This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Miles and I are loving our Insta-Interactions!

Seriously, you guys are awesome, and we want to help you reach your travel goals. While we do offer consulting services, and award trip planning, we also try and answer as many questions as possible when you interact with us directly via the site, or on Miles’ instagram.

Yesterday, we posted a story that asked you for your questions. We got over 30 – so here’s our responses!

Let’s get to answering them!

kswag_22: Can you please come to New Zealand? It is a great country!

Uhhhhhhhh YES! In fact, might end up there next year.

LilScienceQueen: “What’s been your favourite place to visit and why?”

That is a very difficult question. I would say that there are two trips that have been my favorite so far, and both involve surprises. First, I took my mom on an around the world vacation to celebrate her 75th birthday. We went to the great wall of China, Bali, Singapore, Dubai, Abu Dhabi, and the South of France. It was out of control. You can see the highlights of it here:

The second was a trip for my girlfriend to celebrate her birthday as well. We went to Tokyo for just two nights when she had a break in work. It was unreal. You can see those highlights here:

They are my favorite because they were done for those that I love, AND they had no idea where they were going. By using points we were able to stay in 5 star hotels, fly in crazy cabins, and have so much fun. Their reactions were my favorite. I’d highly recommend planning a surprise trip.

Tinkerbell87: “How can you afford to travel as much as you do.”

Great question. I’m in a fortunate position because I write this blog, it earns me money, and is a business so I can write off the majority of my travel. I plan trips for people with their miles, and I also act. This gives me a lot of flexibility time wise, and allows me to plan my travel from places that offer the best deals. This is a link to a situation that I’m referring to: “Why Dublin makes more sense than London.”

Annm.barndt: “We’ve always wanted to go to Spain, but the cost of flights is prohibitive. We have the southwest visa and we trade points for domestic US flights all the time. but they don’t fly to Europe. Any suggestions, and have you been to Spain.

This is a fantastic question. I visited Spain for 3 weeks and absolutely loved it. A wonderful country with amazing food, culture, history, hotels, beaches, and public transport.

The Southwest Visa is a good card for domestic travel as you can earn a companion pass with its spend. However, as you pointed out, it’s not good for International aspirations. I would recommend getting a card that earns you Flexible points. These points can be transferred into partner programs ( including Southwest for that matter). This opens up a lot of options for travel, not only with flights but hotel programs as well. Some of the best flexible options earn American Express Membership Rewards and Chase Ultimate Rewards – which get you flights on just about any airline in the world. Two good, low fee options are:

- Chase Sapphire Preferred

- American Express Everyday and Everyday Preferred

Chaningthegreen: “I’ve never had a credit card before and am terrified of them. Where should I start if I’m interested in getting one for the travel points?”

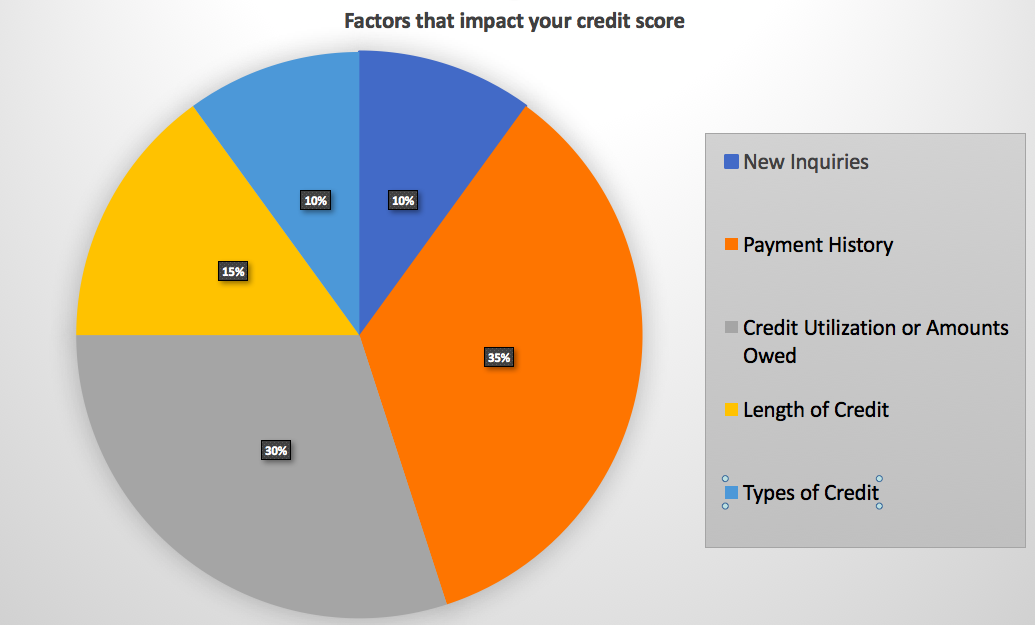

You are not alone. There are a lot of people who fear credit cards. Just make sure you always, always, always, pay them off in full. You should go to www.creditkarma.com and create an account. You’ll learn your credit score this way, and continue to monitor it. Read this post where I explain in detail how your credit is formed and how to improve it.

