This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Brex adds Bitcoin and Ethereum as options for reward redemption

Brex just plugged into Bitcoin and Ethereum. This is a realllllly big deal. If you’re unfamiliar with either of these, I would strongly recommend reading these articles ( Bitcoin 101, and Ethereum 101 ). Personally, I think we are living through one of the biggest disruptions in monetary energy any generation alive has witnessed. I won’t pontificate about this, but payment system after payment system is plugging into a blockchain network and Brex just joined the likes of Paypal and Square by plugging their system into Bitcoin. Currently it appears that the only integration is via their Brex Reward Redemptions, but I’d guess full integration of Bitcoin and Ethereum will soon follow.

Brex is fintech. It’s the latest iteration of how banking is evolving. They just gave a big hat tip that they are embracing DeFi, blockchain, and the growing adoption of cryptocurrency. Whether they add Bitcoin to their balance sheet, the ability for clients to buy/sell crypto via them, or offer custodial services for crypto in the future remains to be seen. But…what we do know – they are swimming in the pool. Even more than that…Brex is in the business of business, so if you’re looking to add BTC to your companies balance sheet, this would effectively allow you to transform your points into corporate treasury.

Let’s take a look at how you can redeem your Brex Points for Bitcoin or Ethereum

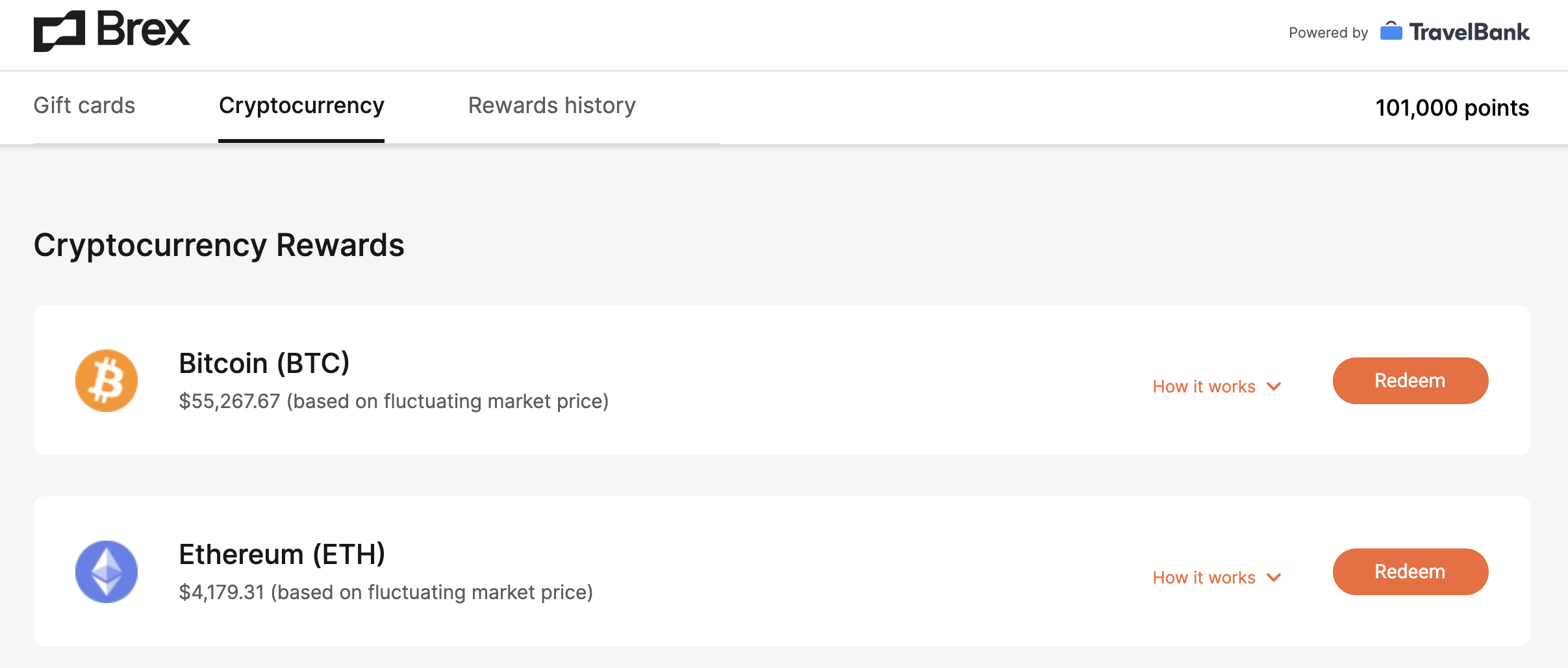

If you click on Rewards, you’re given a few options – notice how “Cryptocurrency is listed as an option”

