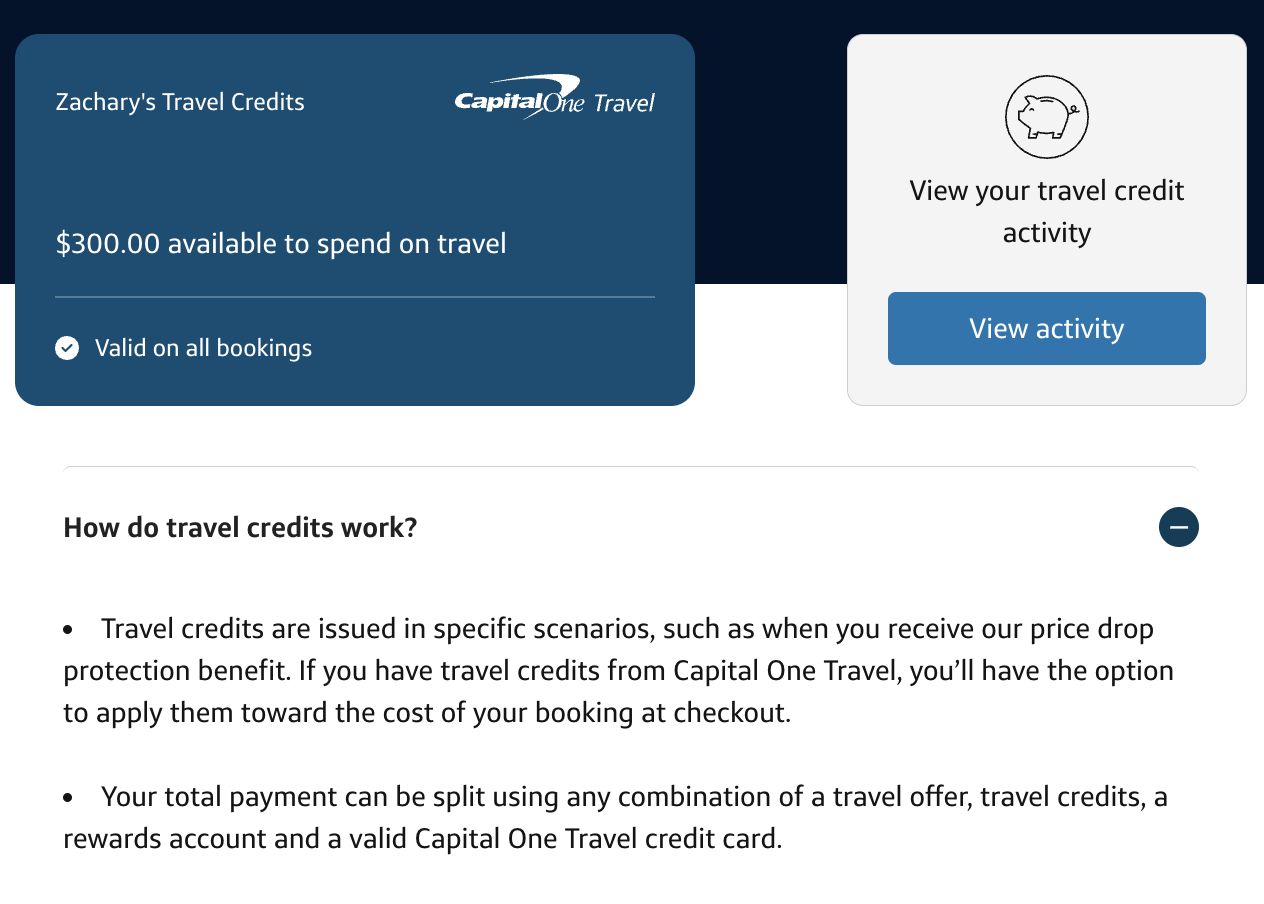

It’s pretty easy to see if you’re surpassing the $395 annual fee in value every year. One of the big benefits that helps offset that fee is the $300 annual credit in the Capital One Travel Portal…If you don’t use it, you lose it.

I’ve had the card for a couple of years now and have first hand information on exactly how the $300 travel credit works.