If your score is over 720 I would recommend getting a Chase Sapphire Preferred or an American Express Everyday/Everyday preferred card. Both of these cards earn great points to redeem for travel, and can be transferred into a number of partner programs for flights and hotels. If it’s under 720, go with a fee free card like the Chase Freedom. It earns you cash back, but later once your score is improved, you will be able to sign up for a Chase Sapphire Preferred and transfer that cash back into points that can be redeemed for greater value.

HGBPink: Can you explain how Monkey Miles works in layman’s term?!

Monkey Miles is my blog where I ( Zachary Abel ) write with my alter ego Miles the Monkey. He’s an absolute fiend for traveling like a prince on a pauper’s budget. We write daily posts that highlight deals, explain how point travel works, and illustrates how you can achieve your travel dreams.

We also consult for a fee and help plan award travel for customers looking to take a trip, but would like assistance.

Our fee schedule is:

- Consulting: $250 an hour with a minimum 4 hour retainer

- Award travel: Ranges from $250 a ticket, depends on the complexity of your trip.

Kelli.mccalla: We aren’t a big credit card family, but want one for miles purposes. If you had to recommend 1 cad what would it be? Do you purchase all your shopping on cards or just travel expenses.

If I had to choose just one, it would be the Chase Sapphire Preferred. I carried it for years before acquiring the Reserve which gives additional benefits, but has a higher annual fee.

The reason? It provides so many benefits for just $95 a year. You can transfer your points to over a dozen partners, you earn 2x points for dining, get primary rental car coverage, you can refer people to earn 10k points, and on and on. You also have access to the Chase Ultimate Rewards shopping portal ( this link explains how I earned 7x points on windows) where you can earn TONS of points making purchases probably ordinarily make.

If you were open to having two cards I would highly recommend adding a Chase Freedom. It carries no annual fee, but has category bonuses every quarter where you can earn 5x points on every purchase in that category up to $1500. Currently the quarter is offering 5x points at WalMart. A super easy way to earn 30k points a year.

I put every single possible purchase on a credit card and pay it off in full.

TQAnnie: “If I were to travel abroad to Europe what 1 thing would you recommend I see in England, Ireland, Scotland, Germany, and for fun Greece because I Love Mama Mia. What credit card would you recommend 2 college students get to start building their points? I know there are extra charges for checked luggage. Can you use points to pay for that?

England: Go to London, hop on a double decker red bus, and see the city. It’s one of my favorite in the world and almost every corner reveals another incredible site

Ireland: I love cities and haven’t toured a lot of Ireland yet, but Trinity college is beautiful in Dublin. It’s also a very easy city to walk and get a good feel. Cliffs of Moher, and kissing the Blarney stone are high on the to-do list. In Northern Ireland, I’d love to visit Belfast, walk the Carrick-a-Rede, and see Giant’s causeway.

Scotland: I’m a golfer. Seeing St.Andrews is incredible. Edinburgh is a very cool city, especially for those who love Harry Potter. Visit the Elephant House and Spoon, where it was written, and check out the school that Hogwarts was modeled after.

Greece: Never been. But I’d take an island over Athens if I was limited and could only do one. Everything I’ve ever been told or read says the islands embody the Grecian spirit.

Best card for a college student? I would go with the Chase Freedom. It’s a cash back card with no annual fee, AND is available to those with a slim credit history or under top tier credit. Best part? Once you’ve built your profile/score you can sign up for Sapphire Preferred, and move that cash back into points to redeem on partners for a great travel.

If you’re worried about paying bag fees, I’d pick up a card from the airline you travel most. You’ll get a great sign up bonus, and most give you free bag fees.

Shieldfansunite: How to you get to the point of being able to travel so much? And in such good conditions

The more points you earn, the more flexibility you have for redemption. I’m absolute geek for this stuff and do it every single day for multiple hours. I earn points on just about everything I do, which is why I started the blog, to share information, and create a business out of it.

For those beginning, I would make sure that you are putting your expenses on a credit card that earns you points that can be transferred and pay it off in full every single month. Banks are incentivizing customers with incredible opportunities to earn a currency that be used for travel. Start with that, and see how you get on.

