This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Capital One Venture X Rewards Credit Card

vs

The American Express Platinum Card®

I recently named the Capital One Venture X Rewards Credit Card the best premium card for most people. To be clear, I’m specifically talking about deluxe, ultra, up-scale, high-end premium cards that come with high annual fees and a bevy of benefits. One of the questions I get asked the most…how does it compare to American Express Platinum Card®?

- This excludes cards like the Chase Sapphire Preferred® Card, Citi Strata Premier, and American Express® Gold Card which I would consider entry level or mid-tier premium cards – all of which are excellent choices at their given price points.

I did a break down on the Capital One Venture X Rewards Credit Card vs The Chase Sapphire Reserve® and gave the Venture X a clear victory. Now, it’s time to do a head to head with the Amex Platinum.

If you want a long story short… I still think the Capital One Venture X is the best premium card for most people, but if you want the prestige an Amex Platinum carries, you qualify for the current incredible offers, and could make use of the litany of credits… it makes sense as well.

| Capital One Venture X Rewards Credit Card | American Express Platinum Card® |

Current Welcome Offers and Annual Fee

Both cards have a high annual fee, but the Capital One Venture X is the cheapest ultra premium card on the market. It rings in at $395 a year vs the $895 that American Express Platinum charges. It gets a little trickier when you take into account the welcome offers since both are offering in excess of 100k points, but Amex Platinum has a mega accelerator attached to restaurants worldwide for 6 months.

Personally, I think the Amex Platinum offer is just too good to be true and opens up the door to earn an enormous amount of points if you were to able maximize the deal. How on earth do you compete with that? Even with a $895 fee that is some monster earning potential.

The only downside of getting the Amex Platinum is if you haven’t gotten an Amex Gold or American Express Green Card® since the new application rules not explicitly say that you’re ineligible for welcome offers on those cards if you have or have had an Amex Platinum in the past.

| Capital One Venture X Rewards Credit Card | American Express Platinum Card® |

| Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel | You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $12,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

*Welcome offers vary and you may not be eligible for an offer. |

| $395 | $895 (Rates and Fees) |

Earn Rates

Capital One makes it very straight forward again… get unlimited 2x miles on every dollar you spend. If you want to buy travel within their portal, you’ll get a hefty bonus for doing so, otherwise, you’ll get 2x miles.

The Amex Platinum card gets 1x Membership Rewards per dollar on every single purchase you make. If you purchase a flight directly form the airline or within Amex Travel you’ll get 5x Membership Rewards up to $500,000 on these purchases per calendar year, then 1x.

It should be noted that often times purchasing travel originating from portals results in an inability to earn elite nights, credits, miles, etc that help you gain airline or hotel status.

I’d go with Cap1 as the victor here

| American Express Platinum Card® | |

| 2x miles on every single purchase without limit | 1x Membership Rewards on everything |

Purchases in the Capital One Travel Portal

|

|

Annual Credits

This is a category in which things get far trickier and personal in terms of distinguishing a winner.

The Capital One Venture X Rewards Credit Card Is a straight forward card that is clear and simple. Each year you get up to a $300 travel credit in the Capital One travel portal and every year you keep the card you get 10k miles, worth minimum $100, on your anniversary. That means, if you spend more than $400 a year on travel, you’ll get the Capital One Venture X Rewards Credit Card free of charge.

The The Platinum Card® from American Express comes with a bevy of statement credits that someone like me is willing to take advantage of, but I question as to whether most people will be able to extract face value for most of credits to offset the $895 annual fee.(Rates and Fees) Another thing to consider with the Amex Platinum is that most of the credits require you to enroll, a split month to month or semi-annual, and add complexity to their redemption.

