This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How long for an Amex Referral Bonus to show?

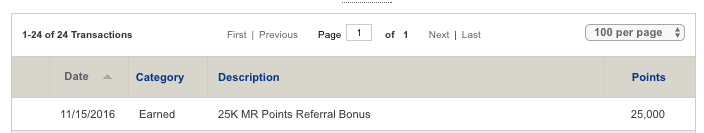

American Express Business Platinum is currently offering an outstanding 100k sign up bonus after $15k spend in 3 months. What’s even better than this, is if you already have an Amex Business Platinum you can refer people to the card and receive a 25k referral bonus. Some people don’t get the 25k link when they use the normal Amex refer-a-friend site ( I was one of them), nor is it available on their profile, but I was able to find a back-end into the 25k referral and wrote about it a while back. Anyways – here’s how long it took for a referral bonus to show up in my account.

My buddy applied and was approved on Monday, November 14th

and BAM!

The very next day I received my referral bonus!

I tell you…one of the best decisions I’ve made this year ( regarding credit cards and points ) was to upgrade my Business Gold to a Platinum when I was targeted for a 50k upgrade. Once I hit my min spend on that card ( 10k in 5 months), I’ll make a minimum of 75k ( 50k upgrade + 25k referral so far ) bonus points. Unreal. I was targeted for that card 2.5 years ago and received a 75k sign up offer. At my account anniversary I received a 15k retention bonus. I paid the annual fee of $175, then got targeted for an upgrade for 50k combined with this referral bonus of 25k means I’ve earned a whopping 165k off just that card not counting spend and spend bonus. Woot Woot!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.