Atoib: What are some of the cheapest places to fly or you most frequently find good deals for? What travel bloggers do you follow or travel hacking groups do you belong to? What’s a reasonable time to go from Novice to Advanced?

I’ve been really impressed with the deals to Europe and Asia. Roundtrips are often pricing less than it would cost to fly in the United States. In fact, I paid just $336 to fly to Shanghai, $400 to Tokyo, and $580 roundtrip to Beijing. I bought economy tickets, used upgrades ( which I had from Elite status, but you can apply points in the same fashion) and flew in lie flat seats. There are regularly flights under $500 r/t to Europe.

Check out the Flight Deal, Secret Flying

I follow both of those blogs named above, and here’s a few others: BoardingArea ( my partner site), MillionMileSecrets, The Points Guy, and UpgradedPoints.

It depends on how much time you put into it. If you read my blog, and the ones named above like a text book, within a few months, if not weeks, you’ll be in a great place. Information is much easier to come by than when I first started doing this, and there are so many guides to walk you through it. Redemption is the hardest, and there are services like mine out there which charge a fee to find options for your trip and max the value of your points.

Nitamarie_js ” I’d also like a more clear explanation of monkey miles and also what kind of financial stability do you need in order to reap these benefits?”

Monkey Miles is my blog where I ( Zachary Abel ) write with my alter ego Miles the Monkey. He’s an absolute fiend for traveling like a prince on a pauper’s budget. We write daily posts that highlight deals, explain how point travel works, and illustrates how you can achieve your travel dreams.

We also consult for a fee and help plan award travel for customers looking to take a trip, but would like assistance.

Our fee schedule is:

- Consulting: $250 an hour with a minimum 4 hour retainer

- Award travel: Ranges from $250 a ticket, depends on the complexity of your trip.

I would recommend checking your credit score at www.creditkarma.com – if it’s over 720 you should be able to acquire a card that earns flexible points – or points that can be transferred into partner programs. If not, your primary focus should be on getting your score up. 750+ is the goal, and will result in lower interest rates on anything you need a loan for.

MitchyTheMan – “how long does it take to acquire enough points to roll in baller class like this picture”

This picture is of Cathay Pacific First Class. I used 70k Alaska miles to redeem it. I credit most of my flights to Alaska and earn a lot of miles that way, but I also have two of their credit cards. Each earned me 30k points after spending a $1k in 3 months. You could also just buy the miles for $1400.

This flight, that we flew to Japan can be had for the price of a Latte. Barclay Aviator Red offers 60k points after a single purchase. Yes, a single purchase.

Nicola_Caldwell – ” Would love to know how I can apply your travel hacks to my own situation outside the US.”

Great question. Here are 3 great travel hacks for any country

- Look at airports to originate out of that are close to you, but may offer more direct and cheaper flights

- For instance, if you live in Europe think of flying out of Dublin, Stockholm, Copenhagen. You’ll save a ton flying internationally originating there instead of London, Paris, etc.

- Follow SecretFlying on twitter and sign up for alerts. They have an algorythm that posts super cheap fares from all over the world.

- Use portals for your shopping

- These portals will earn you bonus points. For instance, BA is offering 6x points on shopping at Debenham’s. You’ll earn 6 Avios for every pound you spend, and whatever kind of point your credit card accumulates.

xtinalaling: Which credit cards are your favorites? Also, a lot of tactics seem to involve sign up bonuses but can you simply some of your strategies for maximizing points with regular/long term credit card usage

I have/had my fair share of cards

I have the Chase trifecta: Chase Reserve/Freedom/Biz Preferred. I also keep an IHG card from Chase. I hold an Amex Biz Plat and Citi Prestige along with a couple of airline cards. I have a spreadsheet that shows which cards offer which benefits and then I can annotate where to use the proper card to max usage.

- Dining: Reserve unless Freedom has an offer. Prestige sometimes.

- Flights: Amex Biz unless another site is more than $10 cheaper, and I’m not hitting a min spend.

- All other: check targeted offers, shopping portals, and use Visa/MC Gift Cards I’ve been able to acquire with a bonus

I push my spend through shopping portals, as well as hit category bonuses to maximize my point usage. The Chase Freedom has been great this year with bonus categories at grocery stores and again at WalMart. This means I’ve been able to buy visa gift cards to hit the bonuses, but use them throughout the year. I can then use those gift cards at places that otherwise wouldn’t offer a bonus through the cards that I have.

Fas828 – what type of equipment and software do you use to make your travel videos

This is something I’m just getting into and haven’t invested a serious amount of money into it. I use my Iphone, a GoPro Hero 5 along with a Hero Session. I edit with iMovie.

