We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Medical Travel Insurance

Personally, I like to make sure I have some sort of medical coverage when I’m traveling overseas. Certain U.S. based health insurance policies do provide coverage, and a couple of my credit cards also provide emergency medical evacuation, but I like to have my bases covered. I use various cards for various travel purposes, and I have a sneaking suspicion that if there is a reason for that Emergency Medical Evacuation to not be covered, the credit card company will find it. I usually use Allianz for travel insurance and discovered something a few years back, while on a trip to Australia, that you CAN buy travel insurance after you’ve departed. It’s not even that expensive…so if you’re currently on a trip, or realize you forgot, like I did, you can cover your trip after you’ve left.

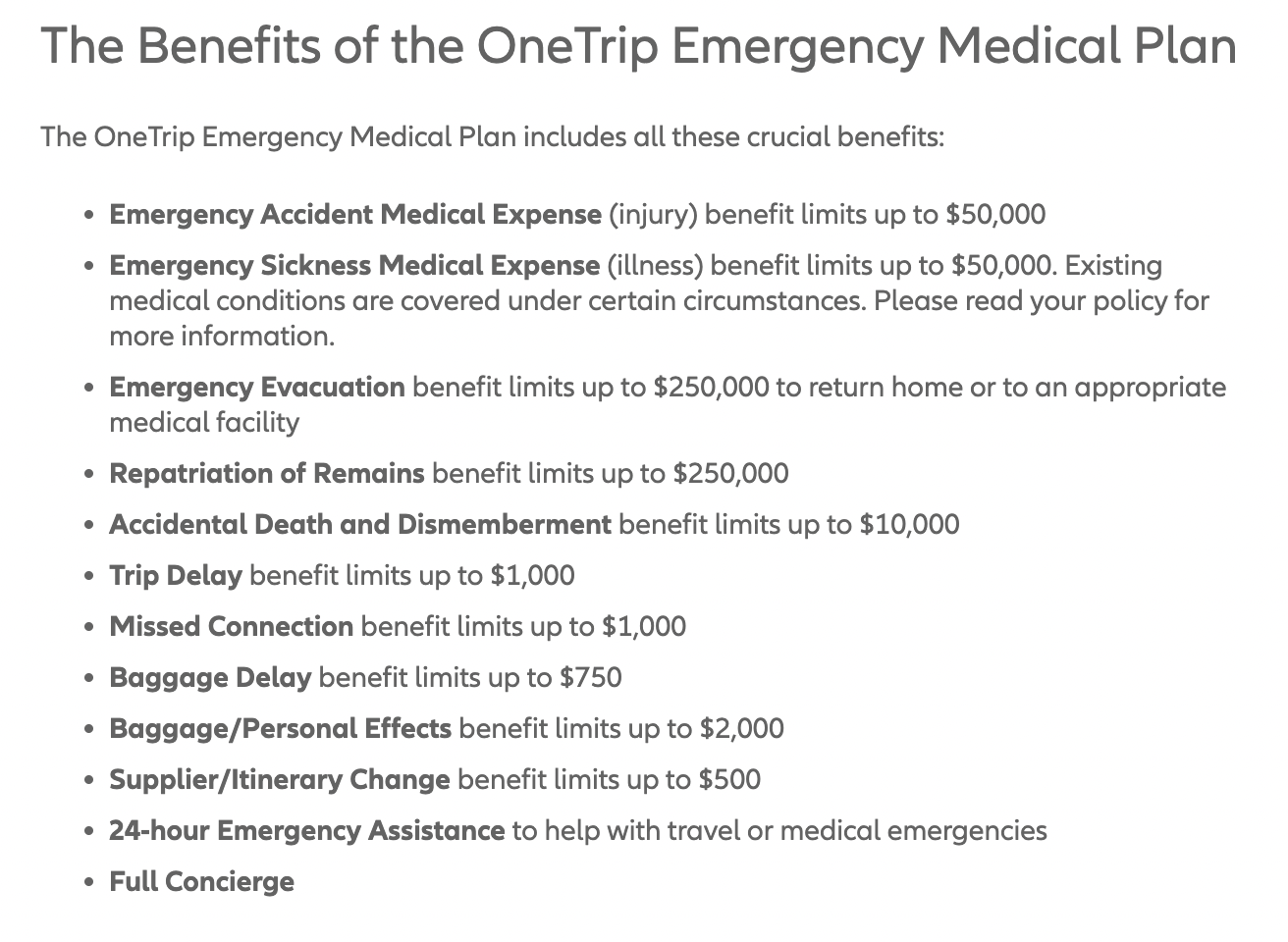

What’s covered?

OneTrip Emergency Medical is a great option if you’ve left on a trip, forgot to get insurance, and are looking for a way to have coverage in a foreign country. Here’s a list of the benefits included pre + post departure.

