We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

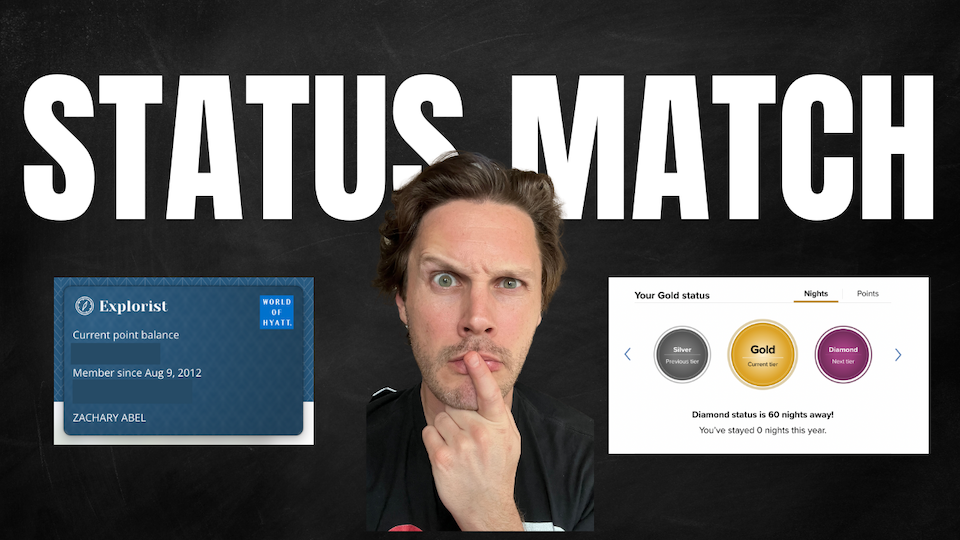

Hilton Status Match

Hilton has a great Status Match opportunity that could result you in you having 90 days of Gold status and achieving top tier Hilton Diamond status in just 14 qualifying nights. This is particularly fantastic since it would give you status through March of 2026, and you can leverage a lower tier status to achieve this. There are several exclusions like if you’ve done in it in the past, highlighting prior stays, etc that you need to pay attention to – let’s take a look!

Go here to sign up if you’re interested!

This status match seems to be annual promotion but oddly they haven’t updated the graphics to show the status you’d attain lasting through 2026. Disregard the 2025 information – LL confirmed that it’s indeed until March 31, 2026

What is a Hilton Status Match?

Hotels and Airlines will often allow you to match the status you maintain in a competitors program to a commensurate level of status in their program. Often times these come with stipulations that you must complete a certain number of flights, nights, or stays in order to keep that matched status after the qualification period.

Usually, as is the case in this Status Match, the period is 90 days. Hilton is looking to lure travelers to their brand by granting them a higher level of status, and the benefits that come along with it.

Can you break down what I need to do?

You’ll need to show elite status in another chain, proof of a stay in the last 24 months, and if approved, you’ll get Hilton Gold Status for 90 days. In order to maintain Hilton Gold until March of 2026, you’ll need to complete 8 paid, qualifying stays during the 90 day trial.

Want an even better bump up? If you stay just 6 more nights ( 14 total ) in 90 days, they will upgrade your status to Hilton Diamond.

Who qualifies?

- Only Paid stays…Reward nights do not count

- If you have Hilton Gold or Diamond cannot participate

- I’m not saying you couldn’t create another account but your lifetime nights, etc wouldn’t count; however, you could probably merge your points since they point pooling. Haven’t tried this, but I’d imagine it’s possible.

How do you do it?

- Submit the hotel status you’re matching from

- Submit a stay from that hotel in the past 24 months

- After you’re approved you’ll have Gold Status for 90 days

- Stay 8 nights and keep Gold through March of 2026

- Stay 14 nights an keep Diamond through March of 2026

You should be aware that you aren’t eligible if you already hold Hilton Gold or Diamond status, or if you have status matched in the past. The coolest part about Hilton Diamond status, in my opinion, is guaranteed Club Access, F/B credit ( breakfast internationally shown below ), and fingers crossed, a suite upgrade. We had absolutely great luck with Hilton Diamond status in 2019 quite a few suite upgrades, like the Waldorf Astoria Dubai, and if we didn’t hold a Hilton Aspire I’d be looking to do this status match myself. We also were upgraded to a suite in 2022 at the Conrad NYC

It looks as though this status match opportunity goes at least goes through the end of April, so if you’re interested you have some time to potentially meet the stay requirements if you earned your status from a credit card. In other words, if you’re an Amex Platinum cardholder with Marriott Gold status and haven’t stayed in the past two years, I believe you could stay before enrolling in this status match challenge expires and you’d fulfill that requirement.

Diamond status is the reason to match…especially if you’re traveling internationally

The main reason I would consider pursuing this is the fact that Hilton has opened up top tier diamond status to those who keep a lower status in other hotel groups.

If you’re Hyatt Explorist, which is mid tier, you could status match into Hilton with this promo, and if you just stay 14 nights you’ll end up with Hilton Diamond status. If you participated in the Bilt Rewards Status Hyatt Trial and Challenge last year, you could potentially use Explorist to match to Gold and go for Diamond. You need to show a stay in the prior 24 months.

How to get Hilton Status without a challenge…

By far the easiest is with a credit card.

- Amex Platinum

- Hilton Gold as a benefit

- Amex Business Platinum

- Hilton Gold as a benefit

- Amex Hilton Business Card

- Hilton Gold as a benefit

- Amex Hilton Surpass

- HIlton Gold as a benefit

- Amex Hilton Aspire

- Hilton Diamond as a benefit

Personally, dollar for dollar, the best hotel credit card out there is the Amex Hilton Aspire…Diamond status, $250 Hilton resort credit, $250 Amex incidental travel credit, etc. $450 ain’t cheap, but to get top tier status and benefits that easily offset the fee makes this a valuable card for those who love Hilton.

Further terms and conditions

You can read the full terms and conditions here:

- You need to have elite status with another hotel chain to qualify and submit proof of that elite status with a screen shot

- This needs to include your current membership of your existing loyalty program and summary page – must be a jpg

- No personal information: phone, address, social security number, DOB, username, password, credit card info, etc

- Proof of a stay in the hotel group you’re matching from in the last 24 months is also required

- You must be a Hilton Honors Silver or Base member and not enrolled in a status match in the past

- If you’re already Gold or Diamond…you can’t enroll

- You should hear in 7 to 12 days if you’ve been matched

- Reward nights don’t count

- You need to complete your stays within a 90 period to extend your status

- 8 nights to keep Gold

- 14 nights to bump up to Diamond

Overall

This is a pretty fantastic deal if you have any trips coming up in the short term that you could leverage to extract amazing benefits on a trip further out in the future.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.