You’re given the option of Bitcoin or Etheruem

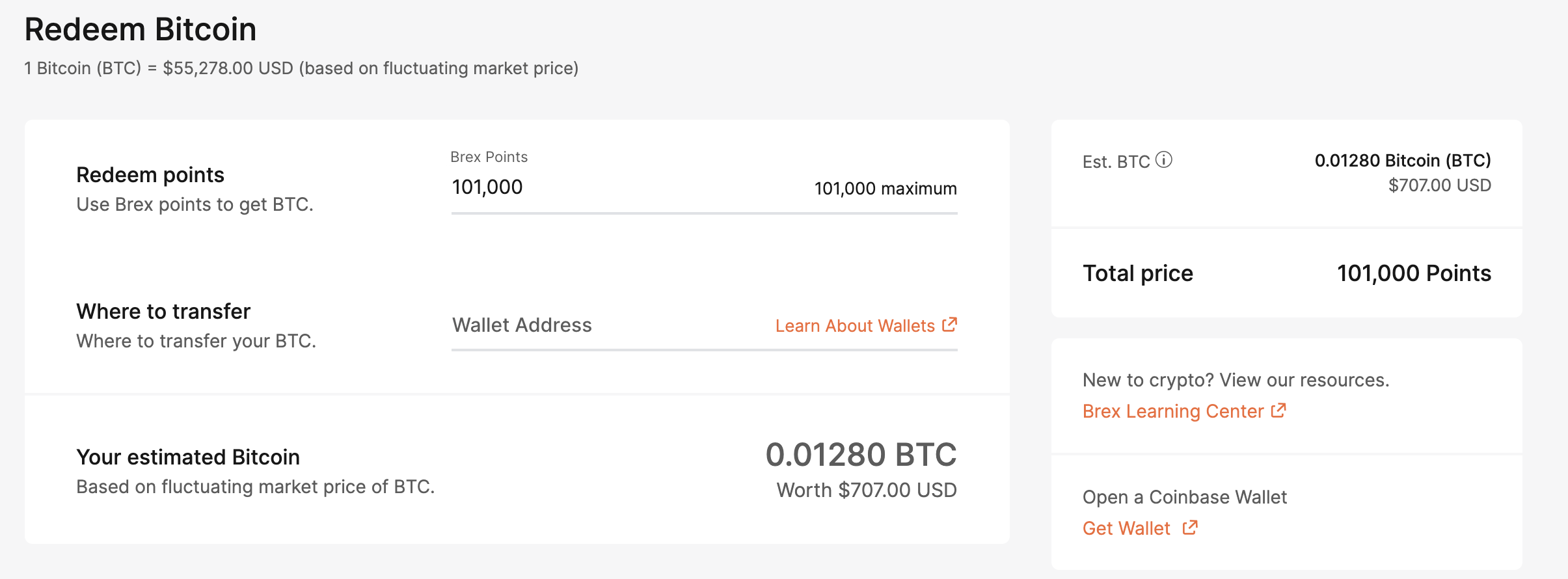

You can redeem for 7/10 of one cent towards Crypto

You can redeem for 7/10 of one cent towards Crypto

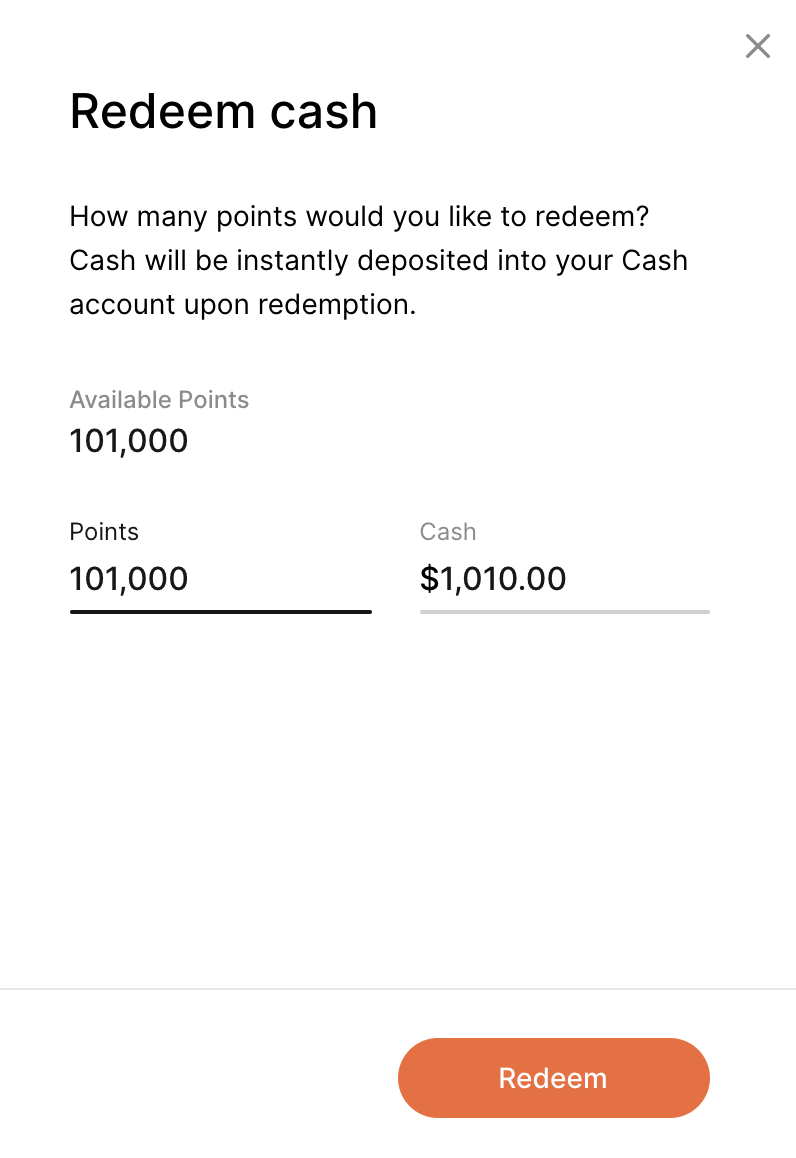

By comparison…you can cash out your points at a penny a piece

If you want to buy Crypto…just cash out your points, transfer to an exchange and buy at a more favorable rate.

No I won’t be converting Brex Rewards to BTC or ETH – but let’s recap

I think this is an incredible development, not necessarily because its a fantastic deal to convert into BTC or ETH, but what it means for the future of Brex and how they are strategizing.

- Will they create a Bitcoin wallet akin to PayPal?

- Will they offer custodial services?

- Will they offer lending services akin to BlockFi so clients can avoid taxable events and access lines of capital?

- Will they offer business banking solutions that involve Crypto?

This is the first step…and one that again brings me back to this observation I have noticed amongst the points and miles community. It seems a lot of us who are points and miles geeks are also swimming into the crypto pool. Is this Brex’s wink at us? It certainly left me giddy about what they are going to do next and all they did was facilitate points to crypto.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.