This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

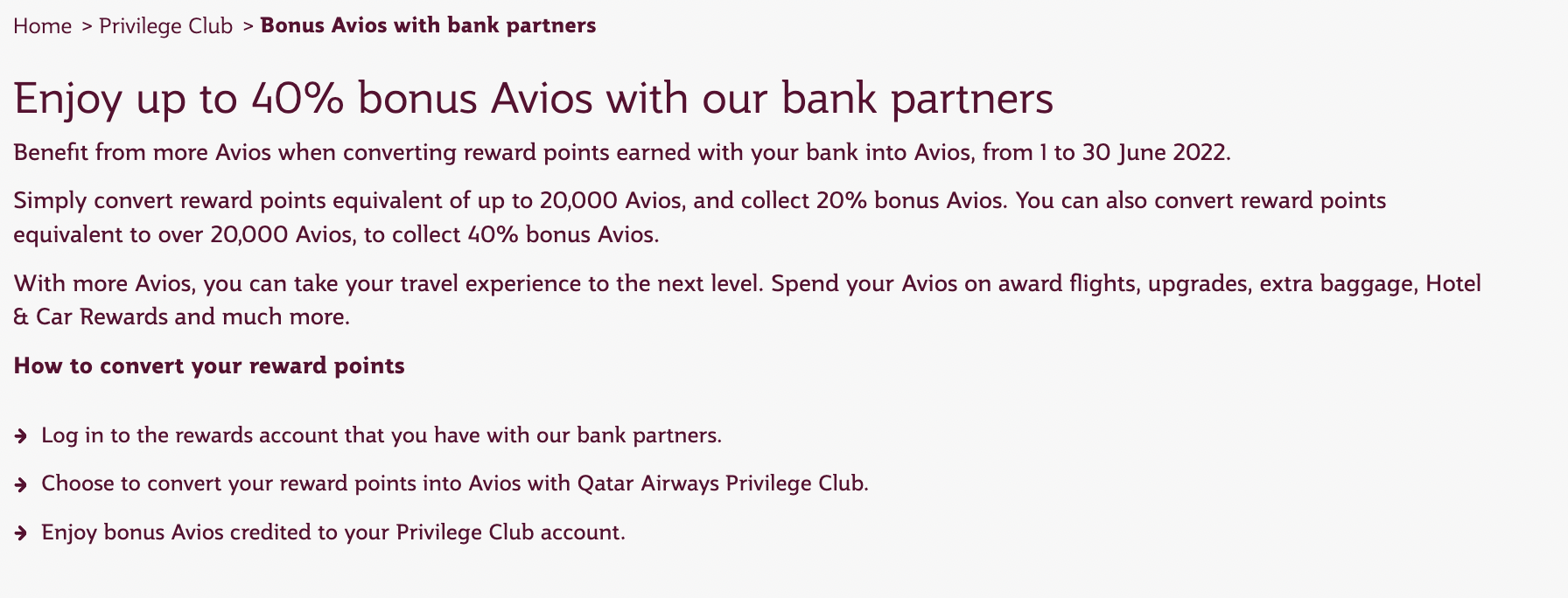

For the month of June, Qatar Airways will give you a 40% bonus when you convert qualifying bank points into Qatar Airways Avios. Note, this won’t show up in your bank’s point transfer page, but rather will be reflected once the points have been moved over. Most of the qualifying banks are outside of the US, but Citi Thank You points do qualify! You can read more here

Let’s look at the deal and h/t to @roniwalakandou

Details – Bank points to Qatar Airways Avios

- Valid between 6/1/22 and 6/30/22

- Bonus is tired based on how many you transfer

- 20% bonus up to 20k points

- 40% bonus over 20k points

- Can take up to 45 days for Avios to populate

Qualifying Banks

The only partner of Qatar Airways that qualifies and is based in the US is Citibank

- Ahli Bank Qatar, Ahli United Bank, Ahlibank Oman, Air Miles, American Express, Amex Centurion Design Cards by Hyundai Card (Korea), Citibank, Commercial Bank of Qatar, Doha Bank, Dukhan Bank, Hana Members, HSBC (Greece, Mexico, Sri Lanka, Taiwan, Hong Kong), Kuwait Finance House, Masraf Al Rayan, Ping An E-wallet (Wanlitong), Qatar International Islamic Bank (QIIB), Qatar Islamic Bank (QIB), Qatar National Bank (QNB), CIMB, KBank, Standard Chartered Bank Singapore, BSF (Banque Saudi Fransi)

Remember that depositing into Qatar Airways means they show up in British Airways as well

As long as you link your accounts, you’ll be able to see both your BA or Qatar Airways balances in either account. You can do so here

