We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’m in the midst of a big wallet change up and this past week I pulled the trigger and added the Citi Thank You Premier back into the flock. I’d had the card a few years ago, but opted to downgrade it to a Citi Double Cash to use in tandem with a Citi Prestige. That all changed this past week when I was approved for the Citi Thank You Premier.

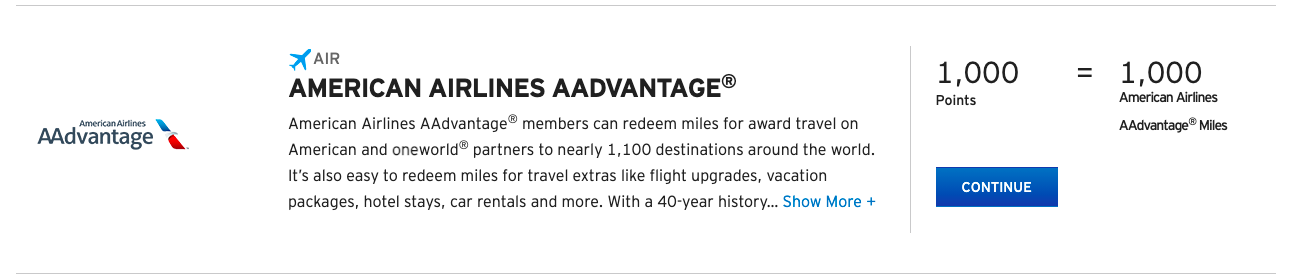

What pushed me over the edge? An incredible combination of an all time high welcome offer ( 80k Thank You points after $4k spend in 3 months ) and the temporary, and hopefully long term, addition of American Airlines as a transfer partner. I’m not sure you can argue that a better all around card exists.

I used 70k AA miles to fly Qatar Airways Qsuites

My fave Citi Thank You Premier benefits

Worry free, every time you swipe, earn triple points on air travel, hotels, supermarkets, dining, AND gas…this is the most straightforward card out there. Even if you don’t wish to utilize the rich transfer partners of Citi Thank You, you can redeem them for 1 penny a piece towards airfare in the Citi Travel Center.

- 80k bonus Thank You points after spending $4k in the first 3 months

- 3x points on

- Air Travel

- Hotel

- Supermarkets

- Dining

- Gas

- Access to Mastercard World Elite benefits

- No foreign Transaction fees

- $95 annual fee

Why this card may not be for everyone

The biggest drawback that I can see is the program’s transfer partners require a bit more savviness in terms of redemption compared with Chase and Amex who both have more US domestic partners. However… until November 13th, American Airlines is a transfer partner of Citi Thank You which I think makes it a very compelling card for no other reason that access to AA.

Personally, I love the traditional Citi Thank You partners, but most of them are foreign carriers. This doesn’t mean you can’t use their miles on domestic carriers

Overall

If Citi made AA a long term transfer partner I would push a lot more of my overall spend through the program. But, if it added in a couple of great hotel programs and improved the referral system…I think Chase and Amex would have a run for their money

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.