We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Hilton has released a slow drip of hotels bookable in their partnership with Small Luxury Hotels over the past month or so. If you remember, SLH used to be partnered with Hyatt, but earlier this year there was a big switcharoo whereby Hyatt acquired Mr and Mrs Smith ( who left IHG ), and Hilton struck a deal with Small Luxury Hotels. You can see the elite benefits offered at SLH properties ( full details below ) and roughly 400 hotels are now bookable at Hilton.

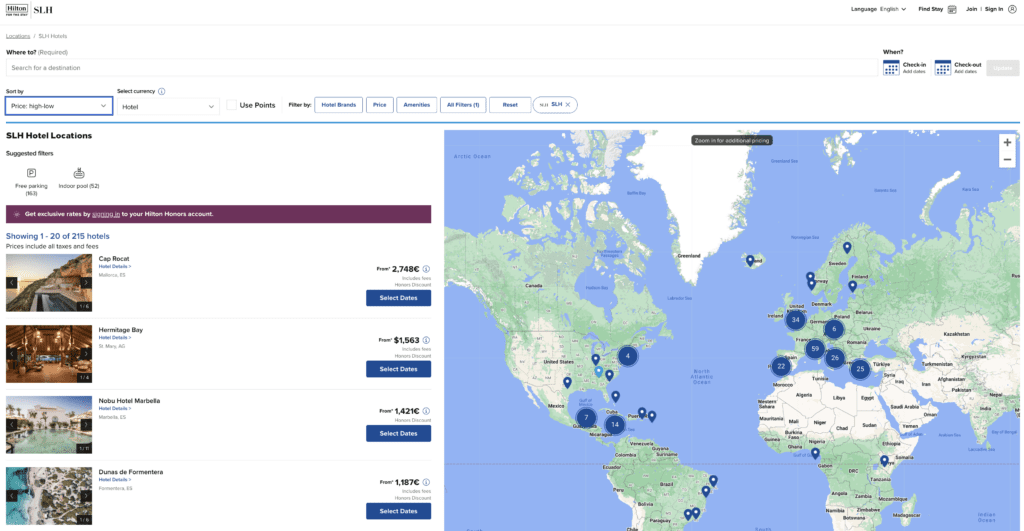

You can find the complete list here – and search

- Hilton Silver and up get 5th night free

- You can use Hilton credit card free night certs at these properties

As you can see below, I sorted by price first just to see where some of the most expensive SLH properties in the world were located.

You can buy points, up to 480k per account until July 23rd, 2024. This puts a lot of these properties at exceptional rates. I clicked “use points” and wow, there are some very good deals!

Let’s use Hermitage Bay in the Caribbean

It’s insanely expensive, all inclusive, and when you search for points they don’t show up on calendar mode. However, when select a specific date, or dates, they do populate. Since you can buy Hilton points most often for 1/2 a penny a point, and as long as you have Silver status you could stay 5 nights for the price of 4, you could get $10k worth of travel for 520k Hilton Honors… or $2600. Note you’d need to buy in 2 separate accounts ( since you can combine 2 million points per year ) if you didn’t have at least 40k points in your account ( or transfer in from Amex at 1:2 ratio )

Hilton Honors Elite Benefits:

The biggest perk is that Gold members get continental breakfast – this is a massive win for those of us who have Hilton Gold via Amex Platinum or the Amex Hilton Surpass. Kudos!

- Member:

- Guaranteed Member Discount, Complimentary Standard Wi-Fi, Complimentary Late Checkout, Bottled Water/Hydration per stay, No Resort Fees on Reward Stays

- Silver:

- 20% Elite Tier Bonus, 5th Standard Reward Night Free, All “Member” benefits

- Gold:

- 80% Elite Tier Bonus, Complimentary Breakfast (for two guests), Space-available Upgrades, 5th Standard Reward Night Free, All “Member” benefits

- Diamond:

- 100% Elite Tier Bonus, Complimentary Breakfast (for two guests), Space-available upgrades, 5th Standard Reward Night Free, All “Member” benefits

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.