Amex isn’t as straight forward, but if you’re like me, it could end up giving you more back than you’d spend on the fee…if you max the credits. For most people, I think Cap1 is much easier to see a path towards cash positive

| Capital One Venture X Rewards Credit Card | American Express Platinum Card® |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Using Points via Transfer Partners + Portal

Travel Portal

Capital One offers two ways to using your points on travel

- Travel statement credit

- Any charge you have on your card, in the past 90 days, categorized as travel can be wiped off your bill at a penny a point

- Capital One Travel Portal

- Redeem your points at a penny a point here as well – the rates may be more advantageous than using the statement credit feature

American Express allows redemptions via Amex Travel

- Ordinarily using American Express Membership Rewards on travel will result in under a penny a point ( sometimes you’ll get the full cent, but most often you will not).

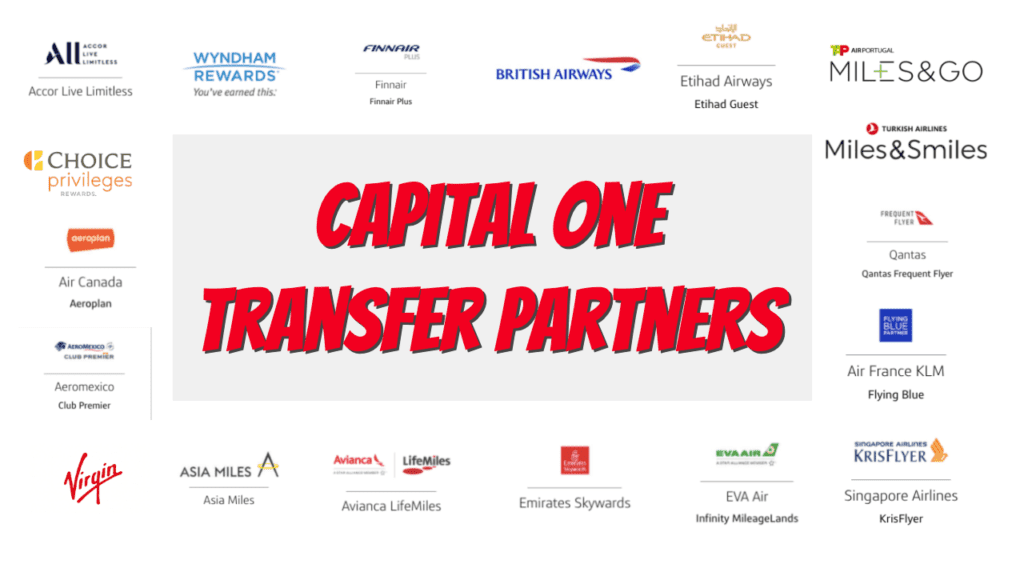

Transfer Partners

This is really where I’d recommend using your points.

- Capital One Venture X Rewards Credit Card rings with 15+ transfer partners of which 16 are 1:1

- Amex rings in 20+ transfer partners of which 20 are 1:1 and only JetBlue is 5:4.

Either program opens to door to an incredible list of transfer partners. If you’re keen on finding out what the best uses of either programs points are – I’d recommend reading out best of guides linked above.

The biggest difference comes from Amex having Marriott, Hilton, and Delta as partners. For the average person this may open up an easier route for redemption; however, these programs offer some of the worse valuations for points. The ideal redemption is to save up and throw them at an international trip in business or first class. Either program provides a great list of partners to find award space on across multiple programs.

| Aeromexico Club Premier | AeroMexico |

| Air Canada Aeroplan | Aer Lingus AerClub |

| Avianca LifeMiles | Air Canada Aeroplan |

| Air France Flying Blue | Air France KLM Flying Blue |

| British Airways Executive Club | Alitalia MileMiglia |

| Cathay Pacific Asia Miles | ANA |

| Choice Privileges | Avianca LifeMiles |

| Etihad Guest | British Airways Executive Club |

| Emirates | Cathay Pacific Asia Miles |

| Finnair Plus | Delta SkyMiles |

| Qantas Frequent Flyer | Emirates Skywards |

| Singapore Airlines | Etihad Guest |

| TAP Air Portugal Miles&Go | Hawaiian Airlines |

| Turkish Airlines Miles and Smiles | Iberia Plus |

| Virgin Red | JetBlue TrueBlue |

| Wyndham Rewards | Qantas Frequent Flyer |

| Accor transfer 2:1

|

Qatar Airways |

| EVA transfers 2:1.5 | Singapore Airlines KrisFlyer |

| Japan Airlines 4:3 | Virgin Atlantic Flying Club |

| IPrefer: 1:2 | Choice Privilege |

| Qatar Airways 1:1 | Marriott Bonvoy |

| Hilton Honors |

Lounge Access

Both the Capital One Venture X Rewards Credit Card and American Express Platinum card come with access to their own branded lounges and Priority Pass Select memberships. There are some big differences so let’s dig in.

