This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Could the Chase Ink Cash be in jeopardy?

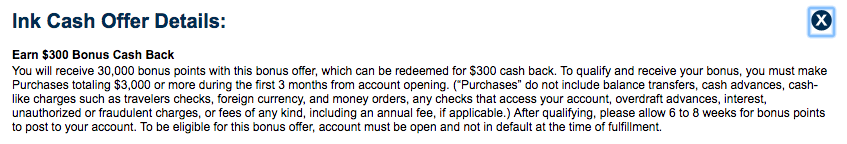

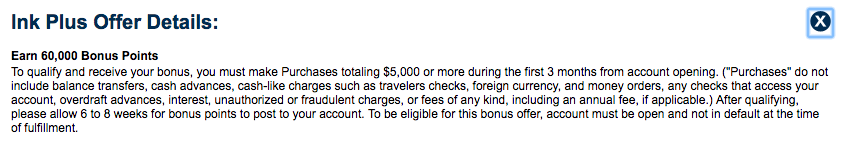

Yesterday the blogosphere was going NUTS over the new Chase Business Preferred card. It’s going to have an 80k sign up bonus and 3x category bonuses on telecom, cable, and internet/social media advertising. Many people have speculated as to what that means for the future of the Chase Ink Plus and the consensus opinion is death. It got me thinking…Could the Chase Ink Cash be in jeopardy?

If the Ink Plus is potentially getting replaced…could this be a pivot to a new line-up of Chase Business Cards?

I think it’s certainly worth considering that both the Ink Plus and the Ink Cash could be replaced by the Chase Business Preferred and a potential Chase Business “Cash Back” offering. This could stream line the category bonuses in the same way that the Ink family has streamlined category bonuses the last several years. Card benefits have varied, but the category bonuses ( with different $ caps) were consistent from card to card within the family.

If this is the case…I’d say that it’s very possible the Ink Cash is a goner too, at some point.

If it is a new line-up, what does that mean?

Potentially, it means you can’t sign up for and Ink Plus or Ink Cash once the new version of the card is available.

If the Ink Cash goes away, could I downgrade my Ink Plus down the line?

That’s a big if…it’s possible that Chase could allow it, but if they aren’t issuing new cards it may be a situation where you – keep the Ink Plus and pay an annual fee, or cancel the card. The downgrade to a fee free version and keep 5x category bonuses may just not be an option. Barclay ( at the moment ) does not issue aviator cards, but they do allow a downgrade from the Aviator Red to the fee free Aviator. With so much uncertainty…

What happens to Ink 5x categories if the Ink cards go away?

We just don’t know. The Ink Plus and Ink Cash could be grandfathered in with the current 5x categories upheld as long as you hold the card, or they could do some sort of switch or downgrade of benefits. I’d say the best case scenario is that they put the consumer first and grandfather in current cardholders, but we have to wait and see.

It seems the 24 month clause has been removed on Ink Plus and Ink Cash…

This speaks to the potential both could be phased out…

Things to consider.

- As long as you have a card that earns Ultimate Rewards – you can convert your cash back earned from a Ink Cash to Ultimate Rewards

- If you don’t have an Ink Plus or an Ink Cash card this would be a good time to consider applying. If you have a small business, even a sole proprietorship, you can qualify. However, it’s worth noting that anecdotal evidence points to both cards falling under the 5/24 rule – so keep that in mind.

If you already have an Ink Plus card…

- It may be worth thinking of getting an Ink Cash card as well

- This would secure a 5x category bonus earning card with no annual fee

- If it becomes hard to downgrade in the future, and you don’t want to pay a fee, you would already have a fee free card that earns 5x points that may not be available for sign up or downgrade.

More will develop

This is all from an article released yesterday, but it’s always advantageous to strategize going forward. Most people got SUPER AMPED about the 80k sign up bonus, and I’m one of those people, but it’s worth looking at the what the new waves of interest will do to existing cards, and how to best position yourself to accumulate the most points going forward.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.