This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

If you pre-registered for the Aeroplan credit card so you could score more bonus points and e-upgrades when you applied ( as described below) …you have more time to apply!

According to Frequent Miler, the application date has been extended from 2/15/22 to 3/31/22. Check out this post where we drill down on the Aeroplan Credit Card and see if it makes sense for your wallet.

Waitlist is closed

A couple months back we learned that Chase and Air Canada were releasing a new credit card. To promote that card they created a waitlist – if you added your name to it you would get a bonus 10k points on whatever the new card’s initial offer would be. They just sweetened that waitlist with 10 eUpgrade Credits. Here’s how it works

- Anyone who is already on the waitlist – you don’t need to do anything and you’ll get an extra 10k bonus points + 10 eUpgrade Credits

- The waitlist is closing to anyone else on 11/8/2021

- You need to sign up by this date

- You must apply and be approved for the new card by 2/15/22 to get the extra 10k and 10 eUpgrades

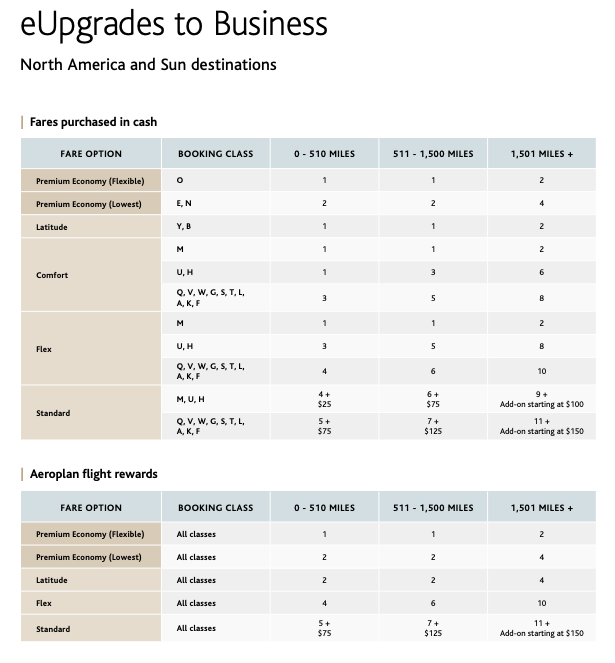

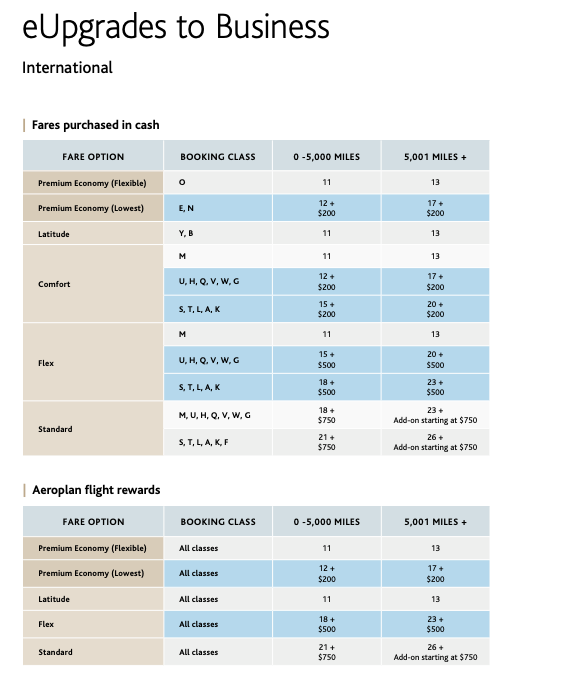

A couple of the eUpgrade charts – if these will be the only eUpgrades you’ll earn…you’ll want to focus on upgrading flights within North America. If you’re an Air Canada elite and have a stack of these…it may help you get enough to upgrade to business internationally.

Register here

Don’t forget that Air Canada is also status matching people in the USA – go here to match

If you carry status with the following carriers, you can match it to a commensurate elite status within Air Canada

- American

- Delta

- Alaska

- Jet Blue

- Southwest

- Hawaiian

A look at the new list of Chase Ultimate Reward transfer partners:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.