We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

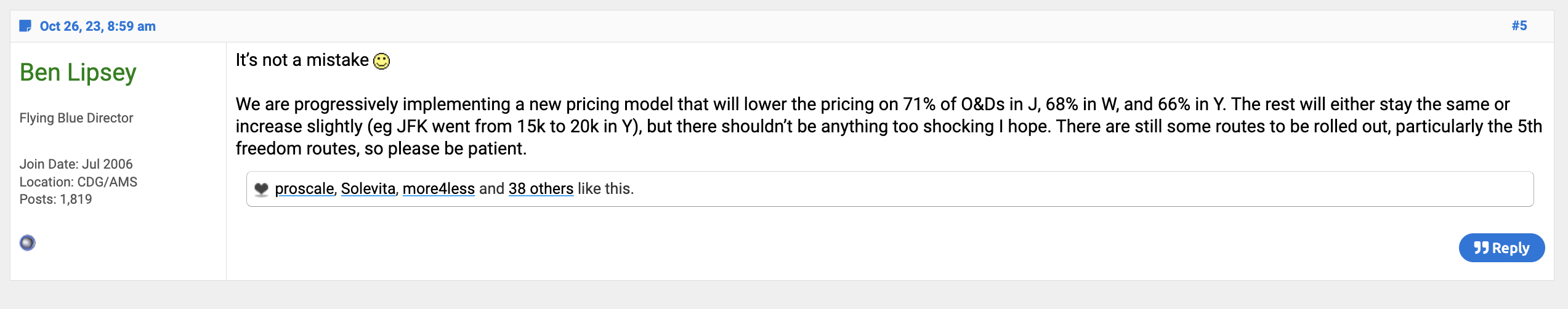

Several days ago a thread on FlyerTalk pointed out that a lot of FlyingBlue Reward prices had dropped. It was speculated that this was a temporary glitch and to book tickets while rates were lower. It’s normal to see Flying Blue Promo Rewards price business class at discounted rates on routes that aren’t featured, and so many thought these reward prices wouldn’t last. However, as OMAAT, pointed out, the director of Flying Blue Ben Lipsey, has confirmed that this is intentional and a new pricing model is being implemented.

- Business Class: 71% of pricing will reduce

- Premium Economy: 68% of pricing will reduce

- Economy: 66% of pricing will reduce

As you can see below – some legs like JFK to CDG will pop from 15k to 20k

Flying Blue Miles are super easy to earn

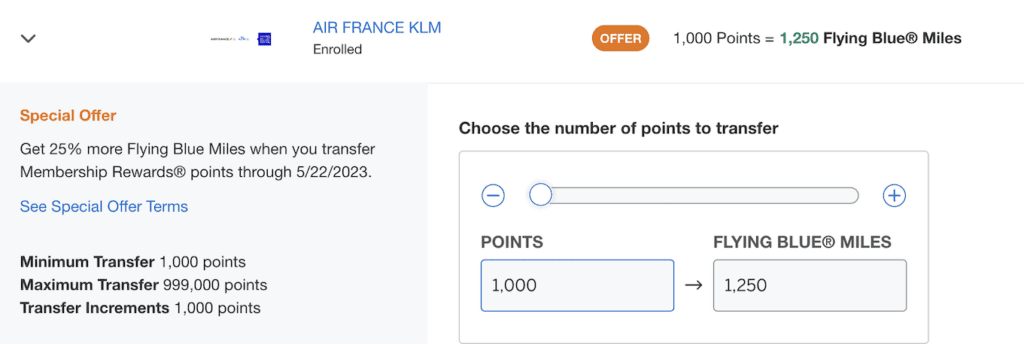

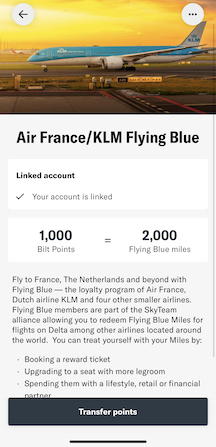

Earlier this year we saw Bilt Rewards offer a 100% Rent Day transfer bonus, and Amex, Chase, Citi, and Capital One are all parnters. I belive every single one of them have had 25% to 30% transfer bonuses this year as well.

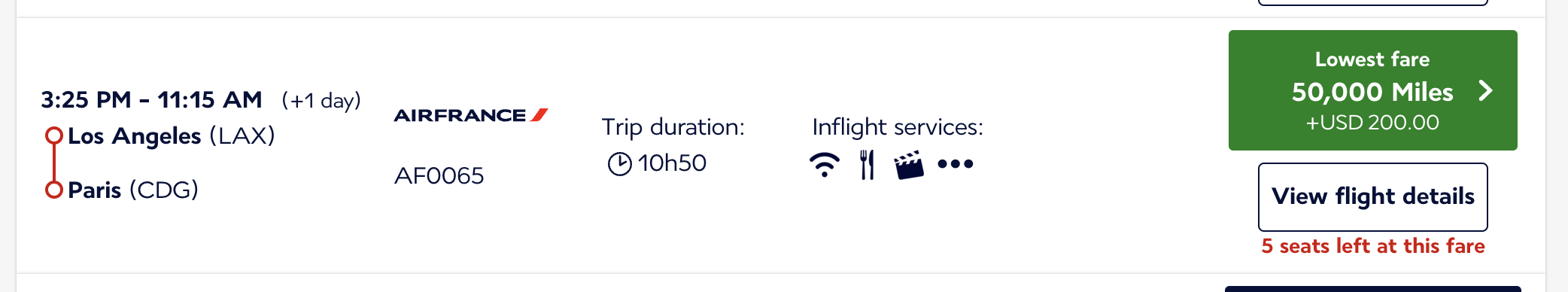

Looking at Calendar Mode – 50k now in business for US to Europe

While the program is still being updated, some dates are populating, even on the west coast at fantastic rates. 50k each way in Business Class from the west coast is a huge get. These used to price over 70k each way.

- Econ will go to 20k

- Premium Econ will be around 35k

The YQ, or surcharges, are looking to be less as well. At $200, some people are seeing sub $100 on select routes, are quite a bit less than it was. I just flew KLM from ORD to AMS to ZNZ and paid nearly $400 in fees.

Don’t speculatively transfer your points

Keeping your stockpile of points in a flexible currency like Amex, Bilt, Chase, Cap1, or Citi is the strategy to adhere to, and what I advocate people do even during transfer bonus periods.

However, if you’re sitting on massive heap of points and think you may take a trip to Europe, it could be advantageous and worth the risk to transfer speculatively. I do this from time to time, but I also keep a multi million point balance across programs. I have the ability to access points whenever I need, so if you’re in a similar situation, you could stick your toe in that water.

Overall

Overall, this is a fantastic development and something Delta should have really done when they decimated their program and attempted to backtrack. It’d be great if FlyingBlue could publish an award chart, this would be a massive step back to how things used to be standardized in award travel, but regardless.. .Flying Blue has made the decision to change the program, and it looks to be a positive iteration for many uses.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.