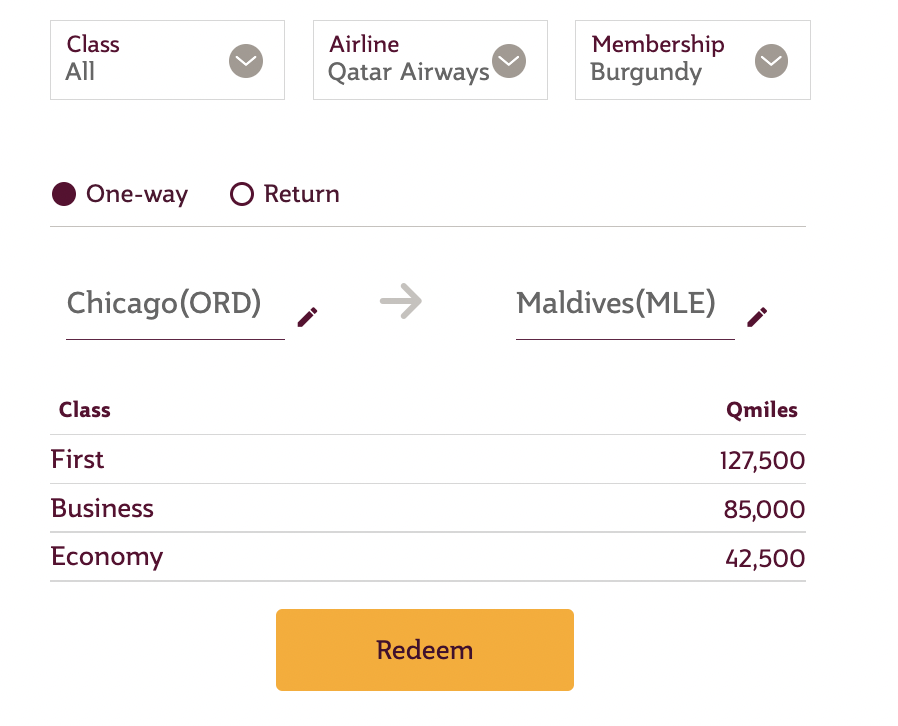

Qatar Airways has very advantageous pricing to the Maldives… with this bonus you’d only need 62k Citi Thank You to fly the world’s best business class.

Full Terms and Conditions:

- These terms and conditions govern the campaign, organized by Qatar Airways Privilege Club, enabling Privilege Club members to earn up to 40% bonus Avios when they convert their Bank Rewards Points to Avios with any participating bank (partners). This campaign commences on 01 June 2022, 0000hrs (GMT+3), and ends on 30 June 2022, 2359hrs (GMT+3).

- This campaign is open to all Privilege Club members who are customers of participating partners in the prescribed participating markets and have Bank Rewards Points.

- Qatar Airways Privilege Club members will earn bonus Avios on converting Bank Rewards Points from a participating partner into Avios.

- The bonus Avios awarded will be 20% of base Avios (up to 20,000) converted in a single transaction and will be 40% of base Avios (20,001 and above) converted in a single transaction.

- The bonus Avios will be calculated per transaction and not on the cumulative sum of base Avios converted from Bank Rewards Points during the campaign period.

- The conversion of Bank Rewards Points to base Avios is subject to the conversion ratio and terms and conditions set forth by the participating partner.

- The participating partners are Ahli Bank Qatar, Ahli United Bank, Ahlibank Oman, Air Miles, American Express, Amex Centurion Design Cards by Hyundai Card (Korea), Citibank, Commercial Bank of Qatar, Doha Bank, Dukhan Bank, Hana Members, HSBC (Greece, Mexico, Sri Lanka, Taiwan, Hong Kong), Kuwait Finance House, Masraf Al Rayan, Ping An E-wallet (Wanlitong), Qatar International Islamic Bank (QIIB), Qatar Islamic Bank (QIB), Qatar National Bank (QNB), CIMB, KBank, Standard Chartered Bank Singapore, BSF (Banque Saudi Fransi). For more details, refer to the respective. partner page here.

- All bonus Avios earned will reflect in your Privilege Club account within 45 days from the date that Bank Rewards Points are converted into Avios or credited to your Privilege Club account.

- The bonus Avios will not be calculated retroactively under any circumstances. If the Avios, which your Bank Rewards Points were converted into, are credited to your Privilege Club account after the period during which this offer is valid has passed, you will not earn bonus Avios under this campaign.

- Once Avios are credited to your Privilege Club account, after converting your Bank Rewards Points into Avios, the transaction will not be reversed.

- All base Avios and bonus Avios awarded under this campaign will be subject to the Qatar Airways Privilege Club Terms & Conditions.

- All decisions made by Qatar Airways Privilege Club with respect to any matter relating to this campaign shall be final. Qatar Airways Privilege Club reserves the right to vary these terms and conditions and terminate or otherwise amend this campaign without prior notice at its sole and absolute discretion. Qatar Airways Privilege Club reserves the right to verify the eligibility of participating Privilege Club members and eliminate if found suspicious and involved in fraudulent activity.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.