Rosieebroderick: As a college student, traveling abroad is really hard. Can you recommend any domestic trips that could be fun and cheap.

Absolutely! Here’s three:

- Road Trip and drive from LA to San Fran.

- It’s a drop dead gorgeous drive with plenty of stop off points to light your gram up. Don’t miss out on Hearst Castle.

- Dallas to Austin.

- Flights are super cheap in out of both of these cities and within a couple hours you can drive from one to the next. They are full of college students, have amazing live music, shows, and sporting events. You’ll find everything from dive bars, to nightclubs, and most offer great deals on food and drink.

- Go to the Keys

- The drive from Miami to Key West is amazing. There are tons of cheap hotels, and cool bars/restaurnats along the way, but Key West is super fun and offers plenty of budget options.

Carter3pics: I don’t think you have kids, but any recommendations/hacks for those of us with kids?

You’re right, I don’t have kids. While I could list you some tips, I think you You should totally read www.pointswithacrew.com – he’s a fellow blogger at BoardingArea and specializes on family travel. Here’s a link to his top tips http://www.pointswithacrew.com/popular-posts/

BigSeaProductions: Any tips for college students on how to get started on using miles? Any suggestions from the best/most economical ways from CA-NY or CA-FL

Step 1: Know and monitor your credit. Get a www.creditkarma.com account.

Step 2: Sign up for a card and start putting all your purchases on it, and pay it off in full. Make this a habit that you never break.

- How much can you spend in 3 months and still pay it off in full?

- I would go with the Chase Freedom. It’s a cash back card with no annual fee, AND is available to those with a slim credit history or under top tier credit. Best part? Once you’ve built your profile/score you can sign up for Sapphire Preferred, and move that cash back into points to redeem on partners for a great travel.

- If your score is already above 720 or 750 apply for the Sapphire Preferred – assuming you can pay off $4k in 3 months. If not…The Freedom is just $500 in 3 month.

Step 3: Read, read , read. Redemption is the hardest part, so treat points like a course. That’s what I did. It’ll pay off big.

Ahmadjamaly_Abumalek: How to use your points best way possible?

In my opinion…the best possible use of points is for aspirational travel and surprise trips for others. Putting a smile on someone’s face is priceless. Using them to fly in cabins that would cost $10k plus is the best possible value, and something I, at least, wouldn’t be able to accomplish without points.

DanielWate.80 “Monkey, have you ever done scuba diving?”

I haven’t, but would love too! Great Barrier Reef is on my bucket list

Multi.Fandom.il “How can you afford to travel so much??”

I don’t pay for a lot of my travel the conventional way. I use points. What travel I do pay for I try and extract the most value out of it, but when you see me in a premium cabin, I paid a fraction of the cost.

I’m very lucky that this blog earns money through consulting, affiliates, and award planning. And I have a schedule that permits me to travel.

Our fee schedule is:

- Consulting: $250 an hour with a minimum 4 hour retainer

- Award travel: Ranges from $250 a ticket, depends on the complexity of your trip.

Dkate5: Do your tips about how to get the most out of your points for any country? ( e.g. for people who live/earn points in Australia) or is this specifically for UK/Europe? Cheers 🙂

My tips work for those who live in Australia, but the credit card offers are primarily for those who live in the U.S. Here is a great blog that is geared for those who live in Australia http://pointsfromthepacific.boardingarea.com/

HenryCastyllo: How do you get ready to visit a country you’ve never been to before?

I hit up tripadvisor, cntraveler, and read DK books. You can get an idea about where to go and what to see. On a first visit I think you want to get a good feel for the place and include the “must-sees”. Visiting the top tourist spots is cool, but I like to mix in some downtime where I’m just roaming some cool areas, eating the food and having drinks with locals. By mixing tripadvisor, cntraveler, and Dk you get a good mix of aggregated tour reviews, “hip” expert recommendations, and DK is the best tour book that you can buy ( in my opinion) – but done to a wide audience. Find the things mentioned in all three and make it a must-do. Then add in the downtime activities that look cool to you.

Shortie_Cake: How easy is it for a beginner to be able to acquire points for travel

Very easy. If you have a credit score of at least 720 you should be in a good shape to sign up for a good credit card and start earning flexible points on all your purchases. I’m going to be updating my beginner’s guide to make it super simple for people to follow and get started, but you don’t even need a new credit card to earn miles/points.

You can associate your credit card with dining programs to earn more points. Like the American dining program. You’ll earn AA miles just for eating out. You can do a similar thing with shopping with a portal .

I really Enjoyed interacting with all of you!!! Please ask me more questions!!!!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.