What can you use the $300 Travel credit on?

Anything that you book in the portal. Flights, Hotels, Car Rentals. Book through the Capital One travel portal and you can trigger the credit.

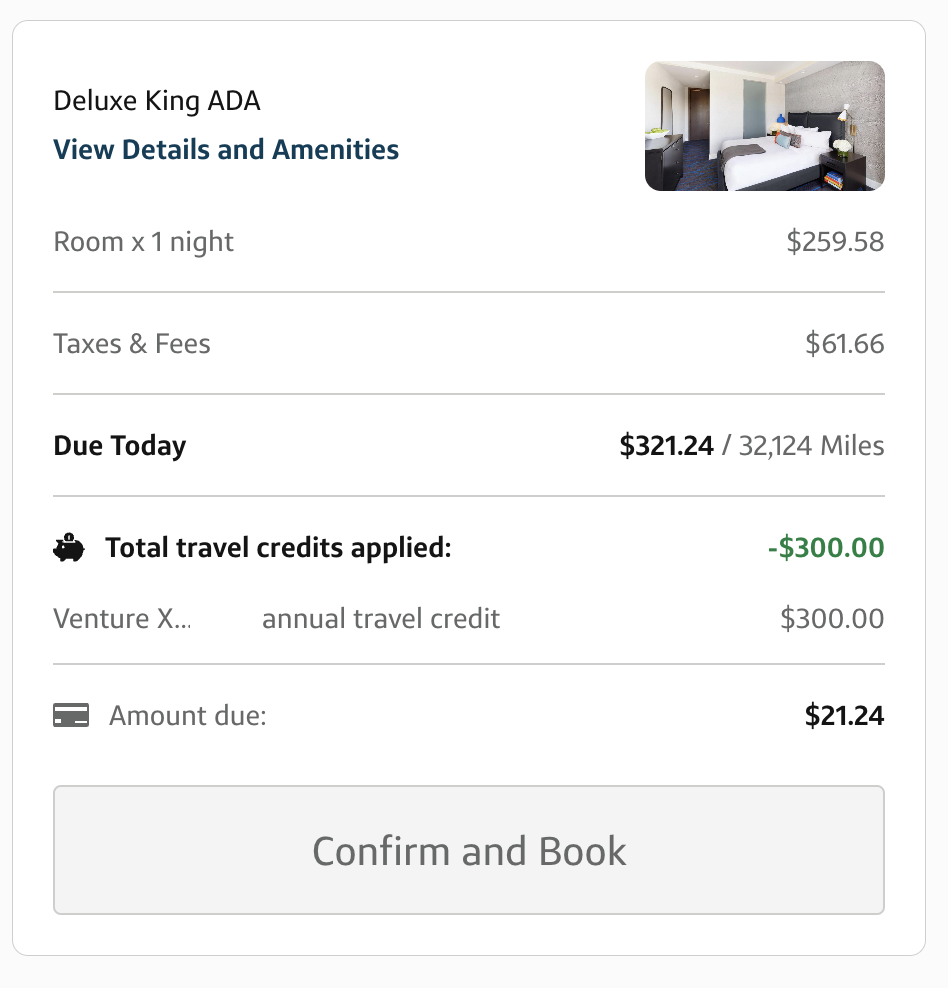

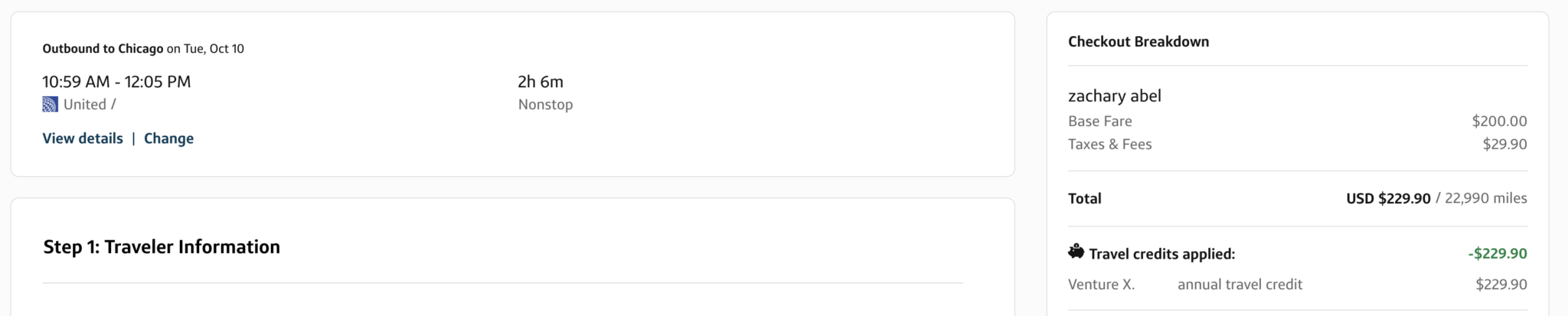

The Capital One Venture X $300 Annual Credit Applies at check out

As you can see below, the credit is now applied during check out and is no longer issued as a statement credit. While this makes it easier to apply the credit, you no longer earn points on the $300 as you did when the card was first issued.

Do I earn miles on Capital One Travel Portal bookings that qualify for the $300 travel credit?

Because the travel credit is issued at the time of booking, you don’t earn Capital One Miles on the booking. However, if you book an airline ticket, you should earn the miles of the program booked.

How long does it take for the Capital One Venture X Rewards Credit Card travel credit to populate?

It used to take approximately 4 days. I booked, the purchase hit on April 4th, and on April 8th it was removed.

But now, it can be applied at the time of booking so there is no wait at all!

But now, it can be applied at the time of booking so there is no wait at all!

What should I use my Capital One Venture X Rewards Credit Card $300 travel credit on?

I would use it on purchases you don’t care about earning any elite status nights, miles, or points on. Why? If you book through the Capital One Travel Portal, you will earn Capital One Miles on that purchase, but you won’t earn any hotel points, car rental points, etc. You may end up earning Airline miles and elite miles, but this is specific to the airline you are booking and how they process the booking.

One thing you can do with hotels, and your luck will vary, is give a hotel your loyalty number upon check in and see if they extend any benefits. Hit or miss, but worth a try.

