This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I went to take advantage of my extended 50% Bonus and hit a brick wall

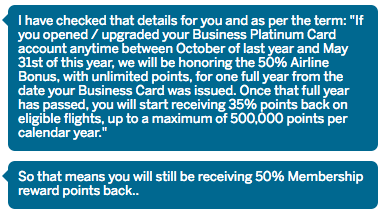

You can read my original post below, but I wanted to give a heads up to anyone who may be in my situation. I Upgraded from the Amex Biz Gold to an Amex Biz Plat for 50k points last September. Shortly thereafter, American Express announced a new perk for the Amex Biz Plat – you’d receive 50% of the points you use for flights booked with Amextravel.com refunded to your account. Earlier this year Amex announced that the benefit would end, and cards issued before October or after May 31st wouldn’t have the benefit anymore. However, when I logged into my account through June I kept seeing a 50% bonus eligible sticker in Amextravel. I inquired via Amex chat, and was told that I was grandfathered into the the extended program through October.

I re-confirmed my grandfathered status this past week. I was told this was a mistake.

I had a redemption I’d been researching, wanted to make sure my calculations were accurate, and re-confirmed.

I am NOT grandfathered in because I upgraded prior to October 1st. Even though I asked a rep via chat to see if I was, and they confirmed I was grandfathered, I’m now being told that was a misunderstanding and I’m under the 35% umbrella.

If you’re in a similar situation, I would recommend reaching out to Amex before you make any travel plans to verify you airline bonus status. Are you 50% or 35%? I escalated via chat to a manager and there was no give in the policy whatsoever.

The only question I really have, and maybe one of you genius readers could help me out, is this: If I paid an annual fee when the card advertised the 50% benefit, shouldn’t I, and others in a similar situation, retain those advertised benefits during the cardmember year?

When I upgraded in September, I was billed a pro-rated amount for the remainder of the year. Then, I was billed again at the end of December for the full 2017 cardmember year. When I was billed in December the Amex Biz Plat was advertising the 50% Airline Bonus, and I’d imagine the reason Amex is extending cardmembers who signed up during this timeframe a year of 50% benefit is because they don’t want trouble with the FTC. But, why would that extension only be limited to new cardmembers? Those who already had the card, but retained it during the 50% bonus period did so under the valuation of those benefits…Right?

I could understand Amex not giving an extended period of 50% had I been billed the full annual fee last September. I paid that fee with the benefits advertised at that time. But I wasn’t billed for the full year, and was only billed the difference between the Platinum fee and Gold fee for the days remaining in 2016. I was billed a full cardmember annual fee in December when they were advertising the new benefits.

Check to see if your Amex Business Platinum 50% Airline Bonus is extended

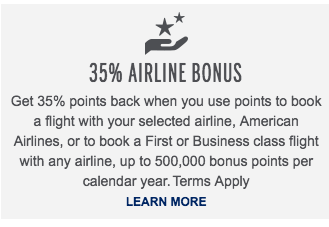

Last year American Express announced they would offer a new feature to the Amex Business Platinum card: a 50% airline bonus on tickets booked with points. This effectively meant that if you had an Amex Business Platinum you could redeem points for $0.02 for flights ( In premium cabins or with your selected airline). Ticket costs a $1000? Use 100,000 points, get a 50,000 point bonus, and your account is deducted a net 50,000 points – pretty good deal really. Recently they pulled back on that offer and said that tickets booked with points would receive a 35% bonus. That same flight that cost 50k would now cost 65k. A large devaluation, and one implemented within a year of its rollout – NOT COOL. They did create exceptions to the devaluation: Those customers whose accounts had been upgraded to the Business Platinum cards, or those who had opened new accounts since the announcement of 50% bonus. The 35% airline bonus is implemented today, June 1st; however, you can check to see if your Amex Business Plaitnum 50% airline bonus is extended.

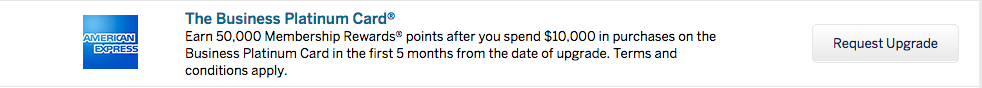

I upgraded my card in September of last year, a week or two before they announced the new perks. I’d been targeted for a 50k bonus and had to do so by September 30th.

I wasn’t really too optimistic that my account would be targeted for the 50% airline bonus extensions because I’d upgraded without the benefits being disclosed or guaranteed.

I logged into my account today and saw the 35% bonus advertised.

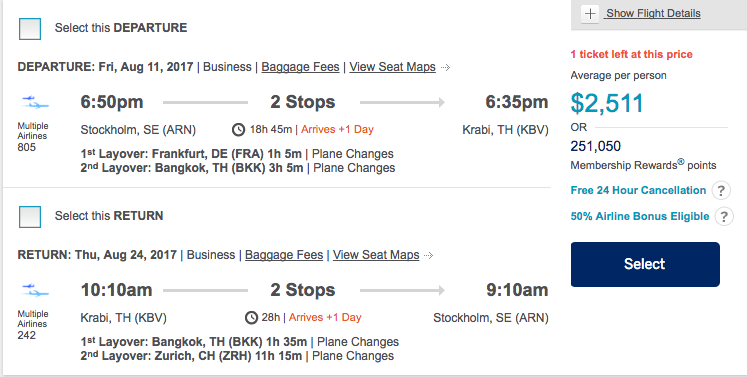

I’ll be returning to Stockholm later in the year and had been debating a quick trip from Stockholm to Asia on Qatar Biz. They have INCREDIBLE deals ( $1100 range) originating out of Stockholm throughout the year to gorgeous areas like Singapore and Krabi, Thailand. I’d wanted to use Amex points with the 50% airline bonus.

I just did a quick search for giggles sake. What I saw DRASTICALLY IMPROVED my morning. The fare isn’t great, but it said that it is 50% bonus eligible. SAY WHAT?!

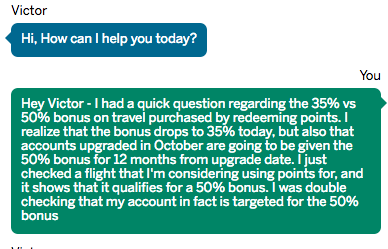

This was private chat worthy. I asked “Victor” to double check my account to see if I had in fact been targeted for the 50% airline bonus extension.

My card was issued in September, but the statement didn’t close til October. Maybe that had something to do with it? In all honesty I’m still skeptical I’m 100% targeted for the 50% airline bonus, but I now have chat proof in case I’m not given the proper amount of points back.

If you’re in a similar situation, I’d double check by doing a quick search in Amex Travel, and confirming via chat.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.