We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier this year I went on my honeymoon to the Maldives and flew Qatar Airways QSuties and stayed at both the Six Senses Maldives and St Regis Maldives. The original plan was actually to fly them roundtrip in/out of Chicago and I booked us two roundtrip tickets via Amex Travel for roughly $2300.

You can read the full review here

Ordinarily, I transfer points out to partners, but I carry an Amex Business Platinum that offers a 35% refund on premium cabin redemptions as a benefit and when tickets price cheap enough, it changes the calculus.

$2300 = 230000 Amex points less a 35% refund of 81000 = 150k Amex points. These tickets also earn points, and since I had Alaska MVP status I’d earn 25k Alaska miles each way. So spend 150k Amex points and earn 50k Alaska miles for a roundtrip ticket. No brainer imo…

The Problem?

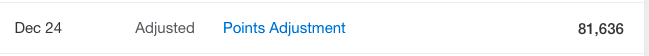

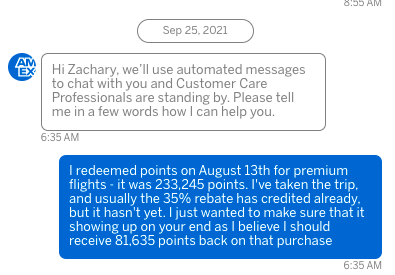

The refund never posted…and I inquired with Amex about it roughly a month later. To put it in perspective… ordinarily the refund is completed after you take the first leg – at least that’s been my experience. It could take 4 to 6 weeks, and Amex iterated on this go around that it could take 12 weeks, but that has been the exception not the rule.

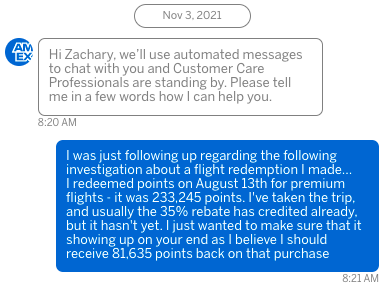

The same thing happened to my wife. We used points out of her account and they never posted either.

They hadn’t posted two months later and I followed up on the investigation that had been opened.

I was going to wait until the new year to inquire again, but here’s the weird thing. I checked both of our accounts today, and voila, we both received our credits! How weird is it that both accounts were resolved on the same day?!

Moral of the story…

Moral of the story…

Don’t trust the system will automatically credit your account. If you run into this problem, make sure you have screen caps and the card that the points were deducted from, and just keep inquiring. In the end, all was squared up, but if you were in need of the points for another trip you’d be waiting for quite some time.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Learn More

Learn More

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.