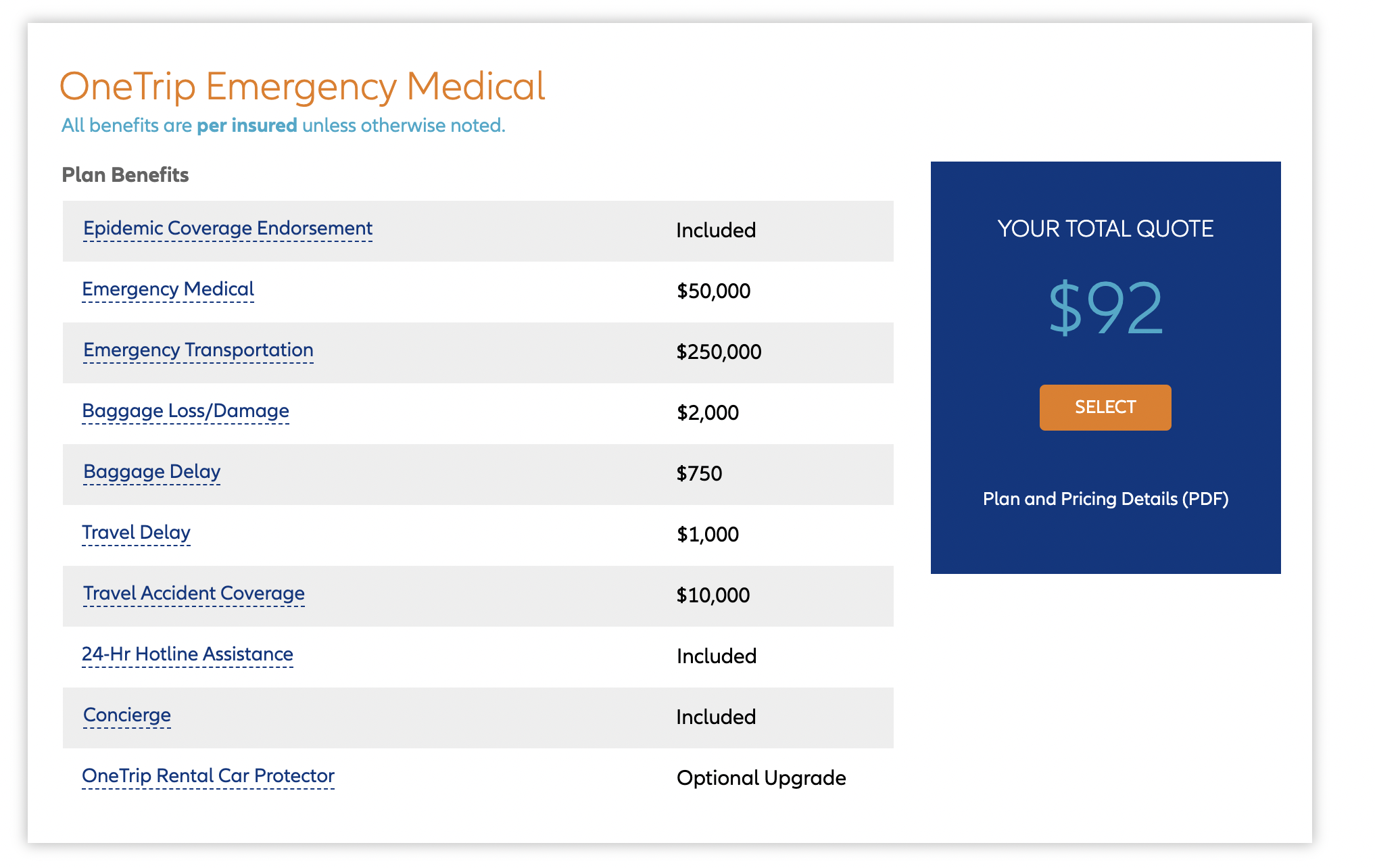

Medical was my primary concern

While it may suck to lose a bag, get delayed, or lose a hotel deposit…getting hit with a life threatening illness or a huge medical bill while abroad was my primary concern. I also have a few different credit cards that will provide lost baggage, trip delay, etc so it’s not my primary concern. Years ago, while in South Africa my mother fell in the hotel room, and ended up breaking her wrist. Her travel insurance not only reimbursed her for all medical expenses while in South Africa, it also covered the bills in the States, including Physical Therapy.

I priced out a trip for my wife and I later this year that may last up to a month and take us around the world. It’ll mostly be covered with points, but I put the other values at $2500. The travel insurance was $92 and covered both of us. A complete no brainer for us and something we will most definitely do, especially in the time of Covid. As you can see…epidemic coverage is included.

If you’re interested you can go here to check prices

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.