This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Freedom Unlimited®

The Chase Freedom Unlimited® has been a pillar of the Chase credit card portfolio for years now, and the current offer is strong. However, I think the best reason to hold a Freedom Unlimited is it earns an unlimited 1.5% cashback, and you can combine it with the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, Chase Ink Business Preferred®, or Chase Sapphire Reserve for Business℠ to take advantage of transfer partners and better Points Boost options. Let’s dig into why this card is a great card to keep in your wallet.

Chase Freedom Unlimited details

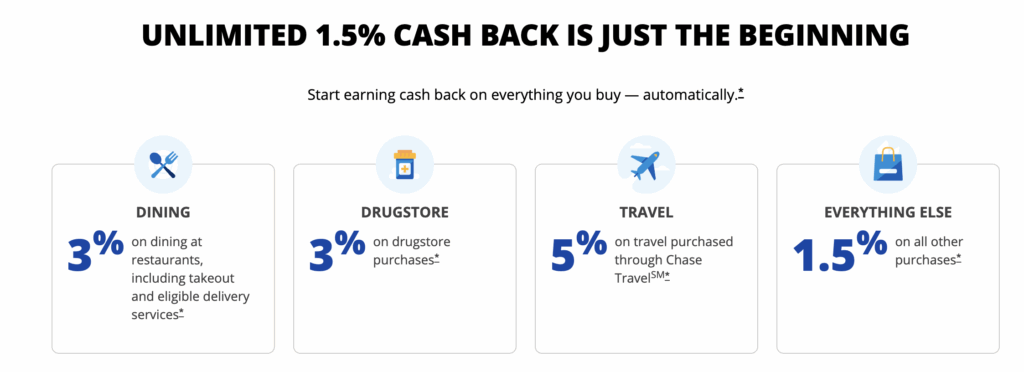

- Enjoy 5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases.

- No minimum to redeem for cash back. You can use points to redeem for cash through an account statement credit or an electronic deposit into an eligible Chase account located in the United States.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

Pairing Chase Freedom Unlimited® with makes your points transferrable

The Chase Freedom Unlimited® credit card is a cash back card when held on its own. This means you’ll earn your points or rewards in the form of Ultimate Rewards which can be used as cashback/statement credit or within Chase Travel℠ at a penny a point.

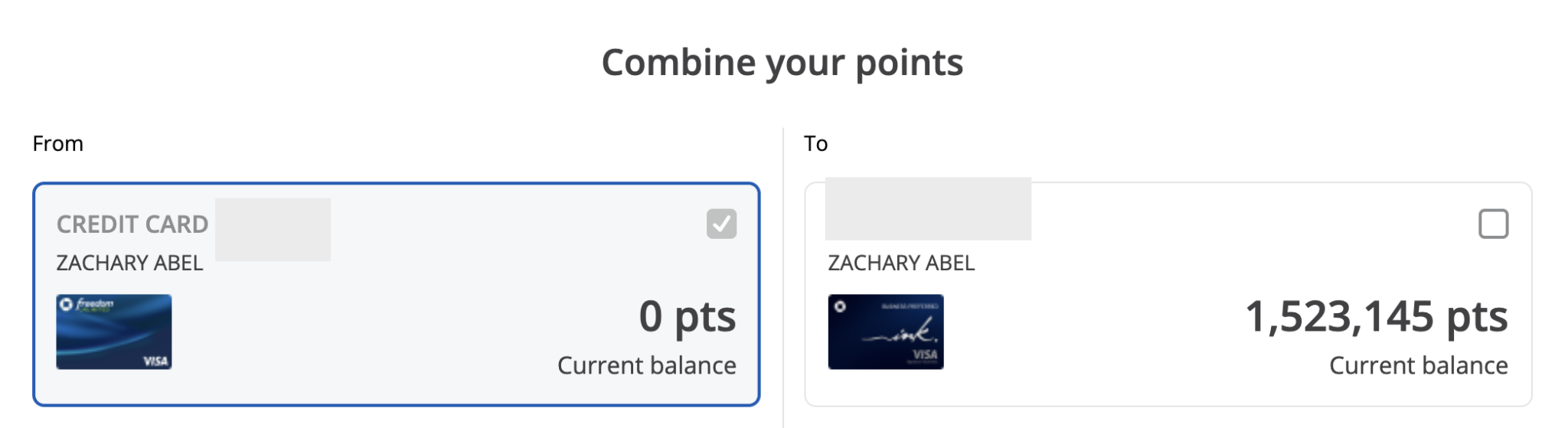

However, since it’s in the family of Ultimate Reward cards, if you hold any of these Ultimate Reward cards concurrently

you can transfer your points from the Chase Freedom Unlimited® to one of the premium cards 1:1. You can go here to learn more about combining Chase points. It’s super simple and looks like this:

This would give you access to Chase’s great list of transfer partners so you could potentially get even more value.

Below is a picture of the Lufthansa First Class – You can book for 100k Aeroplan miles which Is transfer partner of Chase Ultimate Rewards (available when this card is paired a premium Chase credit card like the Sapphire Preferred )

Is this the best welcome bonus we’ve seen?

You can find our spreadsheet on the best current offers as well as the best ever offers here.

How does this card help me reach my travel goals?

It guarantees a great 1.5x base rate on your standard purchases allllll without an annual fee. Let’s say you already have a Chase Freedom Flex® which earns 5x points on rotating categories throughout the year, and an Chase Ink Business Preferred® which gives you access to transfer partners. But what about those expenses you’re missing out on? This card would help fill in the gaps so that you’re maximizing your rate of return on purchases everywhere. Achieving your travel goals is about continually increasing your point balance, and then taking advantage of award availability to get more lux for less bucks 😉

Overall

While the Chase Freedom Unlimited is technically a cash back card you can convert your Freedom Unlimited Cash Back into premium Ultimate Rewards by moving the rewards between accounts. This means that you can earn even more premium Ultimate Rewards when you hold the Freedom Unlimited alongside cards like the Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Chase Ink Business Preferred®.

The Chase Freedom Unlimited® presents a great way to get massive earn a lot of points where you spend money the most + guarantee 1.5x on all purchases. This helps you get closer to those amazing first class seats and 5 star hotel rooms we so often blog about.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.