This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

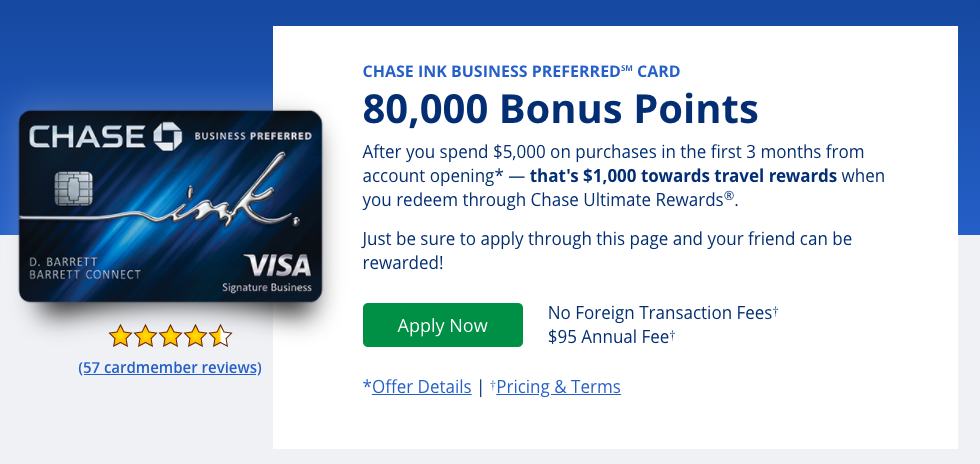

Chase Ink Business Preferred 80k Referral offer

*as of 5/24/2020 this deal is dead – I’ll update if this changes, but is it just me or is it ironic it’s dead on 5/24?

Prior to considering the Chase Ink Business Preferred – I’d highly consider that banks have tightened lending requirements on business cards. More info can be read here, but often times they now require EINs or business banking being done with the bank directly.

Earlier this year, Chase announced a 100k offer on the Ink Business Preferred, but with a caveat: $15k minimum spend in 3 months. I’ve had many readers express their inability to hit the higher spend, especially with the current economic situation, and good news… The referral is still hanging in at the lower 80k/$5k offer. You can also add your referrals to our main Chase referral page. FYI -I make no money off of this, but rather referral points if you’re approved.

I want to note… I have no idea how long this will last at this level – so if you’re interested I would act sooner than later.

Here’s how it works with our site and how you can earn referrals

Referral offers is how I make upwards of 500k points a year, but it’s also how I can help you out. Since I’m constantly trying to use points on my travel for the site, I cycle through my referrals first. I then work my friends and family through the site, and finally, I start adding your links that you leave below. I leave them up for a few weeks and then cycle in another one.

5/24

Yes, this card is restricted by Chase’s 5/24 rule. However, it doesn’t add to your number since it isn’t reported to your credit profile.

Why I love The Chase Ink Business Preferred

This has been a go-to for many of my travel expenses because it earns 3x and has a generous categorization of travel. Other cards may earn higher on flights or hotels, but the Chase Ink Business Preferred gives you 3x on a broad array of travel related purchases:

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages. Merchants that provide transportation and travel-related services are not included in this category; for example, real estate agents, educational merchants arranging travel, in-flight goods and services, on-board cruise line goods and services, sightseeing activities, excursions, tourist attractions, boat rentals, merchants within hotels and airports, and merchants that rent vehicles for the purpose of hauling. The purchasing of gift cards, points or miles do not qualify in this category unless the merchant has set up such purchases to be classified in the travel category.

It also comes with all of these benefits:

Here are 5 of my favorite ways to use Chase Ultimate Rewards at high value

Transfer to Hyatt to stay at Aspirational properties like the Alila Villas Uluwatu

Lufthansa First Class via Singapore Airlines or United

It now costs 95k Singapore miles, which is quite steep, but Singapore miles are one of the easiest currencies to accrue as they partner with all 4 major flexible point programs ( SPG, Chase, Citi, and Chase). Additionally, Singapore has comparatively low change fees, meaning you can book into business class as a backup, and when Lufthansa releases space ( roughly 14 days ahead of departure) swoop in. Alternatively, if you see space avail, and are willing to fork out a few more miles, but avoid fees – you can redeem 110k United for the same award.

You can read about our experience on the A330 the incredible 747-8i, and the A380.

Singapore Suites via Singapore Airlines

For 76k Singapore miles you can fly from JFK to FRA or vice versa, and experience one of the most aspirational first class experiences in the sky, Singapore Suites. It’s truly incredible. You can read our review here

If you’re flying intra-Asia, specifically between Delhi/Bombay/Shanghai/Beijing you can land the new suites for just 53k. Those are 5hr+ flights. Wanna get a quick taste? Just over 40k will put you on it from SIN to HKG

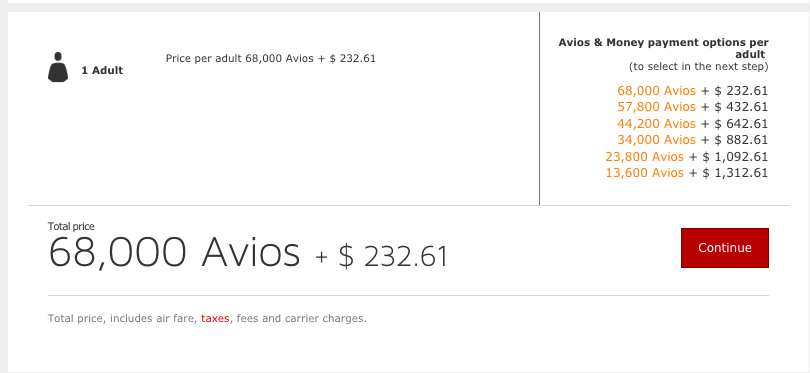

68k Roundtrip Business Class to Europe with Iberia Avios

One of the great spots on Iberia’s award chart is flying business class from Chicago/East Coast to Madrid on Iberia’s own lie-flat business class. I did this last New Year’s and it’s an incredible value.

Transfer to Air France for sweet-spot biz redemptions 52k-67.5k

Air France offers a great reverse herringbone business class that you can find on their 772, 773s, some A330s, and eventually on their A380s. You’ll be hard pressed for find a better way to fly across the pond which is why we chose it to fly home last year.

If you use our link we will receive a 20k bonus when you’re approved – leave you link below

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.