Capital One has 3 lounges currently open ( Dallas, Washington DC, and Denver ). The Capital One Venture X Rewards Credit Card has access for 2 guests, and if you add authorized users, they’ll gain access as well. The Venture X also comes with a Priority Pass membership but, unfortunately, the Capital One Venture X lost the restaurant benefit on 1/1/2023.

American Express set the bar when they created Centurion Lounges. The program has built out to over 40 lounges, but they were too good to be true, quickly became crowded, and the food/drink quality was downgraded. It started in Feb of 2023, but Amex now only permits the cardholder to enter the lounge, and any guest will be charged $50 – one caveat is if you spend $75k a year, you’ll be able to bring in 2 guests free of charge.

Amex comes with a Priority Pass membership as well that includes 2 guest access. They stripped the restaurant access a couple years ago so effectively on par with the Capital One Venture X Rewards Credit Card in terms of access. One thing to also consider, and I recently used was the Delta Lounge access Amex Plat cardholders get when they’re flying Delta. If you’re based in a Delta hub this could be quit valuable to you.

| American Express Platinum Card® | |

Lounge access

|

Centurion lounge access

|

|

Priority Pass select membership (enrollment required )

Delta SkyClub access

|

Other Benefits

Both cards come with complimentary cell phone insurance, but where Cap1 stands out is the primary rental car status and insurance. Insurance has been a reason why I have continued to keep a Chase Sapphire Preferred® Card in my wallet, but now…I could downgrade that card and rent via my Cap1Vx.

Amex falls short on Hertz status and rental car coverage, but does offer both Marriott and Hilton Gold status. If you’re looking to redeem Hilton points this could be advantageous since it Hilton elite members get a 5th night free with points. Otherwise, Marriott and Gold status doesn’t offer a ton of bang for your buck, you may get occasion club level access, upgrade, or even a breakfast credit, but it isn’t always guaranteed and with the easy pathways to top tier status we’ve seen the past couple of years, you’ll be quickly out ranked.

Looking at the Amex Fine Hotels and Resorts access. Most of these properties can be booked with VIP benefits at no additional charge here – in fact, you may be better off booking via Virtuoso

| Hertz President’s Circle Status ( scheduled to end 12/31/24 ) | Hertz President’s Circle Status

Avis Preferred Plus National Executive Status |

| Primary Rental Car coverage ( CDW ) | Secondary Rental Car Coverage |

Complimentary Cell Insurance

|

Complimentary Cell Insurance

|

| No fee for up to 4 Authorized Users |

|

Referrals – up to 100k a year

|

$195 per Authorized User |

| Access to Premier Collection | Access to Amex Fine Hotels and Resorts + Hotel Collection |

Refer a Friend – up to 100k a year

|

Overall

Currently, both cards are offering great incentives to sign up. You can’t go wrong with either in your first year. But, after you’re tried out each card, which would you keep long term?

The Amex Platinum has an extremely rich welcome offer and opens a lot of value if you are able to use up the credits the card offers. Plus… nothing screams status, other than a black card, like an Amex Platinum. That status carries a lot of weight for many people.

The Capital One Venture X has a very competitive offer as well, but makes the case that if you spend $400 a year on travel, which I’d guess most anyone reading this blog does, they will give you all the other benefits of the card free of charge since you’d easily recoup the annual fee.

I mean… how do you beat that deal?

I keep both cards in my wallet because I’m able to extract more value from the cards than I pay in annual fees. I think I’m in a very small minority of people who would truly make use of these credits on an ongoing basis and care to take the time to do so.

Which card would you choose?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.