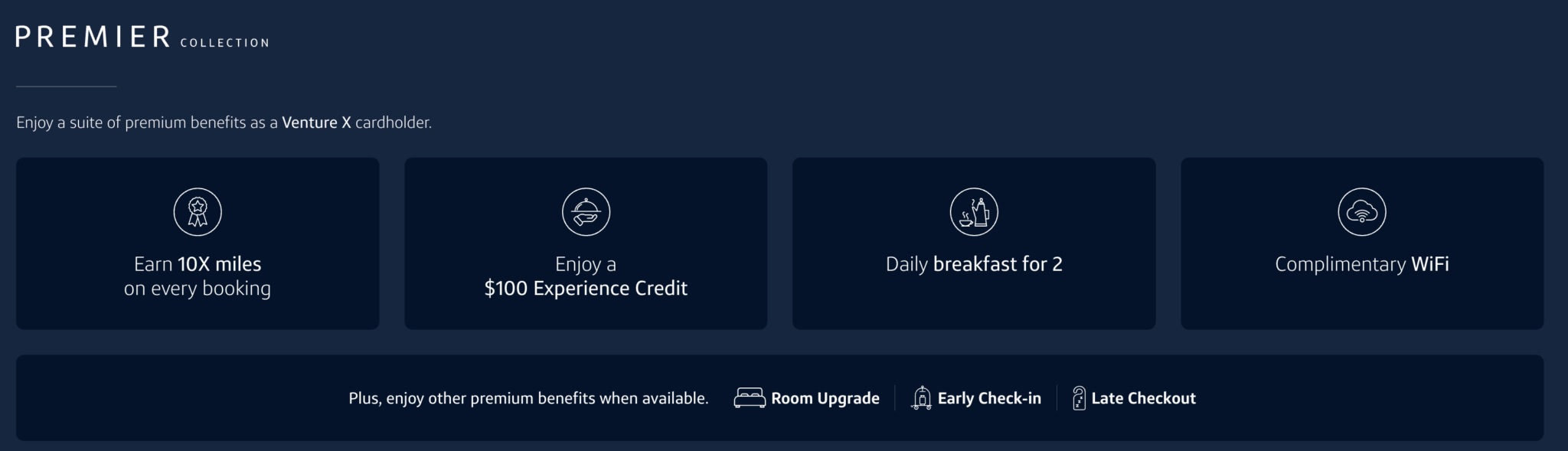

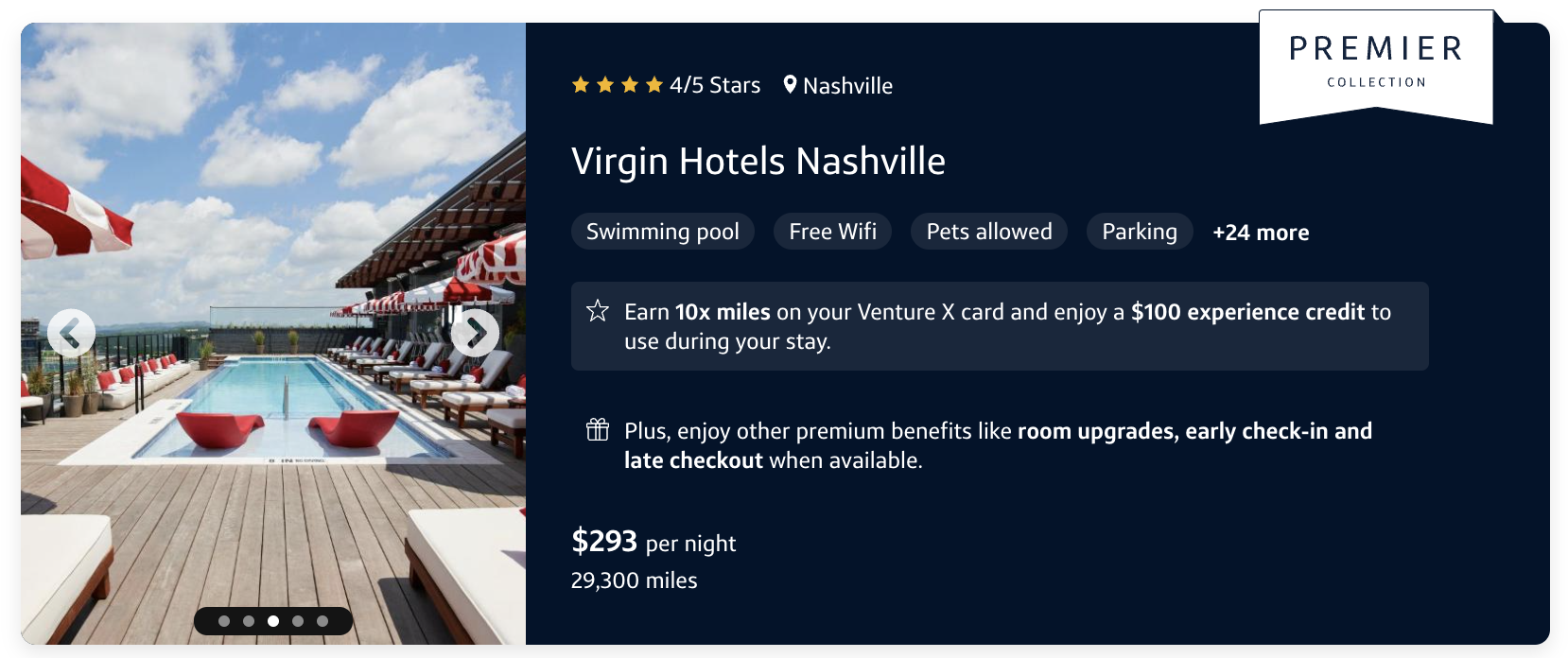

Capital One Premier Collection

I would recommend using the credit at independent properties where you aren’t sacrificing earning elite status, but more specifically, I would check out the Capital One Premier Collection that the Capital One Venture X Rewards Credit Card gives you access to with card membership. Not only could you get up to $300 via the travel credit, but you’d also get fringe benefits as well. These are higher end properties, in select cities, and the portfolio continues to get bigger and bigger.

