This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

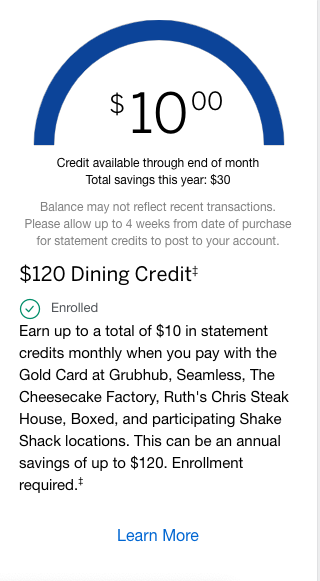

The month ends in a few days. Don’t let your credit go unused.

If you’re an Amex Gold cardholder and are unfamiliar with this benefit, it’s one you need to manually enroll in to utilize. Once enrolled, you’ll get $10 a month statement credit when you use your Amex Gold to dine at:

- Grubhub, Boxed, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House and participating Shake Shack locations. Excludes Shake Shack locations in ballparks, stadiums, airports and racetracks.

While I don’t frequent any these places on a regular basis, I have begun to stop in once a month to grab a snack. The $120 a year helps offset the $250 annual. But honestly the card is chalk full of benefits and has been one of my go-tos for almost all dining and groceries.

How to check your credit:

To see this- Login — More —-Benefits….this is also where you’d enroll if you haven’t already.

Here are the official terms from Amex: note the gift card, merchandise and shake shack location exclusions.

$120 Dining Credit‡To receive this benefit, Card Members must enroll. Only the Basic Card Member or Authorized Account Manager(s) on a U.S. Consumer Gold Card Account can enroll in the benefit. Traditional Gold, Senior Gold, Classic Gold and Ameriprise Gold Cards are not eligible. Eligible purchases must be charged to a Card Member on the enrolled Card Account for the benefit to apply. Purchases by both the Basic Card Member and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a $10 statement credit per month, for a total of $120 per calendar year in statement credits across all Cards on the Account. Participating partners are Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, Boxed, and participating Shake Shack locations. Excludes Shake Shack locations in ballparks, stadiums, airports and racetracks. Not valid on gift cards or merchandise purchases. Only valid for transactions completed in the United States of America, and US Territories. Please allow 2-4 weeks after an eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account. Please call the number on the back of the Card if statement credits have not posted after 4 weeks from the date of purchase. American Express relies on the merchant to process transactions within the same calendar month that you made the purchase in order to apply the $10 monthly statement credit in the month that it was intended. For example, if you make an eligible purchase on the last day of the month, but the merchant doesn’t process that transaction until the next day, then the statement credit would be applied in the following month. If American Express does not receive information that identifies your transaction as eligible for the benefit, you will not receive the statement credit. For example, your transaction will not be eligible if it is not made directly with the merchant. In addition, in most cases, you may not receive the statement credit if your transaction is made with an electronic wallet or through a third party or if the merchant uses a mobile or wireless card reader to process it. To be eligible for this benefit, Card Account(s) must not be canceled and not past due at the time of statement credit fulfillment. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.