We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Hilton will status match with any hotel program

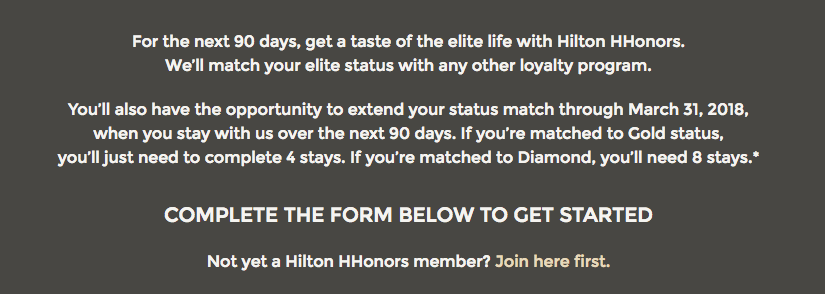

This really sounds too good to be true, but I checked it out. I’m already a Hilton Diamond from a status match last year so I couldn’t check it out myself, but here are the details if you’re interested. It’s a 90 match with the option to extend until 2018 with some stays. Hilton will status match with any hotel program.

The offer:

- After you’re matched you will get 90 days of status

- If matched to gold you need 4 stays in that time period to maintain Gold til March 31, 2018

- If matched to diamond you need 4 stays in that time period to maintain Diamond til March 31, 2018

It’s more like a match and challenge, but seems to be open to everyone

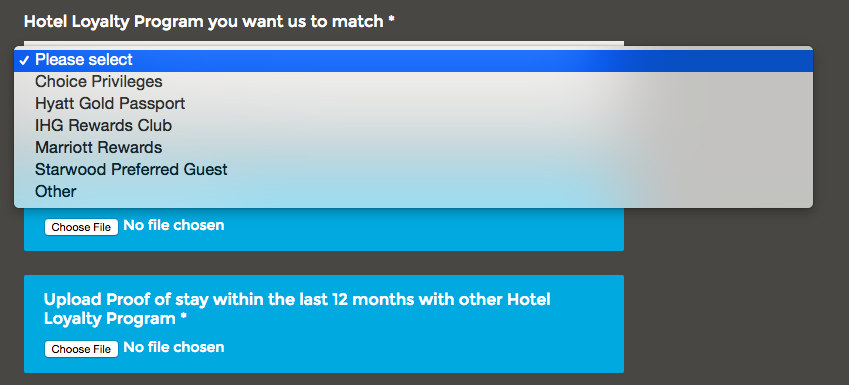

The list of programs…or you can choose other and match from that

I don’t know what matches to what…but I would assume the following

- IHG

- Plat to HH Gold

- Spire to HH Diamond

- Hyatt

- Plat to HH Gold

- Diamond to HH Diamond

- Who knows with Explorist, Globalist if the program is still running

- Marriott

- Gold to HH Gold

- Platinum to HH Diamond

- SPG

- Gold to HH Gold

- Plat to HH Diamond

Go here to sign up

I’ve been a Hilton Diamond for the past year and honestly haven’t had the most amazing experience with upgrades, etc.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.