A look at some of the benefits.

An example: Virgin Nashville…you’d still have some taxes on top of this, but not a bad grab at under $300 for the nightly rate with all of those benefits up above.

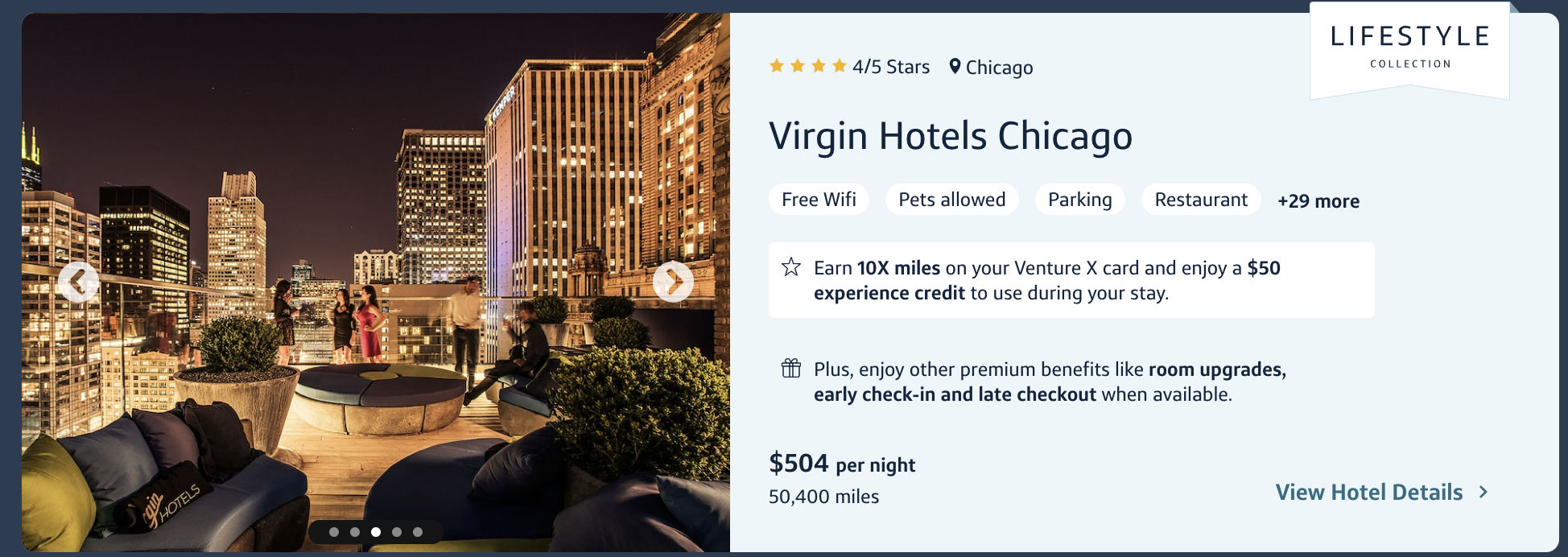

Capital One Lifestyle Collection

The Lifestyle Collection is available to customers with a U.S.-issued, eligible Capital One Venture X, Venture X Business, Venture, and/or a Spark Miles credit card so you could use your credit on these properties as well.

- Earn 10X miles on bookings with Venture X and Venture X Business, and 5X miles with Venture

- $50 experience credit to use during your stay*

- Room upgrades

- When available

- Free Wi-Fi

- Early check-in

- When available

- Late checkout

- When availabl

As you can see, sometimes properites within a group can be included in the Lifestyle Collection or the Premier Collections

Airfare

You can apply the credit to airfare, and then once you’ve been issued the ticket, use the Record Locator or PNR to add your frequent flier number. This way you’re earning miles/elite status.

Recap

The Capital One Venture X Rewards Credit Card $300 annual travel credit offsets all but $95 of the card’s annual fee. That’s incredible, and when you factor in the 10k mile anniversary bonus, you’re effectively holding the card fee free.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.